Wells Fargo 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

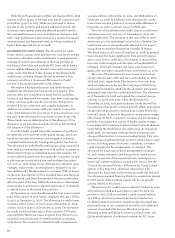

Table 31: Tier Common Equity (1)

December 31,

(in billions) 2009 2008

Total equity $ 114.4 102.3

Less: Noncontrolling interests (2.6) (3.2)

Total Wells Fargo stockholders’ equity 111.8 99.1

Less: Preferred equity (8.1) (30.8)

Goodwill and intangible assets

(other than MSRs) (37.7) (38.1)

Applicable deferred tax assets 5.3 5.6

Deferred tax asset limitation (1.0) (6.0)

MSRs over specified limitations (1.6) (1.5)

Cumulative other

comprehensive income (3.0) 6.9

Other (0.2) (0.8)

Tier 1 common equity (A) $ 65.5 34.4

Total risk-weighted assets (2) (B) $1,013.6 1,101.3

Tier 1 common equity to total

risk-weighted assets (A)/(B) 6.46% 3.13

(1) Tier 1 common equity is a non-GAAP financial measure that is used by

investors, analysts and bank regulatory agencies, including the Federal

Reserve in the SCAP, to assess the capital position of financial services

companies. Tier 1 common equity includes total Wells Fargo stockholders’

equity, less preferred equity, goodwill and intangible assets (excluding MSRs),

net of related deferred taxes, adjusted for specified Tier 1 regulatory capital

limitations covering deferred taxes, MSRs, and cumulative other comprehensive

income. Management reviews Tier 1 common equity along with other measures

of capital as part of its financial analyses and has included this non-GAAP

financial information, and the corresponding reconciliation to total equity,

because of current interest in such information on the part of market participants.

(2) Under the regulatory guidelines for risk-based capital, on-balance sheet assets

and credit equivalent amounts of derivatives and off-balance sheet items are

assigned to one of several broad risk categories according to the obligor or, if

relevant, the guarantor or the nature of any collateral. The aggregate dollar

amount in each risk category is then multiplied by the risk weight associated

with that category. The resulting weighted values from each of the risk

categories are aggregated for determining total risk-weighted assets.

Our significant accounting policies (see Note 1 (Summary of

Significant Accounting Policies) to Financial Statements in

this Report) are fundamental to understanding our results of

operations and financial condition, because they require that

we use estimates and assumptions that may affect the value

of our assets or liabilities and financial results. Six of these

policies are critical because they require management to

make difficult, subjective and complex judgments about

matters that are inherently uncertain and because it is likely

that materially different amounts would be reported under

different conditions or using different assumptions. These

policies govern:

• the allowance for credit losses;

• purchased credit-impaired (PCI) loans;

• the valuation of residential mortgage servicing rights (MSRs);

• the fair valuation of financial instruments;

• pension accounting; and

• income taxes.

Management has reviewed and approved these critical

accounting policies and has discussed these policies with the

Audit and Examination Committee of the Company’s Board.

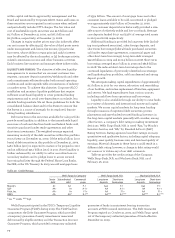

Allowance for Credit Losses

The allowance for credit losses, which consists of the

allowance for loan losses and the reserve for unfunded credit

commitments, reflects management’s judgment of probable

credit losses inherent in the portfolio and unfunded lending

commitments at the balance sheet date.

We use a disciplined process and methodology to establish

our allowance for credit each quarter. While our methodology

attributes portions of the allowance to specific portfolios as

part of our analytical process, the entire allowance for credit

losses is available to absorb credit losses in the total loan

portfolio. Additionally, while the allowance is built by portfo-

lio, it is allocated by loan type for external reporting purposes.

To determine the total allowance for loan losses, we esti-

mate the reserves needed for each component of the portfolio,

including loans analyzed individually and loans analyzed on a

pooled basis.

The allowance for loan losses consists of amounts applica-

ble to: (i) the consumer portfolio; (ii) the commercial, CRE

and lease financing portfolio (including reserve for unfunded

credit commitments); and (iii) the PCI portfolio.

Critical Accounting Policies

PRUDENTIAL JOINT VENTURE As described in the “Contractual

Obligations” section in our 2008 Form 10-K, during 2009 we

owned a controlling interest in a retail securities brokerage

joint venture, which Wachovia entered into with Prudential

Financial, Inc. (Prudential) in 2003. See also Note 1 (Summary

of Significant Accounting Policies – Accounting Standards

Adopted in 2009) to Financial Statements in this Report for

additional information. In 2009, Prudential’s noncontrolling

interest was 23% of the joint venture. On December 31, 2009,

we purchased Prudential’s noncontrolling interest for

$4.5 billion in cash. We now own 100% of the retail

securities brokerage business.