Wells Fargo 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

demands in lieu of repurchasing the loans. We manage the

risk associated with potential repurchases or other forms of

settlement through our underwriting and quality assurance

practices and by servicing mortgage loans to meet investor

and secondary market standards.

We establish mortgage repurchase reserves related to various

representations and warranties that reflect management’s

estimate of losses based on a combination of factors. Such

factors incorporate estimated levels of defects based on internal

quality assurance sampling, default expectations, historical

investor repurchase demand and appeals success rates (where

the investor rescinds the demand based on a cure of the

defect or acknowledges that the loan satisfies the investor’s

applicable representations and warranties), reimbursement by

correspondent and other third party originators, and projected

loss severity. We establish a reserve at the time loans are sold

and continually update our reserve estimate during their life.

Although investors may demand repurchase at any time, the

majority of repurchase demands occurs in the first 24 to 36

months following origination of the mortgage loan and can

vary by investor. Currently, repurchase demands primarily

relate to 2006 through 2008 vintages.

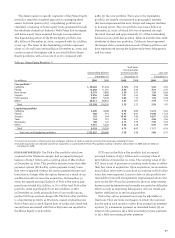

During 2009 we experienced elevated levels of repurchase

activity measured by number of loans, investor repurchase

demands and our level of repurchases. These trends accelerated

in the fourth quarter. We repurchased or otherwise settled

mortgage loans with balances of $1.3 billion in 2009, compared

with $426 million in 2008. We incurred losses on repurchase

activity of $514 million in 2009, compared with $251 million

in 2008. Our reserve for repurchases, included in “Accrued

expenses and other liabilities” in our consolidated financial

statements, was $1.0 billion at December 31, 2009, and $589 mil-

lion at December 31, 2008. To the extent that repurchased

loans are nonperforming, the loans are classified as nonaccrual.

Nonperforming loans included $275 million of repurchased loans

at December 31, 2009, and $193 million at December 31, 2008.

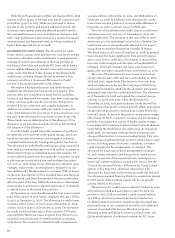

Approximately three-fourths of our repurchases were

government agency conforming loans from Freddie Mac

and Fannie Mae. The increase in repurchase and settlement

activity during 2009 primarily related to weaker economic

conditions as investors, predominantly GSEs, made increased

demands associated with higher levels of defaulted loans. Our

appeals success rate improved from 2008 to 2009 reflecting

our enhanced and more timely loss mitigation efforts.

However, the annual loss increased year over year due to

higher volumes. The appeals success rate is one indicator

of our future repurchase losses and may also be affected by

factors such as the quality of repurchase demands, the mix

of reasons for the demands, and investor repurchase

demand strategies.

To the extent that economic conditions and the housing

market do not recover or future investor repurchase demand

and appeals success rates differ from past experience, we could

continue to have increased demands and increased loss severity

on repurchases, causing future additions to the repurchase

reserve. However, some of the underwriting standards that

were permitted by the GSEs for conforming loans in the 2006

through 2008 vintages, which significantly contributed to

recent levels of repurchase demands, were tightened starting

in mid to late 2008. Accordingly, we do not expect a similar

level of repurchase requests from the 2009 and prospective

vintages, absent deterioration in economic conditions.

Asset/Liability Management

Asset/liability management involves the evaluation,

monitoring and management of interest rate risk, market

risk, liquidity and funding. The Corporate Asset/Liability

Management Committee (Corporate ALCO)—which oversees

these risks and reports periodically to the Finance Committee

of the Board of Directors—consists of senior financial and

business executives. Each of our principal business groups

has its own asset/liability management committee and

process linked to the Corporate ALCO process.

INTEREST RATE RISK Interest rate risk, which potentially can

have a significant earnings impact, is an integral part of being

a financial intermediary. We are subject to interest rate risk

because:

• assets and liabilities may mature or reprice at different

times (for example, if assets reprice faster than liabilities

and interest rates are generally falling, earnings will

initially decline);

• assets and liabilities may reprice at the same time but by

different amounts (for example, when the general level

of interest rates is falling, we may reduce rates paid on

checking and savings deposit accounts by an amount that

is less than the general decline in market interest rates);

• short-term and long-term market interest rates may

change by different amounts (for example, the shape of

the yield curve may affect new loan yields and funding

costs differently); or

• the remaining maturity of various assets or liabilities may

shorten or lengthen as interest rates change (for example,

if long-term mortgage interest rates decline sharply,

MBS held in the securities available-for-sale portfolio

may prepay significantly earlier than anticipated,

which could reduce portfolio income).

Interest rates may also have a direct or indirect effect on

loan demand, credit losses, mortgage origination volume, the

fair value of MSRs and other financial instruments, the value

of the pension liability and other items affecting earnings.

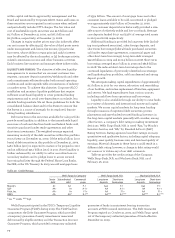

We assess interest rate risk by comparing our most likely

earnings plan with various earnings simulations using many

interest rate scenarios that differ in the direction of interest

rate changes, the degree of change over time, the speed of

change and the projected shape of the yield curve. For example,

as of December 31, 2009, our most recent simulation indicated

estimated earnings at risk of approximately 5% of our most

likely earnings plan over the next 12 months using a scenario

in which the federal funds rate rises to 4.25% and the 10-year

Constant Maturity Treasury bond yield rises to 5.50%. Simulation

estimates depend on, and will change with, the size and mix

of our actual and projected balance sheet at the time of each

simulation. Due to timing differences between the quarterly

valuation of MSRs and the eventual impact of interest rates

on mortgage banking volumes, earnings at risk in any particular