Wells Fargo 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

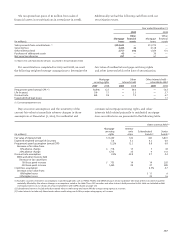

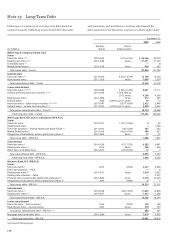

Wealth,

Community Wholesale Brokerage and Consolidated

(in millions) Banking Banking Retirement Company

December 31, 2007 $ 10,591 2,147 368 13,106

Reduction in goodwill related to divested businesses — (1) — (1)

Goodwill from business combinations 6,229 3,303 — 9,532

Foreign currency translation adjustments (10) — — (10)

December 31, 2008 16,810 5,449 368 22,627

Goodwill from business combinations 1,343 830 5 2,178

Foreign currency translation adjustments 7 — — 7

December 31, 2009 $18,160 6,279 373 24,812

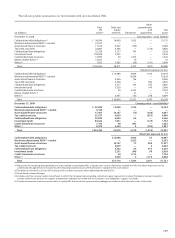

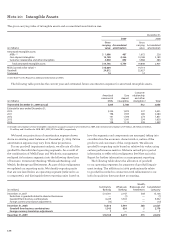

The gross carrying value of intangible assets and accumulated amortization was:

Note 10: Intangible Assets

The following table provides the current year and estimated future amortization expense for amortized intangible assets.

December 31,

2009 2008

Gross Gross

carrying Accumulated carrying Accumulated

(in millions) value amortization value amortization

Amortized intangible assets:

MSRs (1) $ 1,606 487 1,672 226

Core deposit intangibles 15,140 4,366 14,188 2,189

Customer relationship and other intangibles 3,050 896 3,988 486

Total amortized intangible assets $19,796 5,749 19,848 2,901

MSRs (carried at fair value) (1) $16,004 14,714

Goodwill 24,812 22,627

Trademark 14 14

(1) See Note 9 in this Report for additional information on MSRs.

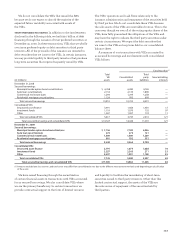

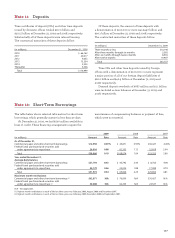

Customer

Amortized Core relationship

commercial deposit and other

(in millions) MSRs intangibles intangibles(1) Total

Year ended December 31, 2009 (actual) $264 2,180 412 2,856

Estimate for year ended December 31,

2010 $224 1,870 337 2,431

2011 198 1,593 289 2,080

2012 161 1,396 274 1,831

2013 125 1,241 254 1,620

2014 108 1,113 238 1,459

(1) Includes amortization of lease intangibles reported in occupancy expense of $8 million for 2009, and estimated amortization of $9 million, $8 million, $8 million,

$5 million, and $4 million for 2010, 2011, 2012, 2013 and 2014, respectively.

We based our projections of amortization expense shown

above on existing asset balances at December 31, 2009. Future

amortization expense may vary from these projections.

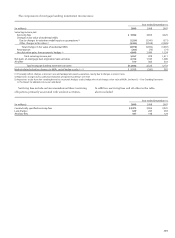

For our goodwill impairment analysis, we allocate all of the

goodwill to the individual operating segments. As a result of

the combination of Wells Fargo and Wachovia, management

realigned its business segments into the following three lines

of business: Community Banking; Wholesale Banking; and

Wealth, Brokerage and Retirement. As part of this realignment,

we updated our reporting units. We identify reporting units

that are one level below an operating segment (referred to as

a component), and distinguish these reporting units based on

how the segments and components are managed, taking into

consideration the economic characteristics, nature of the

products and customers of the components. We allocate

goodwill to reporting units based on relative fair value, using

certain performance metrics. We have revised prior period

information to reflect this realignment. See Note 23 in this

Report for further information on management reporting.

The following table shows the allocation of goodwill

to our operating segments for purposes of goodwill impair-

ment testing. The additions in 2009 predominantly relate

to goodwill recorded in connection with refinements to our

initial acquisition date purchase accounting.