SunTrust 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

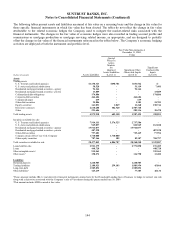

The reserve for estimated losses incurred under its reinsurance contracts totaled $285.0 million at December 31, 2009 and

$180.0 million at December 31, 2008. The Company’s evaluation of the required reserve amount includes an estimate of

claims to be paid by the trust related to loans in default and an assessment of the sufficiency of future revenues, including

premiums and investment income on funds held in the trusts, to cover future claims.

Guarantees

The Company has undertaken certain guarantee obligations in the ordinary course of business. The issuance of a guarantee

imposes an obligation for the Company to stand ready to perform, and should certain triggering events occur, it also imposes

an obligation to make future payments. Payments may be in the form of cash, financial instruments, other assets, shares of

stock, or provisions of the Company’s services. The following is a discussion of the guarantees that the Company has issued

as of December 31, 2009. In addition, the Company has entered into certain contracts that are similar to guarantees, but that

are accounted for as derivatives (see Note 17, “Derivative Financial Instruments,” to the Consolidated Financial Statements).

Visa

The Company issues and acquires credit and debit card transactions through Visa. On October 3, 2007, Visa completed

a restructuring and issued shares of Class B shares to its financial institution members, including 3.2 million shares to

the Company, in contemplation of an IPO, which occurred in March 2008. For purposes of converting Class B shares to

Class A shares of Visa Inc., a conversion factor is applied, which is subject to adjustment depending on the outcome of

certain specifically defined litigation. The Class B shares are not transferable (other than to another member bank) until

the later of the third anniversary of the IPO closing or the date which certain specifically defined litigation has been

resolved; therefore, the Company’s Class B shares were classified in other assets and accounted for at their carryover

basis of $0.

The Company is a defendant, along with Visa U.S.A. Inc. and MasterCard International (the “Card Associations”), as

well as several other banks, in one of several antitrust lawsuits challenging the practices of the Card Associations (the

“Litigation”). The Company has entered into judgment and loss sharing agreements with Visa and certain other banks in

order to apportion financial responsibilities arising from any potential adverse judgment or negotiated settlements

related to the Litigation. Additionally, in connection with the restructuring, a provision of the original Visa By-Laws,

Section 2.05j, was restated in Visa’s certificate of incorporation. Section 2.05j contains a general indemnification

provision between a Visa member and Visa, and explicitly provides that after the closing of the restructuring, each

member’s indemnification obligation is limited to losses arising from its own conduct and the specifically defined

Litigation. The maximum potential amount of future payments that the Company could be required to make under this

indemnification provision cannot be determined as there is no limitation provided under the By-Laws and the amount of

exposure is dependent on the outcome of the Litigation. During 2008, Visa funded $4.1 billion into an escrow account,

established for the purpose of funding judgments in, or settlements of, the Litigation. Agreements associated with the

Visa IPO have provisions that Visa will first use the funds in the escrow account to pay for future settlements of, or

judgments in the Litigation. If the escrow account is insufficient to cover the Litigation losses, then Visa will issue

additional Class A shares (“loss shares”). The proceeds from the sale of the loss shares would then be deposited in the

escrow account. The issuance of the loss shares will cause a dilution of the Class B common stock as a result of an

adjustment to lower the conversion factor of the Class B common stock to Class A common stock. Visa USA’s

members are responsible for any portion of the settlement or loss on the Litigation after the escrow account is depleted

and the value of the Class B shares is fully-diluted. As a result of its indemnification obligations and percentage

ownership of Class B shares, the Company estimated its net guarantee liability to be $43.5 million as of December 31,

2008.

In May 2009, the Company sold its 3.2 million shares of Class B Visa Inc. common stock to another financial institution

(“the Counterparty”) and entered into a derivative with the Counterparty. The Company received $112.1 million and

recognized a gain of $112.1 million in connection with these transactions. Under the derivative, the Counterparty will be

compensated by the Company for any decline in the conversion factor as a result of the outcome of the Litigation.

Conversely, the Company will be compensated by the Counterparty for any increase in the conversion factor.

Accordingly, the Company recorded a derivative liability at its estimated fair value for $50.5 million. The Counterparty,

as a result of its ownership of the Class B common stock, will be impacted by dilutive adjustments to the conversion

factor of the Class B common stock caused by the Litigation losses. Since the Company transferred risk associated with

the Litigation losses to a different responsible party, the Company recorded an offset to its net guarantee liability. In

July 2009, Visa funded an additional $700 million into their escrow account, triggering a payment by SunTrust to the

135