SunTrust 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

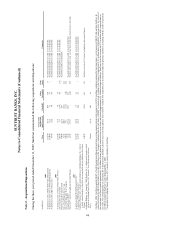

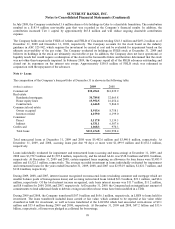

Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in

excess of one year. Minimum payments, by year and in aggregate, as of December 31, 2009 were as follows:

(Dollars in thousands)

Operating

Leases

Capital

Leases

2010 $208,124 $2,488

2011 193,246 2,536

2012 178,568 1,903

2013 166,661 1,947

2014 155,571 1,994

Thereafter 663,627 10,789

Total minimum lease payments $1,565,797 21,657

Amounts representing interest 6,663

Present value of net minimum lease payments $14,994

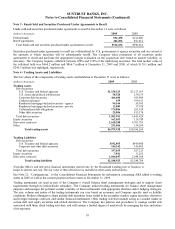

Net premises and equipment included $8.4 million and $9.4 million at December 31, 2009 and 2008, respectively, related to

capital leases. Aggregate rent expense (principally for offices), including contingent rent expense and sublease income,

totaled $171.3 million, $171.3 million, and $137.8 million for 2009, 2008, and 2007, respectively. Depreciation/amortization

expense for the years ended December 31, 2009, 2008, and 2007 totaled $181.6 million, $195.8 million, and $216.2 million,

respectively.

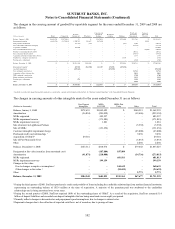

Note 9 – Goodwill and Other Intangible Assets

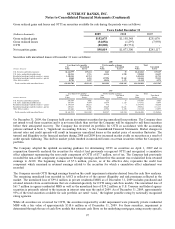

Goodwill is required to be tested for impairment on an annual basis or as events occur or circumstances change that would

more likely than not reduce the fair value of a reporting unit below its carrying amount. In 2009, the Company’s reporting

units were comprised of Retail, Commercial, Commercial Real Estate, Household Lending, Corporate and Investment

Banking, Wealth and Investment Management, and Affordable Housing.

Due to the continued recessionary environment and sustained deterioration in the economy during the first quarter of 2009,

the Company performed a complete goodwill impairment analysis for all of its reporting units. The estimated fair value of

the Retail, Commercial, and Wealth and Investment Management reporting units exceeded their respective carrying values as

of March 31, 2009; however, the fair value of the Household Lending, Corporate and Investment Banking, Commercial Real

Estate (included in Retail and Commercial segment), and Affordable Housing (included in Retail and Commercial segment)

reporting units were less than their respective carrying values. The implied fair value of goodwill of the Corporate and

Investment Banking reporting unit exceeded the carrying value of the goodwill, thus no goodwill impairment was recorded

for this reporting unit as of March 31, 2009. However, the implied fair value of goodwill applicable to the Household

Lending, Commercial Real Estate, and Affordable Housing reporting units was less than the carrying value of the goodwill.

As of March 31, 2009, an impairment loss of $751.2 million was recorded, which was the entire amount of goodwill carried

by each of those reporting units. $677.4 million of the goodwill impairment charge was non-deductible for tax purposes. The

goodwill impairment charge was a direct result of continued deterioration in the real estate markets and macro economic

conditions that put downward pressure on the fair value of these businesses. The primary factor contributing to the

impairment recognition was further deterioration in the actual and projected financial performance of these reporting units, as

evidenced by the increase in net charge-offs and nonperforming loans. The decline in fair value of these reporting units was

significantly influenced by the current economic downturn, which resulted in depressed earnings in these businesses and the

significant decline in the Company’s market capitalization during the first quarter.

During the second quarter of 2009, the Company performed an updated evaluation of the Corporate and Investment Banking

goodwill, which involved estimating the fair value of the reporting unit and the implied fair value of goodwill. The implied fair

value of goodwill exceeded the carrying value of goodwill, thus no goodwill impairment was recorded as of June 30, 2009.

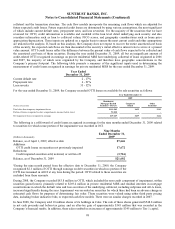

The Company completed its 2009 annual impairment review of goodwill as of September 30, 2009. The review utilized

discounted cash flow analysis, as well as guideline company and guideline transaction information, where available, to

estimate the fair value of each reporting unit. The estimates, specific to each reporting unit, that were incorporated in the

valuations included projections of future cash flows, discount rates, and applicable valuation multiples based on the guideline

information. The assumptions considered the current market conditions in developing short and long-term growth

expectations and discount rates. The estimated fair value of each reporting unit as of September 30, 2009 exceeded its

respective carrying value; therefore, the Company determined there was no impairment of goodwill. The improvement in the

estimated fair value of the Corporate and Investment Banking reporting unit was due to increased observable market values.

101