Wells Fargo 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

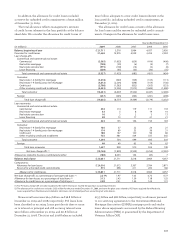

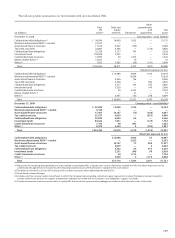

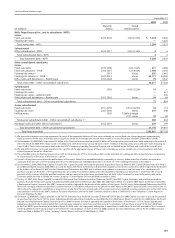

“Maximum exposure to loss” represents the carrying value

of our involvement with off-balance sheet (unconsolidated)

VIEs plus remaining undrawn liquidity and lending commit-

ments, notional amount of net written derivative contracts,

and generally the notional amount of, or stressed loss estimate

for, other commitments and guarantees. Maximum exposure

to loss is a required disclosure under GAAP and, as presented

in the preceding table, represents estimated loss that would be

incurred under severe, hypothetical circumstances, for which

we believe the possibility of occurrence is extremely remote,

such as where the value of our interests and any associated

collateral declines to zero, without any consideration of recov-

ery or offset from any economic hedges. Accordingly, this

required disclosure is not an indication of expected loss.

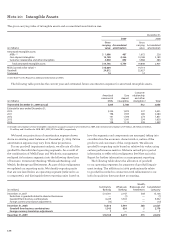

COLLATERALIZED DEBT OBLIGATIONS (CDOS)A CDO is a secu -

ritization where an SPE purchases a pool of assets consisting

of asset-backed securities and issues multiple tranches of

equity or notes to investors. In some transactions a portion

of the assets are obtained synthetically through the use of

derivatives such as credit default swaps or total return swaps.

Prior to 2008, we engaged in the structuring of CDOs on

behalf of third party asset managers who would select and

manage the assets for the CDO. Typically, the asset manager

has some discretion to manage the sale of assets of, or deriva-

tives used by the CDO.

In addition to our role as arranger we may have other forms

of involvement with these transactions. Such involvement may

include acting as liquidity provider, derivative counterparty,

secondary market maker or investor. For certain transactions,

we may also act as the collateral manager or servicer. We

receive fees in connection with our role as collateral manager

or servicer.

We assess whether we are the primary beneficiary of CDOs

at the inception of the transactions based on our expectation

of the variability associated with our continuing involvement.

Subsequently, we monitor our ongoing involvement in these

transactions to determine if a more frequent assessment of

variability is necessary. Variability in these transactions may

be created by credit risk, market risk, interest rate risk or liq-

uidity risk associated with the CDO’s assets. Our assessment

of the variability is performed qualitatively because our con-

tinuing involvement is typically senior in priority to the third

party investors in transactions. In most cases, we are not the

primary beneficiary of these transactions because we do not

retain the subordinate interests in these transactions and,

accordingly, do not absorb the majority of the variability.

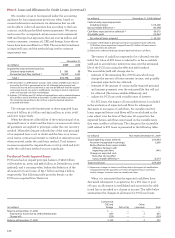

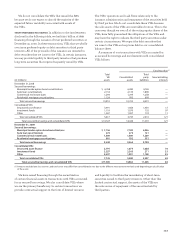

COLLATERALIZED LOAN OBLIGATIONS (CLOS)A CLO is a securi-

tization where an SPE purchases a pool of assets consisting

of loans and issues multiple tranches of equity or notes to

investors. Generally, CLOs are structured on behalf of a third

party asset manager that typically selects and manages the

assets for the term of the CLO. Typically, the asset manager

has some discretion to manage the sale of assets of the CLO.

Prior to the securitization, we may provide all or substan-

tially all of the warehouse financing to the asset manager. The

asset manager uses this financing to purchase the assets into

a bankruptcy remote SPE during the warehouse period. At the

completion of the warehouse period, the assets are sold to the

CLO and the warehouse financing is repaid with the proceeds

received from the securitization’s investors. The warehousing

period is generally less than 12 months in duration. In the

event the securitization does not take place, the assets in the

warehouse are liquidated. We consolidate the warehouse SPEs

when we are the primary beneficiary. We are the primary

beneficiary when we provide substantially all of the financing

and therefore absorb the majority of the variability. Sometimes

we have loss sharing arrangements whereby a third party asset

manager agrees to absorb the credit and market risk during

the warehousing period or upon liquidation of the collateral

in the event a securitization does not take place. In those

circumstances we do not consolidate the warehouse SPE

because the third party asset manager absorbs the majority

of the variability through the loss sharing arrangement.

In addition to our role as arranger and warehouse financ-

ing provider, we may have other forms of involvement with

these transactions. Such involvement may include acting as

underwriter, derivative counterparty, secondary market maker

or investor. For certain transactions, we may also act as the

servicer, for which we receive fees in connection with that

role. We also earn fees for arranging these transactions and

distributing the securities.

We assess whether we are the primary beneficiary of CLOs

at inception of the transactions based on our expectation of

the variability associated with our continuing involvement.

Subsequently, we monitor our ongoing involvement in these

transactions to determine if a more frequent assessment of

variability is necessary. Variability in these transactions may

be created by credit risk, market risk, interest rate risk or liq-

uidity risk associated with the CLO’s assets. Our assessment

of the variability is performed qualitatively because our con-

tinuing involvement is typically senior in priority to the third

party investors in transactions. In most cases, we are not the

primary beneficiary of these transactions because we do not

retain the subordinate interests in these transactions and,

accordingly, do not absorb the majority of the variability.

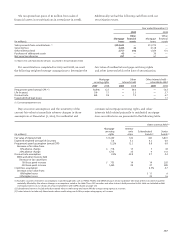

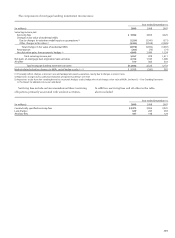

MULTI-SELLER COMMERCIAL PAPER CONDUIT We administer a

multi-seller ABCP conduit that finances certain client trans-

actions. We acquired the relationship with this conduit in the

Wachovia merger. This conduit is a bankruptcy remote entity

that makes loans to, or purchases certificated interests, gener-

ally from SPEs, established by our clients (sellers) and which

are secured by pools of financial assets. The conduit funds

itself through the issuance of highly rated commercial paper

to third party investors. The primary source of repayment

of the commercial paper is the cash flows from the conduit’s

assets or the re-issuance of commercial paper upon maturity.

The conduit’s assets are structured with deal-specific credit

enhancements generally in the form of overcollateralization

provided by the seller, but also may include subordinated

interests, cash reserve accounts, third party credit support

facilities and excess spread capture. The weighted-average life

of the conduit’s assets was 2.5 years at December 31, 2009,

and 3.0 years at December 31, 2008, respectively.

Note 8: Securitizations and Variable Interest Entities (continued)