Wells Fargo 2009 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

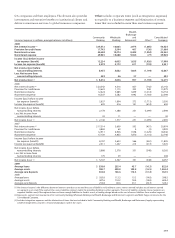

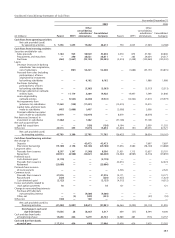

Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) – Quarterly (1)(2) – (Unaudited)

Quarter ended December 31,

2009 2008

Interest Interest

Average Yields/ income/ Average Yields/ income/

(in millions) balance rates expense balance rates expense

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 46,031 0.33% $ 39 9,938 0.73% $ 18

Trading assets 23,179 4.05 235 5,004 4.50 56

Debt securities available for sale (3):

Securities of U.S. Treasury and federal agencies 2,381 3.54 21 1,165 3.75 11

Securities of U.S. states and political subdivisions 13,574 6.48 217 7,124 6.73 139

Mortgage-backed securities:

Federal agencies 85,063 5.43 1,099 51,714 6.07 769

Residential and commercial 43,243 9.20 1,000 18,245 6.40 402

Total mortgage-backed securities 128,306 6.74 2,099 69,959 6.18 1,171

Other debt securities (4) 33,710 7.60 600 14,217 8.10 330

Total debt securities available for sale (4) 177,971 6.84 2,937 92,465 6.50 1,651

Mortgages held for sale (5) 34,750 5.13 446 23,390 6.19 362

Loans held for sale (5) 5,104 2.48 32 1,287 4.14 14

Loans:

Commercial and commercial real estate:

Commercial 164,050 4.65 1,918 107,325 5.66 1,525

Real estate mortgage 104,773 3.44 908 45,555 5.49 628

Real estate construction 30,887 3.03 236 19,943 4.49 225

Lease financing 14,107 10.20 360 7,397 5.58 103

Total commercial and commercial real estate 313,817 4.33 3,422 180,220 5.48 2,481

Consumer:

Real estate 1-4 family first mortgage 232,273 5.26 3,066 78,251 6.37 1,247

Real estate 1-4 family junior lien mortgage 103,584 4.58 1,195 75,838 5.85 1,114

Credit card 23,717 12.18 723 20,626 12.21 629

Other revolving credit and installment 88,963 6.46 1,450 52,638 8.35 1,107

Total consumer 448,537 5.71 6,434 227,353 7.19 4,097

Foreign 30,086 3.74 283 6,367 9.73 156

Total loans (5) 792,440 5.09 10,139 413,940 6.48 6,734

Other 6,147 3.13 49 1,690 5.37 23

Total earning assets $1,085,622 5.12% $13,877 547,714 6.34% $8,858

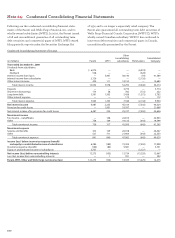

Funding sources

Deposits:

Interest-bearing checking $ 61,229 0.15% $ 23 6,396 0.65% $ 11

Market rate and other savings 389,905 0.31 303 178,301 0.96 430

Savings certificates 109,306 1.66 458 41,189 2.66 275

Other time deposits 16,501 2.28 94 8,128 2.74 54

Deposits in foreign offices 59,870 0.23 35 42,771 0.69 75

Total interest-bearing deposits 636,811 0.57 913 276,785 1.22 845

Short-term borrowings 32,757 0.18 14 60,210 1.35 204

Long-term debt 210,707 2.31 1,218 104,112 3.69 964

Other liabilities 5,587 3.49 50 ———

Total interest-bearing liabilities 885,862 0.99 2,195 441,107 1.82 2,013

Portion of noninterest-bearing funding sources 199,760 — —106,607 — —

Total funding sources $1,085,622 0.81 2,195 547,714 1.44 2,013

Net interest margin and net interest income on

a taxable-equivalent basis (6) 4.31% $11,682 4.90% $6,845

Noninterest-earning assets

Cash and due from banks $ 19,216 11,155

Goodwill 24,093 13,544

Other 110,525 60,810

Total noninterest-earning assets $ 153,834 85,509

Noninterest-bearing funding sources

Deposits $ 179,204 91,229

Other liabilities 45,058 30,651

Total equity 129,332 70,236

Noninterest-bearing funding sources used to

fund earning assets (199,760) (106,607)

Net noninterest-bearing funding sources $ 153,834 85,509

Total assets $1,239,456 633,223

(1) Our average prime rate was 3.25% and 4.06% for the quarters ended December 31, 2009 and 2008, respectively. The average three-month London Interbank Offered Rate

(LIBOR) was 0.27% and 2.77% for the same quarters, respectively.

(2) Interest rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(3) Yields are based on amortized cost balances computed on a settlement date basis.

(4) Includes certain preferred securities.

(5) Nonaccrual loans and related income are included in their respective loan categories.

(6) Includes taxable-equivalent adjustments primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate was 35% for the periods presented.