Wells Fargo 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

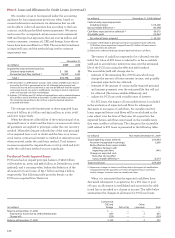

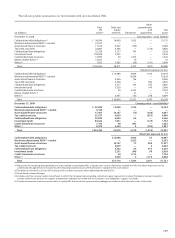

commercial mortgage servicing rights, and other

interests held related primarily to residential mortgage

loan securitizations are presented in the following table.

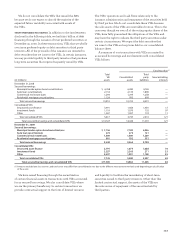

Key economic assumptions and the sensitivity of the

current fair value to immediate adverse changes in those

assumptions at December 31, 2009, for residential and

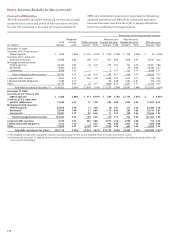

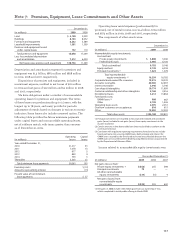

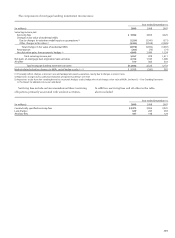

Other interests held(1)

Mortgage Interest-

servicing only Subordinated Senior

(in millions) rights strips bonds (2) bonds(3)

Fair value of interests held $17,259 532 447 5,801

Expected weighted-average life (in years) 5.8 5.2 4.2 6.0

Prepayment speed assumption (annual CPR) 12.2% 12.2 8.8 9.9

Decrease in fair value from:

10% adverse change $ 718 13 3 43

25% adverse change 1,715 35 9 116

Discount rate assumption 9.0% 20.9 9.7 9.4

MSRs and other interests held

Decrease in fair value from:

100 basis point increase $ 755 14 14 203

200 basis point increase 1,449 28 27 389

Credit loss assumption 4.3% 4.7

Decrease in fair value from:

10% higher losses $11 6

25% higher losses 22 16

(1) Excludes securities retained in securitizations issued through GSEs such as FNMA, FHLMC and GNMA because we do not believe the value of these securities would be

materially affected by the adverse changes in assumptions noted in the table. These GSE securities and other interests held presented in this table are included in debt

and equity interests in our disclosure of our involvements with QSPEs shown on page 126.

(2) Subordinated interests include only those bonds whose credit rating was below AAA by a major rating agency at issuance.

(3) Senior interests include only those bonds whose credit rating was AAA by a major rating agency at issuance.

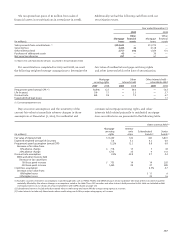

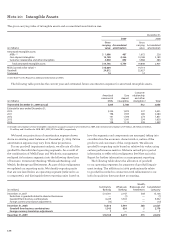

For securitizations completed in 2009 and 2008, we used

the following weighted-average assumptions to determine the

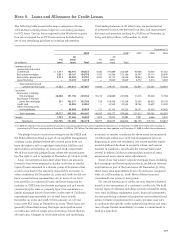

Mortgage Other Other interests held –

servicing rights interests held subordinate debt

2009 2008 2009 2008 2009 2008

Prepayment speed (annual CPR (1) )13.4% 12.7 —36.0 —13.3

Life (in years) 5.6 7.1 —2.3 —5.7

Discount rate 8.3 9.4 —7.2 —6.7

Expected life of loan losses —1.1

(1) Constant prepayment rate.

fair value of residential mortgage servicing rights

and other interests held at the date of securitization.

We recognized net gains of $1 million from sales of

financial assets in securitizations in 2009 (none in 2008).

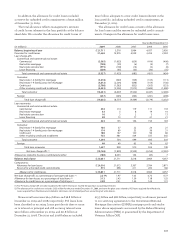

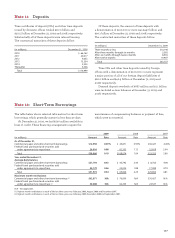

Additionally, we had the following cash flows with our

securitization trusts.

Year ended December 31,

2009 2008

Other Other

Mortgage financial Mortgage financial

(in millions) loans assets loans assets

Sales proceeds from securitizations (1) $394,632 — 212,770 —

Servicing fees 4,283 42 3,128 —

Other interests held 3,757 296 1,509 131

Purchases of delinquent assets 45 — 36 —

Net servicing advances 257 — 61 —

(1) Represents cash flow data for all loans securitized in the period presented.