Wells Fargo 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

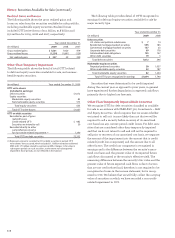

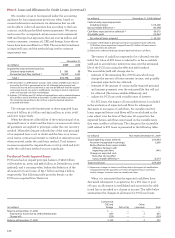

We do not have the intent to sell any securities included

in the table above. For debt securities included in the table

above, we have concluded it is more likely than not that we

will not be required to sell prior to recovery of the amortized

cost basis. We have assessed each security for credit impair-

ment. For debt securities, we evaluate, where necessary,

whether credit impairment exists by comparing the present

value of the expected cash flows to the securities amortized

cost basis. For equity securities, we consider numerous fac-

tors in determining whether impairment exists, including

our intent and ability to hold the securities for a period of

time sufficient to recover the cost basis of the securities.

See Note 1 – “Securities” in this Report for the factors

that we consider in our analysis of OTTI for debt and equity

securities available for sale.

SECURITIES OF U.S. TREASURY AND FEDERAL AGENCIES The

unrealized losses associated with U.S. Treasury and federal

agency securities do not have any credit losses due to the

guarantees provided by the United States government.

SECURITIES OF U.S. STATES AND POLITICAL SUBDIVISIONS The

unrealized losses associated with securities of U.S. states

and political subdivisions are primarily driven by changes

in interest rates and not due to the credit quality of the securi-

ties. The fair value of these investments is almost exclusively

investment grade. The securities were generally underwritten

in accordance with our own investment standards prior to

the decision to purchase, without relying on a bond insurer’s

guarantee in making the investment decision. These invest-

ments will continue to be monitored as part of our ongoing

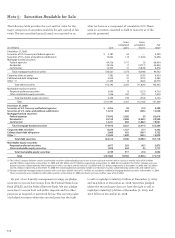

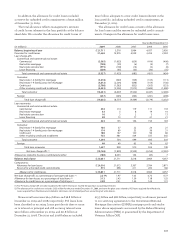

Less than 12 months 12 months or more Total

Gross Gross Gross

unrealized Fair unrealized Fair unrealized Fair

(in millions) losses value losses value losses value

December 31, 2008

Securities of U.S. Treasury and federal agencies $ — — — — — —

Securities of U.S. states and political subdivisions (745) 3,483 (775) 1,702 (1,520) 5,185

Mortgage-backed securities:

Federal agencies (3) 83 — — (3) 83

Residential (4,471) 9,960 (246) 238 (4,717) 10,198

Commercial (1,726) 4,152 (2,152) 2,302 (3,878) 6,454

Total mortgage-backed securities (6,200) 14,195 (2,398) 2,540 (8,598) 16,735

Corporate debt securities (285) 1,056 (254) 469 (539) 1,525

Collateralized debt obligations (113) 215 (457) 180 (570) 395

Other (554) 8,638 (48) 38 (602) 8,676

Total debt securities (7,897) 27,587 (3,932) 4,929 (11,829) 32,516

Marketable equity securities:

Perpetual preferred securities (75) 265 (252) 360 (327) 625

Other marketable equity securities (23) 72 (4) 9 (27) 81

Total marketable equity securities (98) 337 (256) 369 (354) 706

Total $(7,995) 27,924 (4,188) 5,298 (12,183) 33,222

December 31, 2009

Securities of U.S. Treasury and federal agencies $ (14) 530 — — (14) 530

Securities of U.S. states and political subdivisions (55) 1,120 (310) 2,826 (365) 3,946

Mortgage-backed securities:

Federal agencies (9) 767 — — (9) 767

Residential (243) 2,991 (1,800) 9,697 (2,043) 12,688

Commercial (37) 816 (1,825) 6,370 (1,862) 7,186

Total mortgage-backed securities (289) 4,574 (3,625) 16,067 (3,914) 20,641

Corporate debt securities (7) 281 (70) 442 (77) 723

Collateralized debt obligations (55) 398 (312) 512 (367) 910

Other (73) 746 (172) 286 (245) 1,032

Total debt securities (493) 7,649 (4,489) 20,133 (4,982) 27,782

Marketable equity securities:

Perpetual preferred securities (1) 93 (64) 527 (65) 620

Other marketable equity securities (9) 175 — — (9) 175

Total marketable equity securities (10) 268 (64) 527 (74) 795

Total $ (503) 7,917 (4,553) 20,660 (5,056) 28,577

Gross Unrealized Losses and Fair Value

The following table shows the gross unrealized losses and fair

value of securities in the securities available for sale portfolio

by length of time that individual securities in each category

had been in a continuous loss position. Debt securities on

which we have taken only credit-related OTTI write-downs

are categorized as being “less than 12 months” or “12 months

or more” in a continuous loss position based on the point

in time that the fair value declined to below the cost basis

and not the period of time since the credit-related

OTTI write-down.