Wells Fargo 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

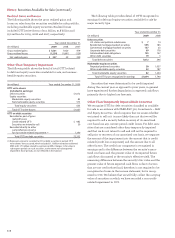

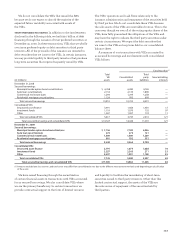

Other

Total Debt and commitments

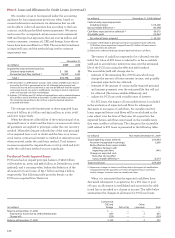

QSPE equity Servicing and Net

(in millions) assets(1) interests(2) assets Derivatives guarantees assets

December 31, 2008 Carrying value –asset (liability)

Residential mortgage loan securitizations (3):

Conforming (4) $ 1,008,824 10,207 11,715 — (426) 21,496

Other/nonconforming 313,447 7,262 2,276 30 (85) 9,483

Commercial mortgage securitizations (3) 320,399 1,452 918 524 — 2,894

Auto loan securitizations 4,133 72 — 43 — 115

Student loan securitizations 2,765 76 57 — — 133

Other 11,877 74 — (3) — 71

Total $ 1,661,345 19,143 14,966 594 (511) 34,192

Maximum exposure to loss

Residential mortgage loan securitizations (3):

Conforming (4) $ 10,207 11,715 — 2,697 24,619

Other/nonconforming 7,262 2,276 300 71 9,909

Commercial mortgage securitizations (3) 1,452 918 524 — 2,894

Auto loan securitizations 72 — 43 — 115

Student loan securitizations 76 57 — — 133

Other 74 — 1,465 37 1,576

Total $ 19,143 14,966 2,332 2,805 39,246

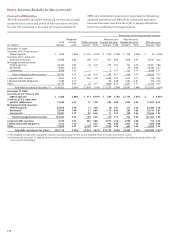

December 31, 2009 Carrying value –asset (liability)

Residential mortgage loan securitizations:

Conforming (4) $1,150,515 5,846 13,949 — (869) 18,926

Other/nonconforming 251,850 11,683 1,538 16 (15) 13,222

Commercial mortgage securitizations 345,561 3,760 696 489 — 4,945

Auto loan securitizations 2,285 137 — 21 — 158

Student loan securitizations 2,637 123 50 — — 173

Other 8,391 57 — 4 — 61

Total $1,761,239 21,606 16,233 530 (884) 37,485

Maximum exposure to loss

Residential mortgage loan securitizations:

Conforming (4) $ 5,846 13,949 — 4,567 24,362

Other/nonconforming 11,683 1,538 30 218 13,469

Commercial mortgage securitizations 3,760 696 766 — 5,222

Auto loan securitizations 137 — 21 — 158

Student loan securitizations 123 50 — — 173

Other 57 — 78 — 135

Total $21,606 16,233 895 4,785 43,519

(1) Represents the remaining principal balance of assets held by QSPEs using the most current information available.

(2) Excludes certain debt securities held related to loans serviced for FNMA, FHLMC and GNMA.

(3) Certain balances have been revised to reflect additionally identified residential mortgage QSPEs, as well as to reflect removal of commercial mortgage asset transfers that

were subsequently determined not to be transfers to QSPEs.

(4) Conforming residential mortgage loan securitizations are those that are guaranteed by GSEs. Other commitments and guarantees include amounts related to loans sold

to QSPEs that we may be required to repurchase, or otherwise indemnify or reimburse the investor or insurer for losses incurred, due to material breach of contractual

representations and warranties. The maximum exposure to loss for material breach of contractual representations and warranties represents a stressed case estimate

we utilize for determining stressed case regulatory capital needs and has been revised as of December 31, 2008, to conform with the 2009 basis of determination.

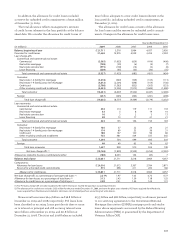

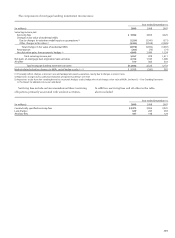

A summary of our involvements with QSPEs follows:

in the preceding table, represents estimated loss that would

be incurred under severe, hypothetical circumstances, for

which we believe the possibility of occurrence is extremely

remote, such as where the value of our interests and any asso-

ciated collateral declines to zero, without any consideration

of recovery or offset from any economic hedges. Accordingly,

this required disclosure is not an indication of expected loss.

“Maximum exposure to loss” represents the carrying

value of our involvement with off-balance sheet QSPEs plus

remaining undrawn liquidity and lending commitments,

notional amount of net written derivative contracts, and gen-

erally the notional amount of, or stressed loss estimate for,

other commitments and guarantees. Maximum exposure to

loss is a required disclosure under GAAP and, as presented

Note 8: Securitizations and Variable Interest Entities (continued)