Wells Fargo 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

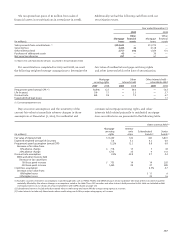

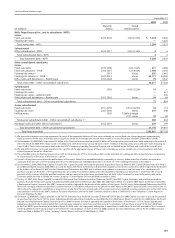

Other

Total Debt and commitments

VIE equity and Net

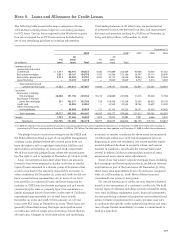

(in millions) assets(1) interests Derivatives guarantees assets

December 31, 2008 Carrying value –asset (liability)

Collateralized debt obligations (2) $ 54,294 14,080 1,053 — 15,133

Wachovia administered ABCP (3) conduit 10,767 ————

Asset-based finance structures 11,614 9,232 (136) — 9,096

Tax credit structures 22,882 4,366 — (516) 3,850

Collateralized loan obligations 23,339 3,217 109 — 3,326

Investment funds 105,808 3,543 — — 3,543

Credit-linked note structures 12,993 50 1,472 — 1,522

Money market funds (4) 13,307 — 10 — 10

Other (5) 1,832 3,983 (36) (141) 3,806

Total $ 256,836 38,471 2,472 (657) 40,286

Maximum exposure to loss

Collateralized debt obligations $ 14,080 4,849 1,514 20,443

Wachovia administered ABCP (3) conduit — 15,824 — 15,824

Asset-based finance structures 9,346 136 — 9,482

Tax credit structures 4,366 — 560 4,926

Collateralized loan obligations 3,217 109 555 3,881

Investment funds 3,550 — 140 3,690

Credit-linked note structures 50 2,253 — 2,303

Money market funds (4) —51—51

Other (5) 3,991 130 578 4,699

Total $ 38,600 23,352 3,347 65,299

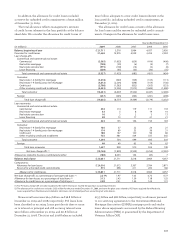

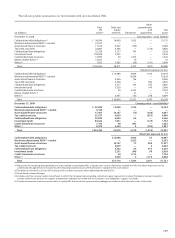

December 31, 2009 Carrying value –asset (liability)

Collateralized debt obligations $ 55,899 12,988 1,746 — 14,734

Wachovia administered ABCP (3) conduit 5,160 ————

Asset-based finance structures 17,467 10,187 (72) (248) 9,867

Tax credit structures 27,537 4,659 — (653) 4,006

Collateralized loan obligations 23,830 3,602 64 — 3,666

Investment funds 84,642 1,831 — (129) 1,702

Credit-linked note structures 1,755 40 985 — 1,025

Other (5) 8,470 3,269 5 (293) 2,981

Total $224,760 36,576 2,728 (1,323) 37,981

Maximum exposure to loss

Collateralized debt obligations $12,988 3,586 33 16,607

Wachovia administered ABCP (3) conduit — 5,263 — 5,263

Asset-based finance structures 10,187 72 968 11,227

Tax credit structures 4,659 — 4 4,663

Collateralized loan obligations 3,702 64 473 4,239

Investment funds 2,331 500 89 2,920

Credit-linked note structures 40 1,714 — 1,754

Other (5) 3,269 5 1,774 5,048

Total $37,176 11,204 3,341 51,721

(1) Represents the remaining principal balance of assets held by unconsolidated VIEs using the most current information available. For VIEs that obtain exposure to assets

synthetically through derivative instruments, the remaining notional amount of the derivative is included in the asset balance.

(2) The balance of total VIE assets for VIEs involving CDOs has been revised to reflect additionally identified CDOs.

(3) Asset-based commercial paper.

(4) Includes only those money market mutual funds to which the Company had outstanding contractual support agreements in place. The balance has been revised to

exclude certain funds because the support arrangements had lapsed or settled and the Company is not obligated to support such funds.

(5) Contains investments in auction rate securities issued by VIEs that we do not sponsor and, accordingly, are unable to obtain the total assets of the entity.

The following table summarizes our involvement with unconsolidated VIEs.