Wells Fargo 2009 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

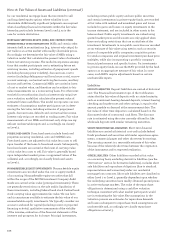

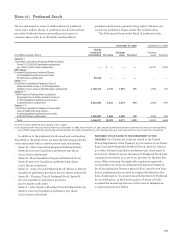

As part of the preferred stock issuance in 2008, Treasury

received a warrant to purchase approximately 110.3 million

shares of Wells Fargo common stock at an initial exercise

price of $34.01. The preferred stock proceeds from Treasury

were allocated based on the relative fair value of the warrant

as compared with the fair value of the preferred stock. The

fair value of the warrant was determined using a third party

proprietary pricing model that produces results similar to the

Black-Scholes model and incorporates a valuation model that

incorporates assumptions including our common stock price,

dividend yield, stock price volatility and the risk-free interest

rate. We determined the fair value of the preferred stock based

on assumptions regarding the discount rate (market rate) on

the preferred stock which was estimated to be approximately

13% at the date of issuance. Prior to the December 23, 2009

redemption, the discount on the preferred stock was being

accreted to par value using a constant effective yield of 7.2%

over a five-year term, which was the expected life of the

preferred stock.

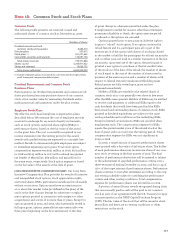

ESOP CUMULATIVE CONVERTIBLE PREFERRED STOCK All shares

of our ESOP (Employee Stock Ownership Plan) Cumulative

Convertible Preferred Stock (ESOP Preferred Stock) were

issued to a trustee acting on behalf of the Wells Fargo &

Company 401(k) Plan (the 401(k) Plan). Dividends on the

ESOP Preferred Stock are cumulative from the date of initial

issuance and are payable quarterly at annual rates ranging

from 8.50% to 12.50%, depending upon the year of issuance.

Each share of ESOP Preferred Stock released from the unallo-

cated reserve of the 401(k) Plan is converted into shares of

our common stock based on the stated value of the ESOP

Preferred Stock and the then current market price of our

common stock. The ESOP Preferred Stock is also convertible

at the option of the holder at any time, unless previously

redeemed. We have the option to redeem the ESOP Preferred

Stock at any time, in whole or in part, at a redemption price

per share equal to the higher of (a) $1,000 per share plus

accrued and unpaid dividends or (b) the fair market value,

as defined in the Certificates of Designation for the ESOP

Preferred Stock.

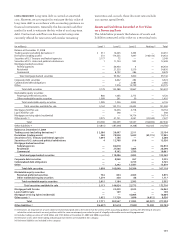

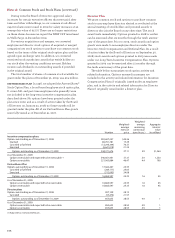

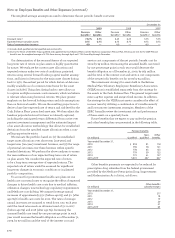

Shares issued and outstanding Carrying value Adjustable

December 31,December 31,dividend rate

(in millions, except shares) 2009 2008 2009 2008 Minimum Maximum

ESOP Preferred Stock (1)

2008 120,289 156,914 $ 120 157 10.50% 11.50

2007 97,624 110,159 98 110 10.75 11.75

2006 71,322 83,249 71 83 10.75 11.75

2005 51,687 62,484 52 63 9.75 10.75

2004 36,425 45,950 37 46 8.50 9.50

2003 21,450 29,218 21 29 8.50 9.50

2002 11,949 18,889 12 19 10.50 11.50

2001 3,273 10,393 310 10.50 11.50

2000 —2,644 —3 11.50 12.50

Total ESOP Preferred Stock 414,019 519,900 $ 414 520

Unearned ESOP shares (2) $(442) (555)

(1) Liquidation preference $1,000. At December 31, 2009 and December 31, 2008, additional paid-in capital included $28 million and $35 million, respectively,

related to preferred stock.

(2) We recorded a corresponding charge to unearned ESOP shares in connection with the issuance of the ESOP Preferred Stock. The unearned ESOP shares are

reduced as shares of the ESOP Preferred Stock are committed to be released.

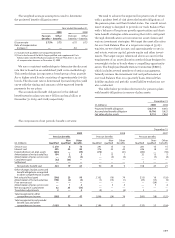

Note 17: Preferred Stock (continued)