Wells Fargo 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

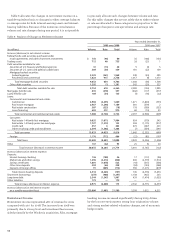

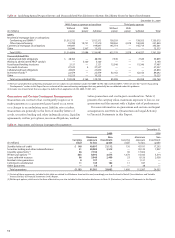

Effective January 1, 2009, we adopted new accounting

guidance that changed the way noncontrolling interests are

presented in the income statement such that the consolidated

income statement includes amounts from both Wells Fargo

interests and the noncontrolling interests. As a result, our

effective tax rate is calculated by dividing income tax expense

by income before income tax expense less the net income

from noncontrolling interests.

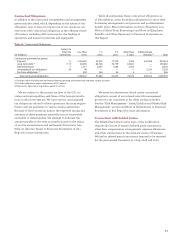

Operating Segment Results

We define our operating segments by product and customer.

As a result of the combination of Wells Fargo and Wachovia,

in 2009 management realigned our business segments into

three lines of business: Community Banking; Wholesale

Banking; and Wealth, Brokerage and Retirement. Our man-

agement accounting process measures the performance of the

operating segments based on our management structure and

is not necessarily comparable with similar information for

other financial services companies. We revised prior period

information to reflect the 2009 realignment of our operating

segments; however, because the acquisition was completed

on December 31, 2008, Wachovia’s results are not included in

the income statement or in average balances for periods prior

to 2009. The Wachovia acquisition was material to us, and the

inclusion of results from Wachovia’s businesses in our 2009

financial statements is a material factor in the changes in

our results compared with prior year results. The significant

matters affecting our financial results for 2009 have been

discussed previously. Table 9 and the following discussion

present our results by operating segment. For a more

complete description of our operating segments, including

additional financial information and the underlying manage-

ment accounting process, see Note 23 (Operating Segments)

to Financial Statements in this Report.

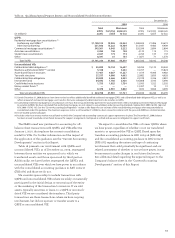

Community Banking offers a complete line of diversified

financial products and services for consumers and small

businesses including investment, insurance and trust services

in 39 states and D.C., and mortgage and home equity loans

in all 50 states and D.C. Wachovia added expanded product

capability as well as expanded channels to better serve our

customers. Community Banking includes Wells Fargo Financial.

Revenue growth for 2009 was driven primarily by signifi-

cant growth in mortgage originations ($420 billion in 2009

compared with $230 billion in prior year) and strong mort-

gage servicing hedge results (primarily due to hedge carry

income arising from the low short-term interest rates) as well

as continued success in the cross-sell of Wells Fargo products.

Double-digit growth in legacy Wells Fargo core deposits and

the ability to retain approximately 60% of Wachovia’s matured

higher-cost CDs portfolio in lower-rate CDs and liquid

deposits at lower than expected yields also contributed to the

growth, mitigated by lower loan interest rates. Noninterest

expense increased from 2008 due to the addition of Wachovia,

increases in FDIC and other deposit assessments, and credit

related expenses, including the addition of resources to han-

dle a higher volume of mortgage loan modifications. To bene-

fit our customers we continued to invest in adding sales and

service team members in regional banking as we aligned

Wachovia banking stores with the Wells Fargo model. The

increases in noninterest expense were mitigated by continued

revenue growth and expense management as we stayed on

track to meet our merger synergy goals.

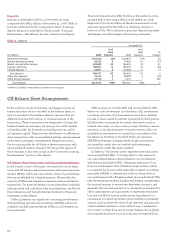

Wholesale Banking provides financial solutions to businesses

across the United States with annual sales generally in excess

of $10 million and to financial institutions globally. Products

include middle market banking, corporate banking, CRE, trea-

sury management, asset-based lending, insurance brokerage,

foreign exchange, correspondent banking, trade services,

specialized lending, equipment finance, corporate trust,

investment banking, capital markets, and asset management.

Wachovia added expanded product capabilities across the

segment, including investment banking, mergers and acquisi-

tions, equity trading, equity structured products, fixed-income

sales and trading, and equity and fixed-income research.

Wholesale Banking earned net income of $3.9 billion and

revenue of $20.3 billion in 2009. Results were driven by the

performance of our many diverse businesses, such as com-

mercial banking, corporate banking, asset-based lending,

asset management, investment banking and international.

With over 750 offices nationwide and globally, plus expanded

product and distribution capabilities, Wholesale Banking saw

gains in 2009 in the number of new middle market companies

we lent money to and in the positive experiences those com-

panies had with our bank. Revenue performance also benefited

from the recovery of the capital markets. We saw the effect

of customers deleveraging, accessing capital markets and

delaying investment decisions as loan balances declined

throughout the year; however, we continued to originate loans

at improved spreads and terms. The provision for loan losses

was $3.6 billion, including $1.2 billion of additional provision

to build reserves for the wholesale portfolio.

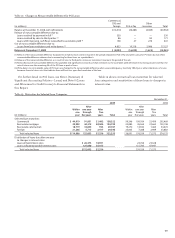

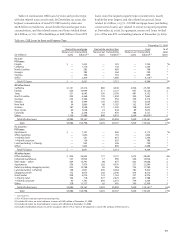

Table 9: Operating Segment Results – Highlights

Wealth, Brokerage

Community Banking Wholesale Banking and Retirement

(in billions) 2009 2008 2009 2008 2009 2008

Revenue $ 59.0 33.0 20.3 8.2 11.5 2.7

Net income 8.6 2.1 3.9 1.4 1.0 0.2

Average loans 538.0 285.6 255.4 112.3 45.7 15.2

Average core deposits 533.0 252.8 146.6 69.6 114.3 23.1