Wells Fargo 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

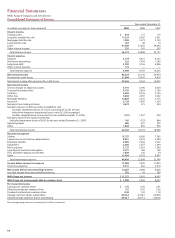

Table 33: Estimated Impact of Initial 2010 Application of

ASU 2009-16 (FAS 166) and ASU 2009-17 (FAS 167)

by Balance Sheet Classification

(in billions) Assets Liabilities Equity

Net increase (decrease)

Trading assets $ 0.1 — —

Securities available for sale (7.2) — —

Loans, net (1) 26.3 — —

Short-term borrowings — 5.2 —

Long-term debt — 13.8 —

Other 0.4 0.1 —

Cumulative other

comprehensive income — — 0.2

Retained earnings — — 0.3

Total $19.6 19.1 0.5

(1) Includes $1.3 billion of nonaccrual loans, substantially all of which are real

estate 1-4 family first mortgage loans.

We have refined our estimate disclosed in our third

quarter 2009 Form 10-Q due largely to the sale of residential

MBS and the proposed amendment to ASU 2009-17 (FAS 167),

which defers application to certain investment funds. The

cumulative effect of adopting these statements will be recorded

as an adjustment to retained earnings on January 1, 2010.

This Report contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words

such as “anticipates,” “intends,” “plans,” “seeks,” “believes,”

“estimates,” “expects,” “projects,” “outlook,” “forecast,” “will,”

“may,” “could,” “should,” “can” and similar references to future

periods. Examples of forward-looking statements include, but

are not limited to, statements we make about: future results

of the Company; expectations for consumer and commercial

credit losses, life-of-loan losses, and the sufficiency of our

credit loss allowance to cover future credit losses; the merger

integration of the Company and Wachovia, including expense

savings, merger costs and revenue synergies; the expected

outcome and impact of legal, regulatory and legislative devel-

opments; and the Company’s plans, objectives and strategies.

Forward-looking statements are based on our current

expectations and assumptions regarding our business, the

economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Our actual results may differ materially

from those contemplated by the forward-looking statements.

We caution you, therefore, against relying on any of these

forward-looking statements. They are neither statements

of historical fact nor guarantees or assurances of future

performance. While there is no assurance that any list of

risks and uncertainties or risk factors is complete, important

factors that could cause actual results to differ materially

from those in the forward-looking statements include the

following, without limitation:

• the effect of political and economic conditions and

geopolitical events;

• economic conditions that affect the general economy,

housing prices, the job market, consumer confidence and

spending habits;

• the level and volatility of the capital markets, interest

rates, currency values and other market indices that affect

the value of our assets and liabilities;

• the availability and cost of both credit and capital as well

as the credit ratings assigned to our debt instruments;

• investor sentiment and confidence in the financial markets;

• our reputation;

• the impact of current, pending and future legislation,

regulation and legal actions;

• changes in accounting standards, rules and interpretations;

• mergers and acquisitions, and our ability to integrate them;

• various monetary and fiscal policies and regulations of the

U.S. and foreign governments; and

• the other factors described in “Risk Factors” below.

Any forward-looking statement made by us in this Report

speaks only as of the date on which it is made. Factors or

events that could cause our actual results to differ may

emerge from time to time, and it is not possible for us to

predict all of them. We undertake no obligation to publicly

update any forward-looking statement, whether as a result of

new information, future developments or otherwise, except as

may be required by law.

Forward-Looking Statements