Wells Fargo 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

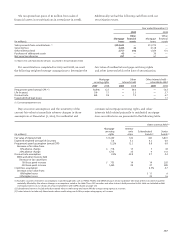

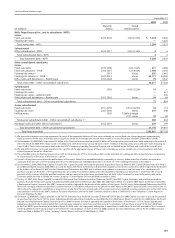

Year ended December 31,

(in millions) 2009 2008 2007

Servicing income, net:

Servicing fees $ 3,942 3,855 4,025

Changes in fair value of residential MSRs:

Due to changes in valuation model inputs or assumptions (1) (1,534) (3,341) (571)

Other changes in fair value (2) (3,436) (2,559) (3,026)

Total changes in fair value of residential MSRs (4,970) (5,900) (3,597)

Amortization (264) (75) (71)

Net derivative gains from economic hedges (3) 6,849 3,099 1,154

Total servicing income, net 5,557 979 1,511

Net gains on mortgage loan origination/sales activities 6,152 1,183 1,289

All other 319 363 333

Total mortgage banking noninterest income $12,028 2,525 3,133

Market-related valuation changes to MSRs, net of hedge results (1) + (3) $ 5,315 (242) 583

(1) Principally reflects changes in discount rates and prepayment speed assumptions, mostly due to changes in interest rates.

(2) Represents changes due to collection/realization of expected cash flows over time.

(3) Represents results from free-standing derivatives (economic hedges) used to hedge the risk of changes in fair value of MSRs. See Note 15 – Free-Standing Derivatives

in this Report for additional discussion and detail.

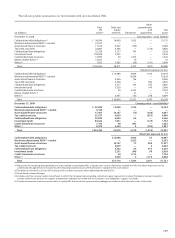

The components of mortgage banking noninterest income were:

Year ended December 31,

(in millions) 2009 2008 2007

Contractually specified servicing fees $4,473 3,904 3,922

Late charges 329 283 293

Ancillary fees 187 148 124

Servicing fees include certain unreimbursed direct servicing

obligations primarily associated with workout activities.

In addition, servicing fees and all other in the table

above included: