Wells Fargo 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

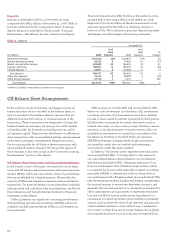

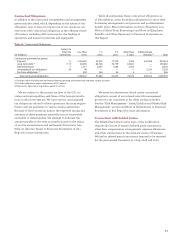

The minimum monthly payment for substantially all of our

Pick-a-Pay loans is reset annually. The new minimum monthly

payment amount usually cannot increase by more than 7.5% of

the then-existing principal and interest payment amount. The

minimum payment may not be sufficient to pay the monthly

interest due and in those situations a loan on which the cus-

tomer has made a minimum payment is subject to “negative

amortization,” where unpaid interest is added to the principal

balance of the loan. The amount of interest that has been

added to a loan balance is referred to as “deferred interest.”

Total deferred interest of $3.7 billion at December 31, 2009,

was down from $4.3 billion at December 31, 2008, due to loan

modification efforts as well as falling interest rates resulting

in the minimum payment option covering the interest and

some principal on many loans. At December 31, 2009,

approximately 47% of customers choosing the minimum

payment option did not defer interest.

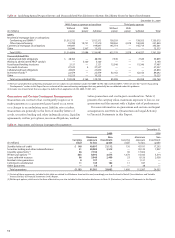

Deferral of interest on a Pick-a-Pay loan may continue

as long as the loan balance remains below a pre-defined

principal cap, which is based on the percentage that the

current loan balance represents to the original loan balance.

Loans with an original loan-to-value (LTV) ratio equal to or

below 85% have a cap of 125% of the original loan balance, and

these loans represent substantially all the Pick-a-Pay portfolio.

Loans with an original LTV ratio above 85% have a cap of

110% of the original loan balance. Most of the Pick-a-Pay loans

on which there is a deferred interest balance re-amortize (the

monthly payment amount is reset or “recast”) on the earlier

of the date when the loan balance reaches its principal cap,

or the 10-year anniversary of the loan. There exists a small

population of Pick-a-Pay loans for which recast occurs at the

five-year anniversary. After a recast, the customers’ new payment

terms are reset to the amount necessary to repay the balance

over the remainder of the original loan term.

Due to the terms of the Pick-a-Pay portfolio, there is little

recast risk over the next three years. Based on assumptions

of a flat rate environment, if all eligible customers elect the

minimum payment option 100% of the time and no balances

prepay, we would expect the following balances of loans to

recast based on reaching the principal cap: $2 million in 2010,

$1 million in 2011 and $4 million in 2012. In 2009, the amount of

loans recast based on reaching the principal cap was $1 million.

In addition, we would expect the following balances of loans to

start fully amortizing due to reaching their recast anniversary

date and also having a payment change at the recast date

greater than the annual 7.5% reset: $44 million in 2010, $52 million

in 2011 and $58 million in 2012. In 2009, the amount of loans

reaching their recast anniversary date and also having a

payment change over the annual 7.5% reset was $25 million.

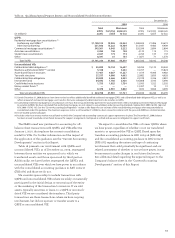

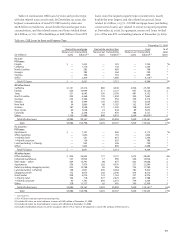

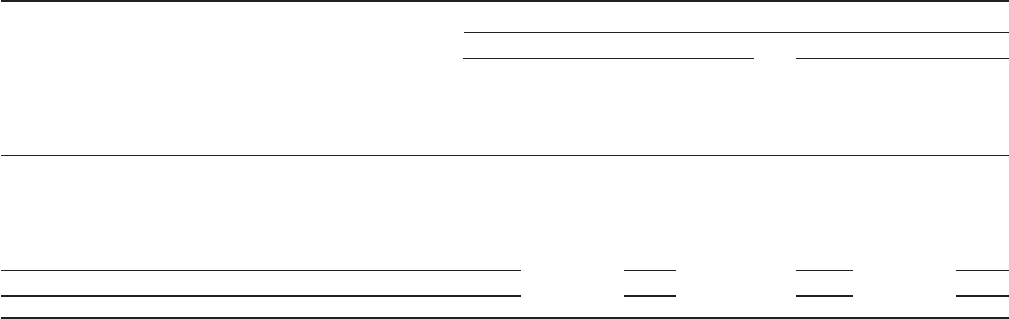

Table 24 reflects the geographic distribution of the

Pick-a-Pay portfolio broken out between PCI loans and all

other loans. In stressed housing markets with declining home

prices and increasing delinquencies, the LTV ratio is a useful

metric in predicting future real estate 1-4 family first mortgage

loan performance, including potential charge-offs. Because

PCI loans were initially recorded at fair value written down

for expected credit losses, the ratio of the carrying value to

the current collateral value for acquired loans with credit

impairment will be lower as compared with the LTV based

on the unpaid principal. For informational purposes, we have

included both ratios in the following table.

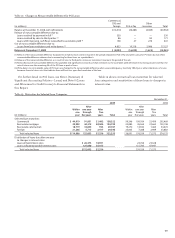

Table 24: Pick-a-Pay Portfolio

December 31, 2009

PCI loans All other loans

Ratio of

carrying

Unpaid Current value to Unpaid Current

principal LTV Carrying current principal LTV Carrying

(in millions) balance ratio(1) value(2) value balance ratio(1) value (2)

California $37,341 141% $25,022 94% $23,795 93% $23,626

Florida 5,751 139 3,199 77 5,046 104 4,942

New Jersey 1,646 101 1,269 77 2,914 82 2,912

Texas 442 82 399 74 1,967 66 1,973

Arizona 1,410 143 712 72 1,124 101 1,106

Other states 8,506 110 6,428 82 13,716 86 13,650

Total Pick-a-Pay loans $55,096 $37,029 $48,562 $48,209

(1) The current LTV ratio is calculated as the unpaid principal balance plus the unpaid principal balance of any equity lines of credit that share common collateral divided by

the collateral value. Collateral values are determined using AVMs and are updated quarterly. AVMs are computer-based tools used to estimate market values of homes

based on processing large volumes of market data including market comparables and price trends for local market areas.

(2) Carrying value, which does not reflect the allowance for loan losses, includes purchase accounting adjustments, which, for PCI loans, are the nonaccretable difference and

the accretable yield, and for all other loans, an adjustment to mark the loans to a market yield at date of merger less any subsequent charge-offs.