Wells Fargo 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We are authorized to issue 20 million shares of preferred

stock and 4 million shares of preference stock, both without

par value. Preferred shares outstanding rank senior to

common shares both as to dividends and liquidation

Note 17: Preferred Stock

preference but have no general voting rights. We have not

issued any preference shares under this authorization.

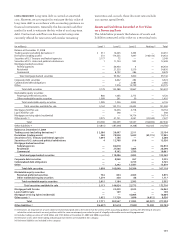

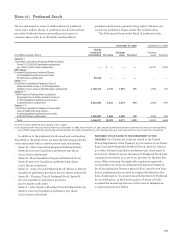

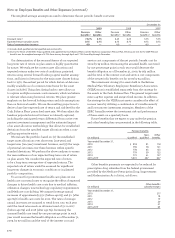

The following table provides detail of preferred stock.

In addition to the preferred stock issued and outstanding

described in the table above, we have the following preferred

stock authorized with no shares issued and outstanding:

• Series A – Non-Cumulative Perpetual Preferred Stock,

Series A, $100,000 liquidation preference per share,

25,001 shares authorized

• Series B – Non-Cumulative Perpetual Preferred Stock,

Series B, $100,000 liquidation preference per share,

17,501 shares authorized

• Series G – 7.25% Class A Preferred Stock, Series G, $15,000

liquidation preference per share, 50,000 shares authorized

• Series H – Floating Class A Preferred Stock, Series H,

$20,000 liquidation preference per share,

50,000 shares authorized

• Series I – 5.80% Fixed to Floating Class A Preferred Stock,

Series I, $100,000 liquidation preference per share,

25,010 shares authorized

PREFERRED STOCK ISSUED TO THE DEPARTMENT OF THE

TREASURY On October 28, 2008, we issued to the United

States Department of the Treasury 25,000 shares of our Fixed

Rate Cumulative Perpetual Preferred Stock, Series D without

par value, having a liquidation preference per share equal to

$1,000,000. Under its terms, the Series D Preferred Stock paid

cumulative dividends at a rate of 5% per year for the first five

years. After obtaining the applicable regulatory approvals,

on December 23, 2009, we redeemed the Series D Preferred

Stock by paying the Treasury $25.13 billion, equal to the liqui-

dation preference plus accrued but unpaid dividends to the

date of redemption. In connection with the Series D Preferred

Stock redemption, in the fourth quarter of 2009, we fully

accreted the remaining discount at the time of redemption,

or approximately $1.9 billion.

December 31, 2009 December 31, 2008

Shares

issued and Carrying Carrying

(in millions, except shares) outstanding Par value value Discount value Discount

Series D (1)

Fixed Rate Cumulative Perpetual Preferred Stock,

Series D, $1,000,000 liquidation preference

per share, 25,000 shares authorized —$——— 22,741 2,259

DEP Shares

Dividend Equalization Preferred Shares,

$10 liquidation preference per share,

97,000 shares authorized 96,546 — — — ——

Series J (1)(2)

8.00% Non-Cumulative Perpetual Class A

Preferred Stock, Series J, $1,000 liquidation

preference per share, 2,300,000 shares authorized 2,150,375 2,150 1,995 155 1,995 155

Series K (1)(2)

7.98% Fixed-to-Floating Non-Cumulative

Perpetual Class A Preferred Stock, Series K,

$1,000 liquidation preference per share,

3,500,000 shares authorized 3,352,000 3,352 2,876 476 2,876 476

Series L (1)(2)

7.50% Non-Cumulative Perpetual Convertible

Class A Preferred Stock, Series L,

$1,000 liquidation preference per share,

4,025,000 shares authorized 3,968,000 3,968 3,200 768 3,200 768

Total 9,566,921 $9,470 8,071 1,399 30,812 3,658

(1) Series J, K and L preferred shares qualify as Tier 1 capital.

(2) In conjunction with the acquisition of Wachovia, at December 31, 2008, shares of Series J, K and L perpetual preferred stock were converted into shares of a corresponding

series of Wells Fargo preferred stock having substantially the same rights and preferences. The carrying value is par value adjusted to fair value in purchase accounting.