Wells Fargo 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

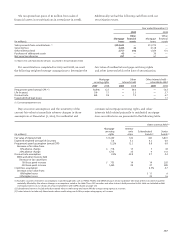

Transactions with VIEs

Our transactions with VIEs include securitization, investment

and financing activities involving CDOs backed by asset-

backed and CRE securities, collateralized loan obligations

(CLOs) backed by corporate loans or bonds, and other types

of structured financing. We have various forms of involve-

ment with VIEs, including holding senior or subordinated

interests, entering into liquidity arrangements, credit default

swaps and other derivative contracts. These involvements

with unconsolidated VIEs are recorded on our balance sheet

primarily in trading assets, securities available for sale, loans,

MSRs, other assets and other liabilities, as appropriate.

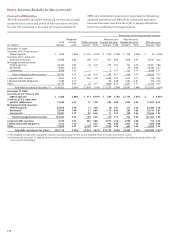

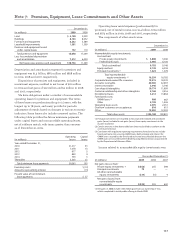

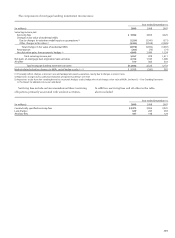

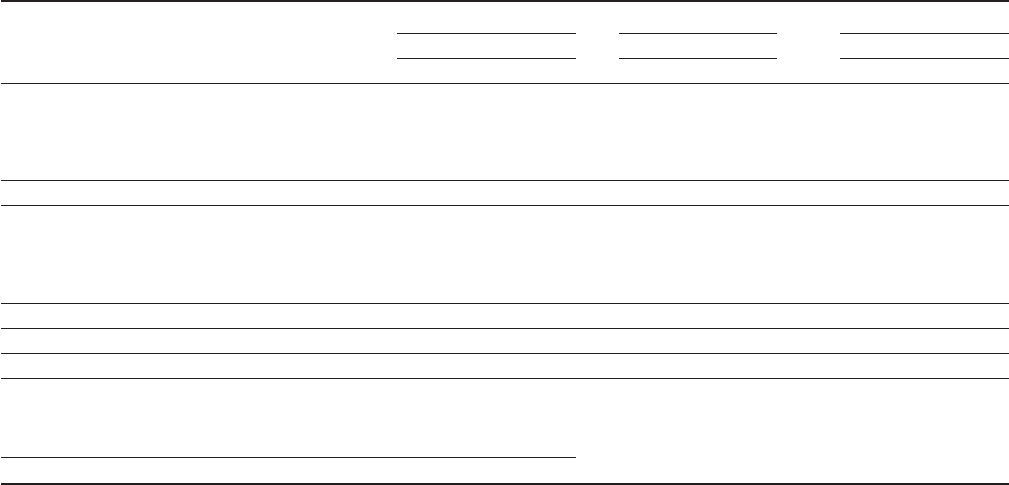

Total loans(1) Delinquent loans(2)(3) Net charge-offs(3)

December 31,December 31, Year ended December 31,

(in millions) 2009 2008 2009 2008 2009 2008

Commercial and commercial real estate:

Commercial $ 159,185 204,113 5,052 1,471 3,111 1,539

Real estate mortgage 326,314 310,480 12,375 1,058 833 26

Real estate construction 29,707 34,676 3,765 1,221 959 175

Lease financing 14,210 15,829 171 92 209 52

Total commercial and commercial real estate 529,416 565,098 21,363 3,842 5,112 1,792

Consumer:

Real estate 1-4 family first mortgage 1,331,568 1,165,456 19,224 6,849 4,420 902

Real estate 1-4 family junior lien mortgage 107,000 115,308 2,854 1,421 4,692 2,115

Credit card 24,003 23,555 795 687 2,528 1,416

Other revolving credit and installment 99,140 104,886 1,765 1,427 2,775 1,819

Total consumer 1,561,711 1,409,205 24,638 10,384 14,415 6,252

Foreign 29,398 33,882 219 91 197 196

Total loans owned and securitized $2,120,525 2,008,185 46,220 14,317 19,724 8,240

Less:

Securitized loans 1,292,928 1,117,039

Mortgages held for sale 39,094 20,088

Loans held for sale 5,733 6,228

Total loans held $ 782,770 864,830

(1) Represents loans in the balance sheet or that have been securitized and includes residential mortgages sold to FNMA, FHLMC and GNMA and securitizations where

servicing is our only form of continuing involvement.

(2) Delinquent loans are 90 days or more past due and still accruing interest as well as nonaccrual loans.

(3) Delinquent loans and net charge-offs exclude loans sold to FNMA, FHLMC and GNMA. We continue to service the loans and would only experience a loss if required

to repurchase a delinquent loan due to a breach in original representations and warranties associated with our underwriting standards.

Note 8: Securitizations and Variable Interest Entities (continued)

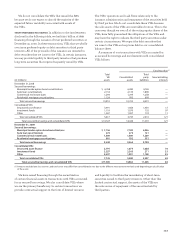

The sensitivities in the preceding table are hypothetical

and caution should be exercised when relying on this data.

Changes in fair value based on variations in assumptions gen-

erally cannot be extrapolated because the relationship of the

change in the assumption to the change in fair value may not

be linear. Also, the effect of a variation in a particular assump-

tion on the fair value of the other interests held is calculated

independently without changing any other assumptions. In

reality, changes in one factor may result in changes in others

(for example, changes in prepayment speed estimates could

result in changes in the discount rates), which might magnify

or counteract the sensitivities.

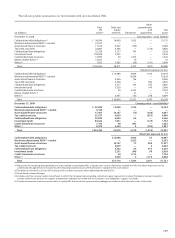

The table below presents information about the principal

balances of owned and securitized loans.