SunTrust 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

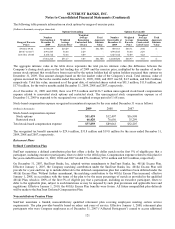

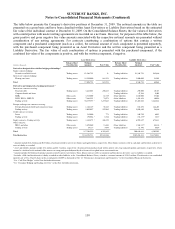

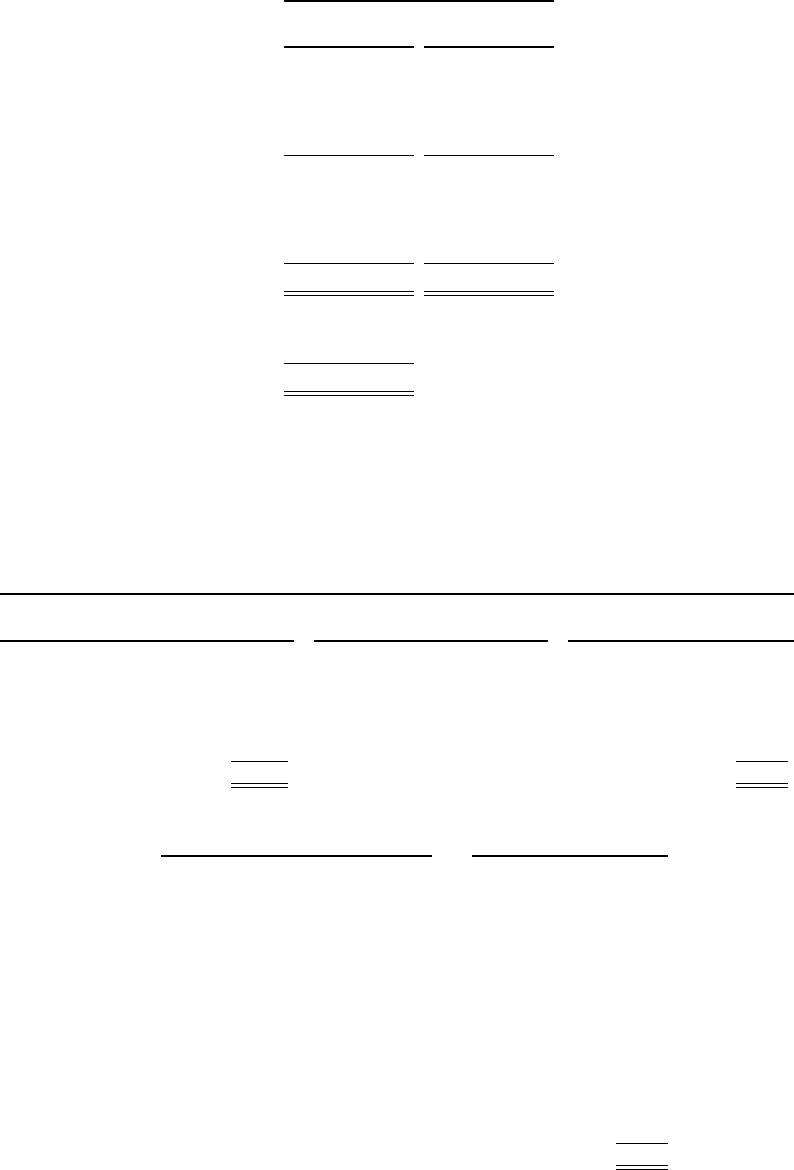

The Company’s derivative positions as of December 31, 2008 were as follows:

Contract or Notional Amount

(Dollars in millions) End User

For

Clients

Derivatives contracts

Interest rate contracts

Swaps $20,193 $126,913

Futures and forwards 10,089 40,057

Options 1,500 28,098

Total interest rate contracts 31,782 195,068

Interest rate lock commitments 7,161 -

Equity contracts 3,094 11,214

Foreign exchange contracts 2,009 5,659

Other derivative contracts 345 1,671

Total derivatives contracts $44,391 $213,612

Credit-related arrangements

Commitments to extend credit $79,191

Standby letters of credit and similar arrangements 13,942

Total credit-related arrangements $93,133

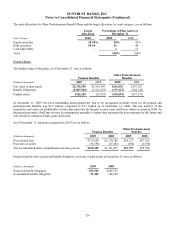

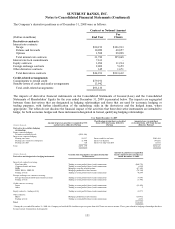

The impacts of derivative financial instruments on the Consolidated Statements of Income/(Loss) and the Consolidated

Statements of Shareholders’ Equity for the year ended December 31, 2009 is presented below. The impacts are segregated

between those derivatives that are designated in hedging relationships and those that are used for economic hedging or

trading purposes, with further identification of the underlying risks in the derivatives and the hedged items, where

appropriate. The tables do not disclose the financial impact of the activities that these derivative instruments are intended to

hedge, for both economic hedges and those instruments designated in formal, qualifying hedging relationships.

Year Ended December 31, 2009

(Dollars in thousands)

Amount of pre-tax gain/(loss) recognized in OCI

on Derivatives (Effective Portion)

Classification of gain/(loss) reclassified

from AOCI into Income (Effective

Portion)

Amount of pre-tax gain/(loss)

reclassified from AOCI into Income

(Effective Portion)1

Derivatives in cash flow hedging

relationships

Equity contracts hedging:

Securities available for sale ($295,982)

Interest rate contracts hedging:

Floating rate loans 99,317 Interest and fees on loans $503,424

Floating rate certificates of deposits (1,499) Interest on deposits (47,265)

Floating rate debt (15) Interest on long-term debt (1,333)

Total ($198,179) $454,826

(Dollars in thousands)

Derivatives not designated as hedging instruments

Classification of gain/(loss) recognized in Income

on Derivatives

Amount of gain/(loss) recognized in

Income on Derivatives for the year

ended December 31, 2009

Interest rate contracts covering:

Fixed rate debt Trading account profits/(losses) and commissions ($60,731)

Corporate bonds and loans Trading account profits/(losses) and commissions 6,530

MSRs Mortgage servicing related income (87,855)

LHFS, IRLCs, LHFI-FV Mortgage production related income (74,914)

Trading activity Trading account profits/(losses) and commissions 46,399

Foreign exchange rate contracts covering:

Foreign-denominated debt and commercial loans Trading account profits/(losses) and commissions 71,696

Trading activity Trading account profits/(losses) and commissions (3,991)

Credit contracts covering:

Loans Trading account profits/(losses) and commissions (19,493)

Other Trading account profits/(losses) and commissions 9

Equity contracts - trading activity Trading account profits/(losses) and commissions 22,571

Other contracts:

IRLCs Mortgage production related income 629,972

Trading activity Trading account profits/(losses) and commissions 2,636

Total $532,829

1During the year ended December 31, 2009, the Company reclassified $30.8 million in pre-tax gains from AOCI into net interest income. These gains related to hedging relationships that have

been previously terminated or de-designated.

131