SunTrust 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

the QSPE status of the transferee. All the student loans that were securitized are U.S. government guaranteed student loans.

As such, the Company has agreed to service each loan consistent with the guidelines determined by the applicable

government agencies. Accordingly, the Company believes that it does not have the power to direct activities that most

significantly impact the economic performance of the SPE that holds these student loans. Based on the application of the

new consolidation guidance adopted on January 1, 2010, the Company has determined that it will not consolidate this SPE.

CDO Securities

The Company has transferred bank trust preferred securities in securitization transactions. The majority of these

transfers occurred between 2002 and 2005 with one transaction completed in 2007. The Company retained equity

interests in certain of these entities and also holds certain senior interests that were acquired during 2007 and 2008 in

conjunction with its acquisition of assets from Three Pillars and the ARS transactions discussed in Note 21,

“Contingencies,” to the Consolidated Financial Statements. During 2008, the Company recognized impairment losses,

net of distributions received, of $15.9 million related to the ownership of its equity interests in these VIEs and, at

December 31, 2008, these equity interests had all been written down to a fair value of zero due to increased losses in the

underlying collateral. During 2009, the Company sold its senior interest related to the acquisition of assets from Three

Pillars. The Company continues to hold, at December 31, 2009, senior interests related to the ARS purchases. The

Company is not obligated to provide any support to these entities and its maximum exposure to loss at December 31,

2009 and December 31, 2008 is limited to (i) the current senior interests held in trading securities with a fair value of

$25.5 million and $45.0 million, respectively, and (ii) the remaining senior interests expected to be purchased in

conjunction with the ARS issue, which have a total fair value of $1.5 million and $9.7 million, respectively. The total

assets of the trust preferred CDO entities in which the Company has remaining exposure to loss was $1.3 billion at

December 31, 2009 and $2.0 billion at December 31, 2008. No events occurred during the year ended December 31,

2009 that called into question either the Company’s sale accounting or the Company’s conclusions that it is not the

primary beneficiary of these VIEs. The Company determined that it was not the primary beneficiary of any of these

VIEs under ASC 810-10, as the Company lacks the power to direct the significant activities of any of the VIEs.

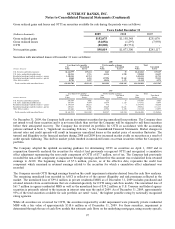

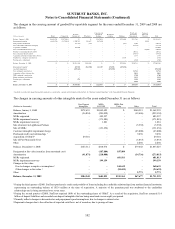

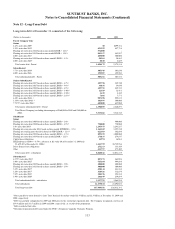

The following tables present certain information related to the Company’s asset transfers in which it has continuing

economic involvement for the years ended December 31, 2009, 2008, and 2007.

Year Ended December 31, 2009

(Dollars in thousands)

Residential

Mortgage Loans

Commercial

Mortgage Loans

Commercial and

Corporate Loans Student Loans CDO Securities Consolidated

Cash flows on interests held $93,674 $- $1,861 $7,601 $2,799 $105,935

Servicing or management

fees 4,908 - 11,090 709 - 16,707

Year Ended December 31, 2008

(Dollars in thousands)

Residential

Mortgage Loans

Commercial

Mortgage Loans

Commercial and

Corporate Loans Student Loans CDO Securities Consolidated

Cash flows on interests held $85,848 $- $24,282 $7,971 $4,134 $122,235

Servicing or management

fees 5,900 182 14,216 833 - 21,131

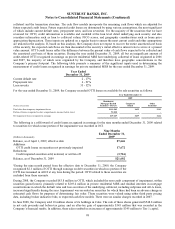

Year Ended December 31, 2007

(Dollars in thousands)

Residential

Mortgage Loans

Commercial

Mortgage Loans

Commercial and

Corporate Loans Student Loans CDO Securities Consolidated

Total proceeds $1,892,819 $416,321 $2,186,367 $- $- $4,495,507

Gain/(loss) (15,669) (4,041) 4,949 - - (14,761)

Cash flows on interests held 52,882 - 22,194 - 3,198 78,274

Servicing or management

fees 3,909 207 10,309 854 389 15,668

As transferor, the Company typically provides standard representations and warranties in relation to assets transferred.

However, other than the loan substitution discussed previously herein, purchases of assets previously transferred in

securitization transactions were insignificant across all categories for all periods presented other than those related to Ginnie

Mae, Fannie Mae, and Freddie Mac as discussed in Note 18, “Reinsurance Arrangements and Guarantees,” to the

Consolidated Financial Statements.

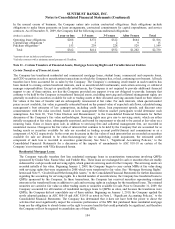

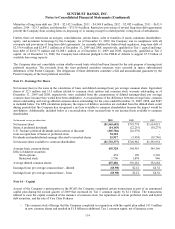

The following tables present key assumptions and inputs, along with the impacts on the fair values of two unfavorable

variations from the expected amounts, related to the fair values of the Company’s retained interests, excluding MSRs, which

are separately addressed herein. Retained interests in residential mortgage securitization transactions include senior and

106