SunTrust 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

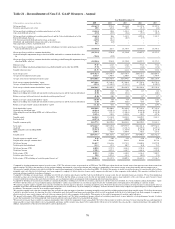

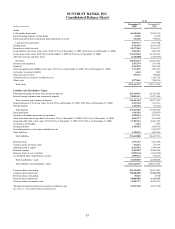

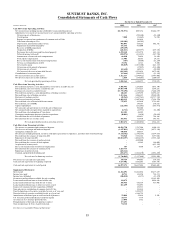

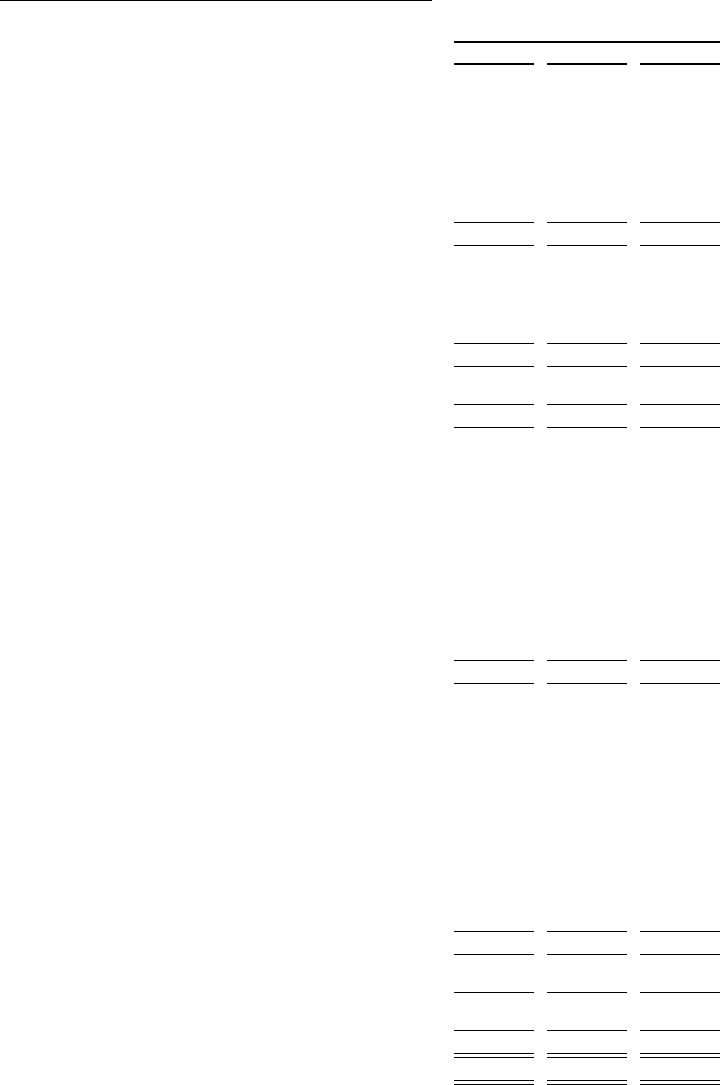

SUNTRUST BANKS, INC.

Consolidated Statements of Income/(Loss)

For the Year Ended December 31

(Dollars and shares in thousands, except per share data) 2009 2008 2007

Interest Income

Interest and fees on loans $5,530,162 $6,933,657 $7,979,281

Interest and fees on loans held for sale 232,775 289,920 668,939

Interest and dividends on securities available for sale

Taxable interest 716,684 628,006 516,289

Tax-exempt interest 39,730 44,088 43,158

Dividends173,257 103,005 122,779

Interest on funds sold and securities purchased under agreements to resell 2,204 25,112 48,835

Interest on deposits in other banks 231 812 1,305

Trading account interest 114,704 302,782 655,334

Total interest income 6,709,747 8,327,382 10,035,920

Interest Expense

Interest on deposits 1,439,942 2,377,473 3,660,766

Interest on funds purchased and securities sold under agreements to repurchase 7,827 130,563 440,260

Interest on trading liabilities 20,206 27,160 15,586

Interest on other short-term borrowings 14,678 55,102 121,011

Interest on long-term debt 761,404 1,117,428 1,078,753

Total interest expense 2,244,057 3,707,726 5,316,376

Net interest income 4,465,690 4,619,656 4,719,544

Provision for credit losses 4,063,914 2,474,215 664,922

Net interest income after provision for credit losses 401,776 2,145,441 4,054,622

Noninterest Income

Service charges on deposit accounts 848,354 904,127 822,031

Other charges and fees 522,749 510,794 479,074

Trust and investment management income 486,523 592,324 685,034

Mortgage production related income 376,097 171,368 90,983

Mortgage servicing related income 329,908 (211,829) 195,436

Card fees 323,842 308,374 280,706

Investment banking income 271,999 236,533 214,885

Retail investment services 217,803 289,093 278,042

Trading account profits/(losses) and commissions (40,738) 38,169 (361,711)

Gain from ownership in Visa 112,102 86,305 -

Net gain on sale of businesses -198,140 32,340

Net gain on sale/leaseback of premises -37,039 118,840

Other noninterest income 163,620 239,726 349,907

Net securities gains298,019 1,073,300 243,117

Total noninterest income 3,710,278 4,473,463 3,428,684

Noninterest Expense

Employee compensation 2,257,532 2,327,228 2,329,034

Employee benefits 542,390 434,036 441,154

Amortization/impairment of goodwill/intangible assets 806,834 121,260 96,680

Outside processing and software 579,277 492,611 410,945

Net occupancy expense 356,791 347,289 351,238

Regulatory assessments 302,147 54,876 22,425

Credit and collection services 259,406 156,445 112,547

Other real estate expense 243,727 104,684 15,797

Equipment expense 171,887 203,209 206,498

Marketing and customer development 151,538 372,235 195,043

Operating losses 99,527 446,178 134,028

Mortgage reinsurance 114,905 179,927 174

Net loss on debt extinguishment 39,356 11,723 9,800

Visa litigation 7,000 (33,469) 76,930

Other noninterest expense 630,091 660,791 818,760

Total noninterest expense 6,562,408 5,879,023 5,221,053

Income/(loss) before provision/(benefit) for income taxes (2,450,354) 739,881 2,262,253

Provision/(benefit) for income taxes (898,783) (67,271) 615,514

Net income/(loss) including income attributable to noncontrolling interest (1,551,571) 807,152 1,646,739

Net income attributable to noncontrolling interest 12,112 11,378 12,724

Net income/(loss) ($1,563,683) $795,774 $1,634,015

Net income/(loss) available to common shareholders ($1,733,377) $740,982 $1,592,954

Net income/(loss) per average common share

Diluted ($3.98) $2.12 $4.52

Basic (3.98) 2.12 4.56

Dividends declared per common share 0.22 2.85 2.92

Average common shares - diluted3435,328 350,183 352,688

Average common shares - basic 435,328 348,919 349,346

1Includes dividends on common stock of The Coca-Cola Company $49,200 $55,920 $60,915

2Includes other-than-temporary impairment losses of $20.0 million for the year ended December 31, 2009, consisting of $112.8 million of total unrealized losses, net of $92.8 million of

non-credit related unrealized losses recorded in other comprehensive income, before taxes.

3For earnings per share calculation purposes, the impact of dilutive securities are excluded from the diluted share count during periods that the Company has recognized a net loss available to

common shareholders because the impact would be anti-dilutive.

See Notes to Consolidated Financial Statements.

82