Wells Fargo 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

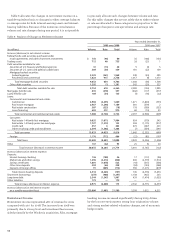

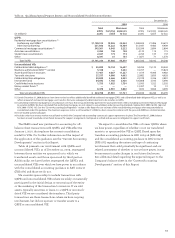

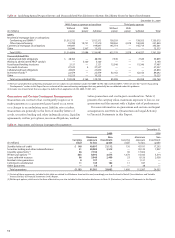

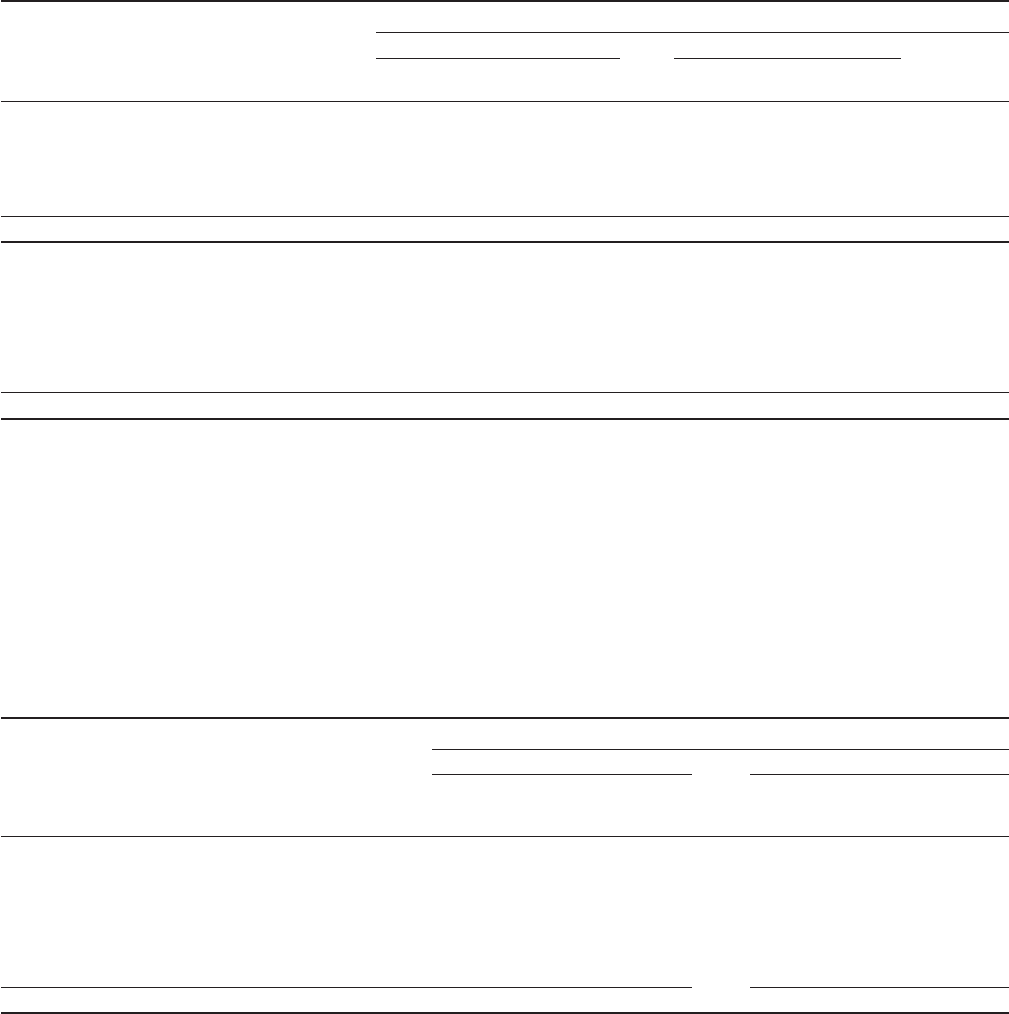

Table 16: Qualifying Special Purpose Entities and Unconsolidated Variable Interest Entities Total Entity Assets by Type of Involvement

December 31, 2009

Wells Fargo as sponsor or transferor Third party sponsor

Without With Without With

(in millions) power power Subtotal power power Subtotal Total

QSPEs

Residential mortgage loan securitizations:

Conforming and GNMA (1) $1,012,312 — 1,012,312 138,203 — 138,203 1,150,515

Other/nonconforming 91,789 19,721 111,510 138,262 2,078 140,340 251,850

Commercial mortgage securitizations 199,847 — 199,847 145,714 — 145,714 345,561

Other 10,946 2,367 13,313 — — — 13,313

Total QSPEs $1,314,894 22,088 1,336,982 422,179 2,078 424,257 1,761,239

Unconsolidated VIEs

Collateralized debt obligations $ 48,350 — 48,350 7,549 — 7,549 55,899

Wachovia administered ABCP conduit — 5,160 5,160 — — — 5,160

Asset-based lending structures 2,121 — 2,121 15,346 — 15,346 17,467

Tax credit structures 27,533 4 27,537 — — — 27,537

Collateralized loan obligations 23,830 — 23,830 — — — 23,830

Investment funds (2) 22,479 — 22,479 62,163 — 62,163 84,642

Other 10,225 — 10,225 — — — 10,225

Total unconsolidated VIEs $ 134,538 5,164 139,702 85,058 — 85,058 224,760

(1) We have concluded that conforming mortgages are not subject to consolidation under ASU 2009-16 (FAS 166) and ASU 2009-17 (FAS 167). See the “Current Accounting

Developments” section in this Report for our estimate of the nonconforming mortgages that may potentially be consolidated under this guidance.

(2) Includes investment funds that are subject to deferral from application of ASU 2009-17 (FAS 167).

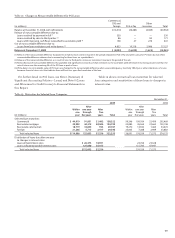

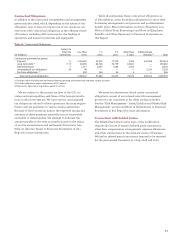

Table 17: Guarantees and Certain Contingent Arrangements

December 31,

2009 2008

Maximum Non- Maximum Non-

Carrying exposure investment Carrying exposure investment

(in millions) value to loss grade value to loss grade

Standby letters of credit $ 148 49,997 21,112 130 47,191 17,293

Securities lending and other indemnifications 51 20,002 2,512 — 30,120 1,907

Liquidity agreements (1) 66 7,744 — 30 17,602 —

Written put options (1)(2) 803 8,392 3,674 1,376 10,182 5,314

Loans sold with recourse 96 5,049 2,400 53 6,126 2,038

Residual value guarantees 8 197 — — 1,121 —

Contingent consideration 11 145 102 11 187 —

Other guarantees —55 2 —38—

Total guarantees $1,183 91,581 29,802 1,600 112,567 26,552

(1) Certain of these agreements included in this table are related to off-balance sheet entities and, accordingly, are also disclosed in Note 8 (Securitizations and Variable

Interest Entities) to Financial Statements in this Report.

(2) Written put options, which are in the form of derivatives, are also included in the derivative disclosures in Note 15 (Derivatives) to Financial Statements in this Report.

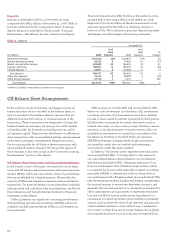

Guarantees and Certain Contingent Arrangements

Guarantees are contracts that contingently require us to

make payments to a guaranteed party based on an event

or a change in an underlying asset, liability, rate or index.

Guarantees are generally in the form of standby letters of

credit, securities lending and other indemnifications, liquidity

agreements, written put options, recourse obligations, residual

value guarantees and contingent consideration. Table 17

presents the carrying value, maximum exposure to loss on our

guarantees and the amount with a higher risk of performance.

For more information on guarantees and certain contingent

arrangements, see Note 14 (Guarantees and Legal Actions)

to Financial Statements in this Report.