Wells Fargo 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

maturities and, as such, these discount rates include

our current spread levels.

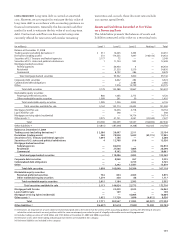

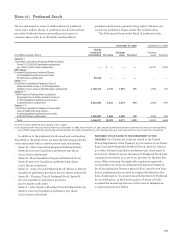

Assets and Liabilities Recorded at Fair Value

on a Recurring Basis

The table below presents the balances of assets and

liabilities measured at fair value on a recurring basis.

LONG-TERM DEBT Long-term debt is carried at amortized

cost. However, we are required to estimate the fair value of

long-term debt in accordance with accounting guidance on

financial instruments. Generally, the discounted cash flow

method is used to estimate the fair value of our long-term

debt. Contractual cash flows are discounted using rates

currently offered for new notes with similar remaining

(in millions) Level 1 Level 2 Level 3 Netting(1) Total

Balance at December 31, 2008

Trading assets (excluding derivatives) (2) $ 911 16,045 3,495 — 20,451

Derivatives (trading assets) 331 174,355 7,897 (148,150) 34,433

Securities of U.S. Treasury and federal agencies 3,177 72 — — 3,249

Securities of U.S. states and political subdivisions 1 11,754 903 — 12,658

Mortgage-backed securities:

Federal agencies — 66,430 4 — 66,434

Residential — 21,320 3,510 — 24,830

Commercial — 8,192 286 — 8,478

Total mortgage-backed securities — 95,942 3,800 — 99,742

Corporate debt securities — 6,642 282 — 6,924

Collateralized debt obligations — 2 2,083 — 2,085

Other — 7,976 12,799 — 20,775

Total debt securities 3,178 122,388 19,867 — 145,433

Marketable equity securities:

Perpetual preferred securities 886 1,065 2,775 — 4,726

Other marketable equity securities 1,099 261 50 — 1,410

Total marketable equity securities 1,985 1,326 2,825 — 6,136

Total securities available for sale 5,163 123,714 22,692 — 151,569

Mortgages held for sale — 14,036 4,718 — 18,754

Loans held for sale — 398 — — 398

Mortgage servicing rights (residential) — — 14,714 — 14,714

Other assets (3) 3,975 21,751 2,041 (20,540) 7,227

Total $10,380 350,299 55,557 (168,690) 247,546

Other liabilities (4) $ (4,815) (187,098) (9,308) 182,435 (18,786)

Balance at December 31, 2009

Trading assets (excluding derivatives) (2) $ 2,386 20,497 2,311 — 25,194

Derivatives (trading assets) 340 70,938 5,682 (59,115) 17,845

Securities of U.S. Treasury and federal agencies 1,094 1,186 — — 2,280

Securities of U.S. states and political subdivisions 4 12,708 818 — 13,530

Mortgage-backed securities:

Federal agencies — 82,818 — — 82,818

Residential — 27,506 1,084 — 28,590

Commercial — 9,162 1,799 — 10,961

Total mortgage-backed securities — 119,486 2,883 — 122,369

Corporate debt securities — 8,968 367 — 9,335

Collateralized debt obligations — — 3,725 — 3,725

Other — 3,292 12,587 — 15,879

Total debt securities 1,098 145,640 20,380 — 167,118

Marketable equity securities:

Perpetual preferred securities 736 834 2,305 — 3,875

Other marketable equity securities 1,279 350 88 — 1,717

Total marketable equity securities 2,015 1,184 2,393 — 5,592

Total securities available for sale 3,113 146,824 22,773 — 172,710

Mortgages held for sale — 33,439 3,523 — 36,962

Loans held for sale — 149 — — 149

Mortgage servicing rights (residential) — — 16,004 — 16,004

Other assets (3) 1,932 11,720 1,690 (6,812) 8,530

Total $ 7,771 283,567 51,983 (65,927) 277,394

Other liabilities (4) $(6,527) (81,613) (7,942) 73,299 (22,783)

(1) Derivatives are reported net of cash collateral received and paid and, to the extent that the criteria of the accounting guidance covering the offsetting of amounts

related to certain contracts are met, positions with the same counterparty are netted as part of a legally enforceable master netting agreement.

(2) Includes trading securities of $24.0 billion and $19.5 billion at December 31, 2009 and 2008, respectively.

(3) Derivative assets other than trading and principal investments are included in this category.

(4) Derivative liabilities are included in this category.