SunTrust 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Bank and the Parent Company experienced credit rating downgrades from Moody’s, S&P, and Fitch during the first half

of 2009. As of December 31, 2009, the senior, long-term debt ratings for the Bank were A2, A- and A- from Moody’s, S&P

and Fitch, respectively. The comparable senior, long-term debt ratings for the Parent Company as of December 31, 2009

were Baa1, BBB+ and A-. The Bank’s corresponding short-term ratings were P-1, A-2, and F1 (Moody’s, S&P and Fitch),

while the Parent Company’s short-term ratings were P-2, A-2 and F1, respectively.

S&P’s April downgrade of the Bank’s short-term credit rating from A-1 to A-2 materially impacted some of our business

activities. The activities most affected were two off-balance sheet businesses: our ABCP conduit, Three Pillars, and our

VRDO remarketing operation, both of which depend upon the support of investors who primarily purchase obligations rated

A-1 or equivalent. The Bank and the Parent Company have purchased certain amounts of Three Pillars’ overnight CP at

estimated market rates, on a discretionary and non-contractual basis (See Note 11, “Certain Transfers of Financial Assets,

Mortgage Servicing Rights and Variable Interest Entities”, in the Consolidated Financial Statements for additional

information). We did not own any of the outstanding Three Pillars’ CP as of December 31, 2009.

We conduct remarketing of municipal securities known as VRDOs. The terms of the VRDOs allow investors to put or tender

the securities for repayment prior to maturity. The Bank backs most of these securities with letters of credit that provide

liquidity in the event of this early repayment. After the S&P downgrade in April, a substantial portion of our VRDO

investors tendered their bonds for repayment, which required the Bank to provide liquidity by funding the letters of credit

backing the tendered VRDOs. The Bank’s contingency funding plans anticipated this potential use of liquidity, and the Bank

secured ample liquidity for the VRDO program as the funded loans came on to our balance sheet. As the year came to a

close, this use of Bank liquidity declined as investor demand for remarketed VRDOs increased and VRDO clients were able

to find alternative sources of funding.

The Bank and the Parent Company borrow in the money markets using instruments such as Fed funds, Eurodollars, or CP.

Lenders in these unsecured instruments extend credit lines to borrowers based in large part upon the borrower’s credit ratings

from the three large nationally recognized statistical ratings organizations. After the S&P downgrade in April, the Bank

experienced a decrease in its available credit lines which reduced its depth of access and slightly increased its cost of

borrowing in these instruments. The Bank’s conservative liquidity profile and prudent liquidity management greatly

mitigated the impact of the downgrade on its daily money markets funding activities and costs. During the fourth quarter, the

Parent Company had no CP outstanding and the Bank was a net lender into short-term money markets.

On February 1, 2010, S&P downgraded our senior, long-term debt Bank and Parent Company ratings from A- and BBB+,

respectively, to BBB+ and BBB, respectively. Our short-term ratings remained unchanged at A-2. S&P cited expectations of

continued stress in and high exposure to residential mortgages, especially in Florida, as the primary factor in its decision to

downgrade our long-term ratings. However, concurrent with the downgrade, S&P changed the outlook on our credit ratings

to “stable” noting our strong franchise, good liquidity and funding profile, and commercial loan portfolio performance that

was in line with their expectations. Our business activities have not been materially impacted as a result of this recent

downgrade by S&P.

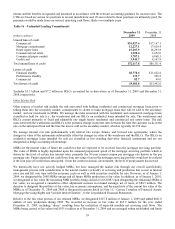

Sources of Funds. Our primary sources of funds include a large, stable retail deposit base. Core deposits, primarily gathered

from our retail branch network, are our largest and most cost-effective source of funding. During 2009, the Bank experienced

strong core deposit growth. Core deposits totaled $116.3 billion as of December 31, 2009, up from $105.3 billion as of

December 31, 2008. The Bank used core deposit growth to replace short-term wholesale funding, contributing to the Bank’s

strong liquidity position.

We also maintain access to a diversified base of wholesale funding sources. These uncommitted sources include Fed funds

purchased from other banks, securities sold under agreements to repurchase, negotiable certificates of deposit, offshore

deposits, FHLB advances, global bank notes, and CP. Aggregate wholesale funding totaled $28.2 billion as of December 31,

2009 reduced from $44.0 billion as of December 31, 2008. Net short-term unsecured borrowings, which includes wholesale

domestic and foreign deposits and Fed funds purchased, totaled $8.9 billion as of December 31, 2009, down from $14.2

billion as of December 31, 2008.

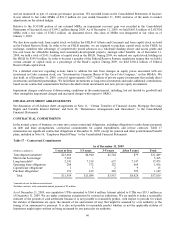

An additional source of wholesale liquidity is our access to the capital markets. The Parent Company maintains an SEC shelf

registration statement from which it may issue senior or subordinated notes, and various capital securities such as common or

preferred stock. The current shelf allows the Parent Company to issue up to $3 billion of such securities. The Bank maintains

a Global Bank Note program under which it may issue senior or subordinated debt with various terms. As of December 31,

2009, the Bank had capacity to issue $30.9 billion of notes under the Global Bank Note program. Borrowings under these

programs are designed to appeal primarily to domestic and international institutional investors. Institutional investor demand

for these securities is dependent upon numerous factors, including but not limited to our credit ratings and investor

perception of financial market conditions and the health of the banking sector. Our capacity under these programs refers to

authorization granted by our Board, and does not refer to a commitment to purchase by any investor.

57