Wells Fargo 2009 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

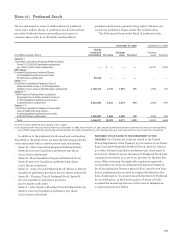

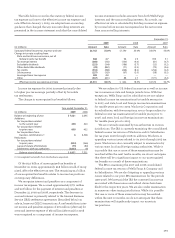

As of December 31, 2009, there was $186 million of

unrecognized compensation cost related to stock options.

That cost is expected to be recognized over a weighted-

average period of 1.9 years. The total intrinsic value of

options exercised during 2009 and 2008 was $50 million

and $348 million, respectively.

Cash received from the exercise of options for 2009 and

2008 was $153 million and $747 million, respectively. The

actual tax benefit recognized in stockholders’ equity for

the tax deductions from the exercise of options totaled

$18 million and $123 million, respectively, for 2009 and 2008.

We do not have a specific policy on repurchasing shares

to satisfy share option exercises. Rather, we have a general

policy on repurchasing shares to meet common stock

issuance requirements for our benefit plans (including share

option exercises), conversion of our convertible securities,

acquisitions and other corporate purposes. Various factors

determine the amount and timing of our share repurchases,

including our capital requirements, the number of shares we

expect to issue for acquisitions and employee benefit plans,

market conditions (including the trading price of our stock),

and regulatory and legal considerations. These factors can

change at any time, and there can be no assurance as to

the number of shares we will repurchase or when we will

repurchase them.

The fair value of each option award granted on or after

January 1, 2006, is estimated using a Black-Scholes valuation

model. The expected term of options granted is generally

based on the historical exercise behavior of full-term options.

Our expected volatilities are based on a combination of the

historical volatility of our common stock and implied volatili-

ties for traded options on our common stock. The risk-free

rate is based on the U.S. Treasury zero-coupon yield curve

in effect at the time of grant. Both expected volatility and

the risk-free rates are based on a period commensurate with

our expected term. For 2009, the expected dividend is based

on a fixed dividend amount. For 2008 and 2007, the expected

dividend was based on the current dividend, consideration

of our historical pattern of dividend increases and the market

price of our stock. We changed our method of estimating

the expected dividend assumption from a yield approach

to a fixed amount due to our participation in the TARP CPP

during 2009, which restricted us from increasing our dividend

without approval from the U.S. Treasury. A dividend yield

approach models a constant dividend yield, which was consid-

ered inappropriate given the restriction on our ability to

increase dividends.

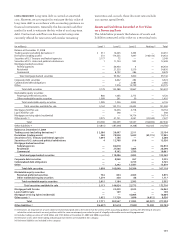

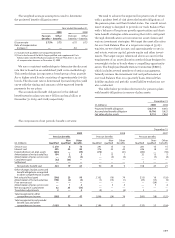

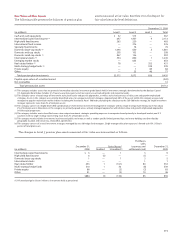

The following table presents the weighted-average per

share fair value of options granted and the assumptions used,

based on a Black-Scholes option valuation model.

Year ended December 31,

2009 2008 2007

Per share fair value of options granted $3.29 4.06 3.84

Expected volatility 53.9% 22.4 13.3

Expected dividends (yield) —4.1 3.4

Expected dividends $0.33 ——

Expected term (in years) 4.5 4.4 4.2

Risk-free interest rate 1.8% 2.7 4.6

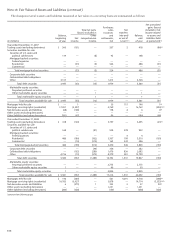

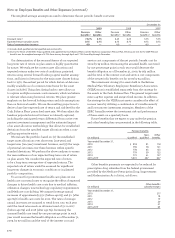

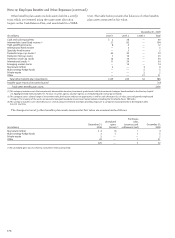

Weighted-average

Number grant-date fair value

Nonvested at January 1, 2009 1,026,166 $29.79

Granted 1,100,241 19.04

Vested (62,073) 29.79

Canceled or forfeited (155,379) 29.56

Nonvested at December 31, 2009 1,908,955 23.62

At December 31, 2009, there was $22 million of total

unrecognized compensation cost related to nonvested RSRs.

The cost is expected to be recognized over a weighted-average

period of 3.3 years. The total fair value of RSRs that vested

during 2009 and 2008 was $2 million and $1 million, respectively.

A summary of the status of our RSRs and restricted share

awards at December 31, 2009, and changes during 2009 is in

the following table:

The weighted-average grant date fair value of RSRs granted

during 2008 was $29.68.