Wells Fargo 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

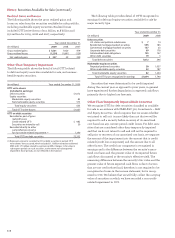

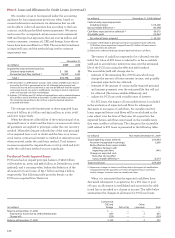

As part of our liquidity management strategy, we pledge

securities to secure borrowings from the Federal Home Loan

Bank (FHLB) and the Federal Reserve Bank. We also pledge

securities to secure trust and public deposits and for other

purposes as required or permitted by law. The carrying value

of pledged securities where the secured party has the right

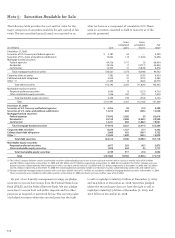

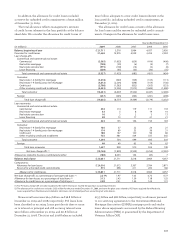

The following table provides the cost and fair value for the

major categories of securities available for sale carried at fair

value. The net unrealized gains (losses) are reported on an

Note 5: Securities Available for Sale

after tax basis as a component of cumulative OCI. There

were no securities classified as held to maturity as of the

periods presented.

to sell or repledge totaled $5.0 billion at December 31, 2009,

and $4.5 billion at December 31, 2008. Securities pledged

where the secured party does not have the right to sell or

repledge totaled $93.9 billion at December 31, 2009, and

$71.6 billion at December 31, 2008.

Gross Gross

unrealized unrealized Fair

(in millions) Cost gains losses value

December 31, 2008

Securities of U.S. Treasury and federal agencies $ 3,187 62 — 3,249

Securities of U.S. states and political subdivisions 14,062 116 (1,520) 12,658

Mortgage-backed securities:

Federal agencies 64,726 1,711 (3) 66,434

Residential 29,536 11 (4,717) 24,830

Commercial 12,305 51 (3,878) 8,478

Total mortgage-backed securities 106,567 1,773 (8,598) 99,742

Corporate debt securities 7,382 81 (539) 6,924

Collateralized debt obligations 2,634 21 (570) 2,085

Other (1)(2) 21,363 14 (602) 20,775

Total debt securities 155,195 2,067 (11,829) 145,433

Marketable equity securities:

Perpetual preferred securities 5,040 13 (327) 4,726

Other marketable equity securities 1,256 181 (27) 1,410

Total marketable equity securities 6,296 194 (354) 6,136

Total $ 161,491 2,261 (12,183) 151,569

December 31, 2009

Securities of U.S. Treasury and federal agencies $ 2,256 38 (14) 2,280

Securities of U.S. states and political subdivisions 13,212 683 (365) 13,530

Mortgage-backed securities:

Federal agencies 79,542 3,285 (9) 82,818

Residential (2) 28,153 2,480 (2,043) 28,590

Commercial 12,221 602 (1,862) 10,961

Total mortgage-backed securities 119,916 6,367 (3,914) 122,369

Corporate debt securities 8,245 1,167 (77) 9,335

Collateralized debt obligations 3,660 432 (367) 3,725

Other (1) 15,025 1,099 (245) 15,879

Total debt securities 162,314 9,786 (4,982) 167,118

Marketable equity securities:

Perpetual preferred securities 3,677 263 (65) 3,875

Other marketable equity securities 1,072 654 (9) 1,717

Total marketable equity securities 4,749 917 (74) 5,592

Total $167,063 10,703 (5,056) 172,710

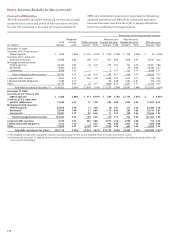

(1) The “Other” category includes certain asset-backed securities collateralized by auto leases or loans and cash reserves with a cost basis and fair value of $8.2 billion

and $8.5 billion, respectively, at December 31, 2009, and $8.3 billion and $7.9 billion, respectively, at December 31, 2008. Also included in the “Other” category are asset-

backed securities collateralized by home equity loans with a cost basis and fair value of $2.3 billion and $2.5 billion, respectively, at December 31, 2009, and $3.2 billion

and $3.2 billion, respectively, at December 31, 2008. The remaining balances primarily include asset-backed securities collateralized by credit cards and student loans.

(2) Foreign residential mortgage-backed securities with a cost basis and fair value of $51 million are included in residential mortgage-backed securities at December 31, 2009.

These instruments were included in other debt securities at December 31, 2008, and had a cost basis and fair value of $6.3 billion.