Wells Fargo 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wells Fargo Financial auto portfolio net charge-offs for 2008

were $1.2 billion (4.50% of average auto loans), compared with

$1.0 billion (3.45%) in 2007. While we continued to reduce

the size of this portfolio and limited additional growth, the

economic environment adversely affected portfolio results.

We remained focused on our loss mitigation strategies; how-

ever, credit performance deteriorated as a result of increased

unemployment and depressed used car values, resulting in

higher than expected losses for 2008.

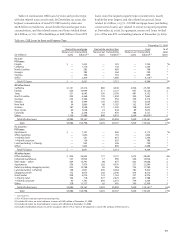

ALLOWANCE FOR CREDIT LOSSES The allowance for credit

losses, which consists of the allowance for loan losses and the

reserve for unfunded credit commitments, is management’s

estimate of credit losses inherent in the loan portfolio at

the balance sheet date and excludes PCI loans which have a

nonaccretable difference to absorb losses and loans carried

at fair value. The detail of the changes in the allowance for

credit losses, including charge-offs and recoveries by loan

category, is in Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

We employ a disciplined process and methodology to

establish our allowance for loan losses each quarter. This

process takes into consideration many factors, including

historical and forecasted loss trends, loan-level credit quality

ratings and loan grade specific loss factors. The process

involves difficult, subjective, and complex judgments. In

addition, we review several credit ratio trends, such as the

ratio of the allowance for loan losses to nonaccrual loans and

the ratio of the allowance for loan losses to net charge-offs.

These trends are not determinative of the adequacy of the

allowance as we use several analytical tools in determining

the adequacy of the allowance.

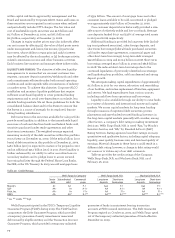

For individually graded (typically commercial) portfolios,

we generally use loan-level credit quality ratings, which are

based on borrower information and strength of collateral,

combined with historically based grade specific loss factors.

The allowance for individually rated nonaccruing commercial

loans with an outstanding exposure of $5 million or greater is

determined through an individual impairment analysis. For

statistically evaluated portfolios (typically consumer), we gen-

erally leverage models which use credit-related characteris-

tics such as credit rating scores, delinquency migration rates,

vintages, and portfolio concentrations to estimate loss con-

tent. Additionally, the allowance for consumer TDRs is based

on the risk characteristics of the modified loans and the resul-

tant estimated cash flows discounted at the pre-modification

effective yield of the loan. While the allowance is determined

using product and business segment estimates, it is available

to absorb losses in the entire loan portfolio.

At December 31, 2009, the allowance for loan losses totaled

$24.5 billion (3.13% of total loans), compared with $21.0 billion

(2.43%), at December 31, 2008. The allowance for credit losses

was $25.0 billion (3.20% of total loans) at December 31, 2009,

and $21.7 billion (2.51%) at December 31, 2008. The allowance

for credit losses included $333 million related to PCI loans

acquired from Wachovia. Loans acquired from Wachovia are

included in total loans net of related purchase accounting

write-downs. The reserve for unfunded credit commitments

was $515 million at December 31, 2009, and $698 million at

December 31, 2008. In addition to the allowance for credit

losses there was $22.9 billion of nonaccretable difference at

December 31, 2009, to absorb losses for PCI loans.

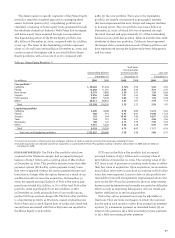

The ratio of the allowance for credit losses to total nonac-

crual loans was 103% and 319% at December 31, 2009 and

2008, respectively. The decrease in this ratio reflects some

deterioration in the underlying loan portfolio. However, the

trend in the ratio is also profoundly affected by the impact

of purchase accounting eliminating virtually all legacy

Wachovia nonaccrual loans at December 31, 2008. In general,

this ratio may fluctuate significantly from period to period

due to such factors as the mix of loan types in the portfolio,

borrower credit strength and the value and marketability of

collateral. Over half of nonaccrual loans were home mort-

gages, auto and other consumer loans at December 31, 2009.

The ratio of the allowance for loan losses to annual net

charge-offs was 135%, 268% and 150% at December 31, 2009,

2008 and 2007, respectively. The decline in this ratio from

2008 is largely due to the fact that only legacy Wells Fargo

losses were included in 2008, but the allowance anticipated

emerging losses from the combined portfolios. The allowance

as of December 31, 2008, anticipated the increased charge-

offs that occurred over 2009, while the allowance for

December 31, 2009, anticipates inherent losses that will be

recognized as charge-offs in future periods. When anticipated

charge-offs are projected to decline from current levels, this

ratio will shrink. As more of the portfolio experiences charge-

offs, charge-off levels continue to increase and the remaining

portfolio is anticipated to consist of higher quality vintage

loans subjected to tightened underwriting standards adminis-

tered during the downturn in the credit cycle. As charge-off

levels peak, we anticipate coverage levels will shrink until

charge-off levels return to more normalized levels. This ratio

may fluctuate significantly from period to period due to many

factors, including general economic conditions, customer

credit strength and the marketability of collateral. The

allowance for loan losses reflects management’s estimate

of credit losses inherent in the loan portfolio based on loss

emergence periods of the respective loans, underlying eco-

nomic and market conditions, among other factors. See the

“Critical Accounting Policies – Allowance for Credit Losses”

section in this Report for additional information. The

allowance for loan losses at December 31, 2008, also includes

the allowance acquired from the Wachovia acquisition (except

for PCI loans), while 2008 net charge-offs do not include

activity related to Wachovia.

The provision for credit losses totaled $21.7 billion in 2009,

$16.0 billion in 2008 and $4.9 billion in 2007. In 2009, the

provision of $21.7 billion included a credit reserve build of

$3.5 billion, which was primarily driven by three factors:

(1) deterioration in economic conditions that increased the

projected losses in our commercial portfolios, (2) additional

reserves associated with loan modification programs

designed to keep qualifying borrowers in their homes, and

(3) the establishment of additional reserves for PCI loans.