Wells Fargo 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

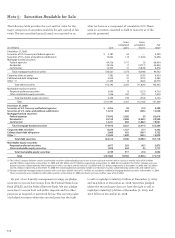

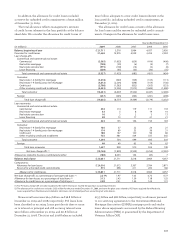

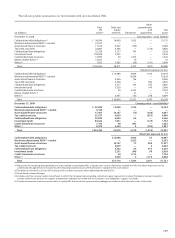

The following table presents the major categories of loans

outstanding including those subject to accounting guidance

for PCI loans. Certain loans acquired in the Wachovia acquisi-

tion are accounted for as PCI loans and are included below,

net of any remaining purchase accounting adjustments.

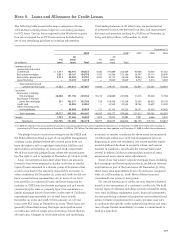

Note 6: Loans and Allowance for Credit Losses

December 31,

2009 2008(1) 2007 2006 2005

All All

PCI other PCI other

(in millions) loans loans Total loans loans Total

Commercial and

commercial real estate:

Commercial $ 1,911 156,441 158,352 4,580 197,889 202,469 90,468 70,404 61,552

Real estate mortgage 5,631 99,167 104,798 7,762 95,346 103,108 36,747 30,112 28,545

Real estate construction 3,713 25,994 29,707 4,503 30,173 34,676 18,854 15,935 13,406

Lease financing — 14,210 14,210 — 15,829 15,829 6,772 5,614 5,400

Total commercial and

commercial real estate 11,255 295,812 307,067 16,845 339,237 356,082 152,841 122,065 108,903

Consumer:

Real estate 1-4 family

first mortgage 38,386 191,150 229,536 39,214 208,680 247,894 71,415 53,228 77,768

Real estate 1-4 family

junior lien mortgage 331 103,377 103,708 728 109,436 110,164 75,565 68,926 59,143

Credit card — 24,003 24,003 — 23,555 23,555 18,762 14,697 12,009

Other revolving credit

and installment — 89,058 89,058 151 93,102 93,253 56,171 53,534 47,462

Total consumer 38,717 407,588 446,305 40,093 434,773 474,866 221,913 190,385 196,382

Foreign 1,733 27,665 29,398 1,859 32,023 33,882 7,441 6,666 5,552

Total loans $51,705 731,065 782,770 58,797 806,033 864,830 382,195 319,116 310,837

(1) In 2009, we refined certain of our preliminary purchase accounting adjustments based on additional information as of December 31, 2008. These refinements resulted in

increasing the PCI loans carrying value at December 31, 2008, to $59.2 billion. The table above has not been updated as of December 31, 2008, to reflect these refinements.

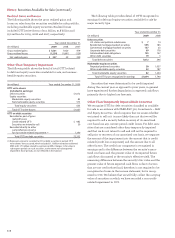

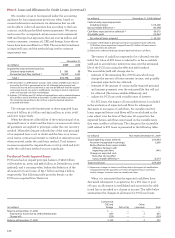

We pledge loans to secure borrowings from the FHLB and

the Federal Reserve Bank as part of our liquidity management

strategy. Loans pledged where the secured party does not

have the right to sell or repledge totaled $312.6 billion and

$337.5 billion at December 31, 2009 and 2008, respectively.

We did not have any pledged loans where the secured party

has the right to sell or repledge at December 31, 2009 or 2008.

Loan concentrations may exist when there are amounts

loaned to borrowers engaged in similar activities or similar

types of loans extended to a diverse group of borrowers that

would cause them to be similarly impacted by economic or

other conditions. At December 31, 2009 and 2008, we did not

have concentrations representing 10% or more of our total

loan portfolio in commercial loans and lease financing by

industry or CRE loans (real estate mortgage and real estate

construction) by state or property type. Our real estate 1-4

family mortgage loans to borrowers in the state of California

represented approximately 14% of total loans at both

December 31, 2009 and 2008. Of this amount, 3% of total

loans were PCI loans at December 31, 2009. These loans are

generally diversified among the larger metropolitan areas

in California, with no single area consisting of more than 3%

of total loans. Changes in real estate values and underlying

economic or market conditions for these areas are monitored

continuously within our credit risk management process.

Beginning in 2007, the residential real estate markets experi-

enced significant declines in property values, and several

markets in California, specifically the Central Valley and

several Southern California metropolitan statistical areas,

experienced more severe value adjustments.

Some of our real estate 1-4 family mortgage loans, including

first mortgage and home equity products, include an interest-

only feature as part of the loan terms. At December 31, 2009,

these loans were approximately 15% of total loans, compared

with 11% at December 31, 2008. Most of these loans are

considered to be prime or near prime.

For certain extensions of credit, we may require collateral,

based on our assessment of a customer’s credit risk. We hold

various types of collateral, including accounts receivable, inven-

tory, land, buildings, equipment, autos, financial instruments,

income-producing commercial properties and residential real

estate. Collateral requirements for each customer may vary

according to the specific credit underwriting, terms and struc-

ture of loans funded immediately or under a commitment to

fund at a later date.

Outstanding balances of all other loans are presented net

of unearned income, net deferred loan fees, and unamortized

discount and premium totaling $14.6 billion at December 31,

2009, and $16.9 billion, at December 31, 2008.