Wells Fargo 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

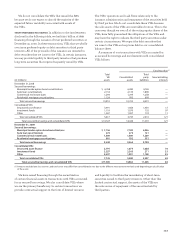

Note 8: Securitizations and Variable Interest Entities

Involvement with SPEs

In the normal course of business, we enter into various types

of on- and off-balance sheet transactions with special purpose

entities (SPEs), which are corporations, trusts or partnerships

that are established for a limited purpose. Historically, the

majority of SPEs were formed in connection with securitization

transactions. In a securitization transaction, assets from our

balance sheet are transferred to an SPE, which then issues

to investors various forms of interests in those assets and

may also enter into derivative transactions. In a securitization

transaction, we typically receive cash and/or other interests

in an SPE as proceeds for the assets we transfer. Also, in

certain transactions, we may retain the right to service the

transferred receivables and to repurchase those receivables

from the SPE if the outstanding balance of the receivables

falls to a level where the cost exceeds the benefits of servicing

such receivables. In addition, we may purchase the right to

service loans in a SPE that were transferred to the SPE by

a third party.

In connection with our securitization activities, we have

various forms of ongoing involvement with SPEs, which

may include:

• underwriting securities issued by SPEs and subsequently

making markets in those securities;

• providing liquidity facilities to support short-term

obligations of SPEs issued to third party investors;

• providing credit enhancement on securities issued by

SPEs or market value guarantees of assets held by SPEs

through the use of letters of credit, financial guarantees,

credit default swaps and total return swaps;

• entering into other derivative contracts with SPEs;

• holding senior or subordinated interests in SPEs;

• acting as servicer or investment manager for SPEs; and

• providing administrative or trustee services to SPEs.

The SPEs we use are primarily either qualifying SPEs

(QSPEs), which are not consolidated under existing accounting

guidance if the criteria described below are met, or variable

interest entities (VIEs). To qualify as a QSPE, an entity must

be passive and must adhere to significant limitations on the

types of assets and derivative instruments it may own and

the extent of activities and decision making in which it may

engage. For example, a QSPE’s activities are generally limited

to purchasing assets, passing along the cash flows of those

assets to its investors, servicing its assets and, in certain

transactions, issuing liabilities. Among other restrictions

on a QSPE’s activities, a QSPE may not actively manage its

assets through discretionary sales or modifications.

A VIE is an entity that has either a total equity investment

that is insufficient to permit the entity to finance its activities

without additional subordinated financial support or whose

equity investors lack the characteristics of a controlling

financial interest. Under existing accounting guidance,

a VIE is consolidated by its primary beneficiary, which, under

current accounting standards, is the entity that, through its

variable interests, absorbs the majority of a VIE’s variability.

A variable interest is a contractual, ownership or other

interest that changes with changes in the fair value of the

VIE’s net assets.