Wells Fargo 2009 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

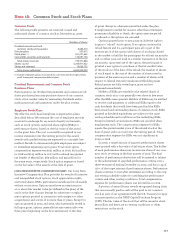

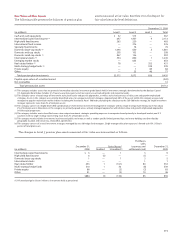

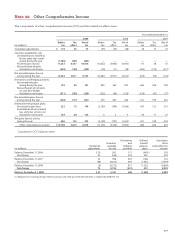

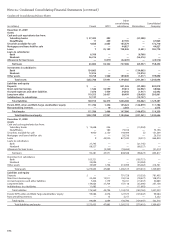

Year ended December 31,

(in millions) 2009 2008 2007

Outside professional services $1,982 847 899

Contract services 1,088 407 448

Foreclosed assets 1,071 414 256

Outside data processing 1,027 480 482

Postage, stationery and supplies 933 556 565

Insurance 845 725 416

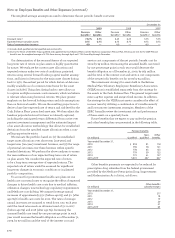

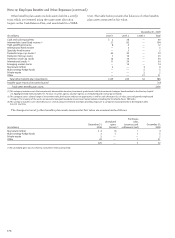

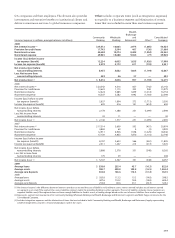

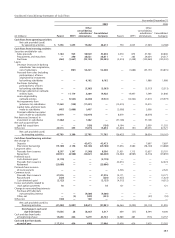

VALUATION METHODOLOGIES Following is a description

of the valuation methodologies used for assets measured

at fair value.

Cash and Cash Equivalents – includes investments in U.S.

Treasury bills, valued at quoted market prices and collective

investment funds. Investments in collective investment funds

are valued at fair value based upon the quoted market values

of the underlying net assets. The unit price is quoted on a

private market that is not active; however, the unit price is

based on underlying investments traded on an active market.

Intermediate (Core), High-Yield, International and

Specialty Fixed Income – includes bonds and notes traded

on a national securities exchange valued at the last reported

sale price on the last business day of the year. Also includes

investments traded on the OTC market and listed securities

for which no sale was reported on that date; both are valued

at the average of the last reported bid and ask prices. Also

includes investments in collective investment funds

described above.

Domestic, International and Emerging Market Stocks –

investments in common stock are valued at quoted market

values. Investments in registered investment companies are

valued at the NAV of shares held at year end. Also includes

investments in collective investment funds described above.

Real Estate and Timber – the fair value of real estate and

timber is estimated based primarily on appraisals prepared

by third-party appraisers. Market values are estimates

and the actual market price of the real estate can only be

determined by negotiation between independent third

parties in a sales transaction.

Multi-Strategy Hedge Funds and Private Equity – the fair

values of hedge funds are valued based on the proportionate

share of the underlying net assets of the investment funds

that comprise the fund, based on valuations supplied by the

underlying investment funds. Investments in private equity

funds are valued at the NAV provided by the fund sponsor.

Market values are estimates and the actual market price

of the investments can only be determined by negotiation

between independent third parties in a sales transaction.

Other – the fair values of miscellaneous investments are val-

ued at the NAV provided by the fund sponsor. Market values

are estimates and the actual market price of the investments

can only be determined by negotiation between independent

third parties in a sales transaction. Also includes insurance

contracts that are generally stated at cash surrender value.

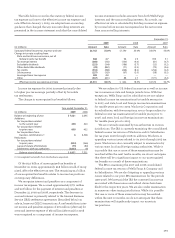

The methods described above may produce a fair value

calculation that may not be indicative of net realizable

value or reflective of future fair values. While we believe our

valuation methods are appropriate and consistent with other

market participants, the use of different methodologies or

assumptions to determine the fair value of certain financial

instruments could result in a different fair value measurement

at the reporting date.

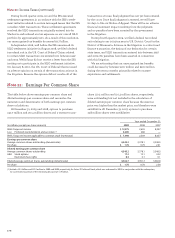

Other Expenses

Expenses exceeding 1% of total interest income and

noninterest income in any of the years presented that are

not otherwise shown separately in the financial statements

or Notes to Financial Statements were: