SunTrust 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

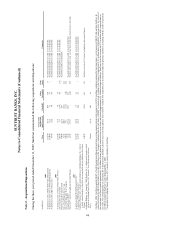

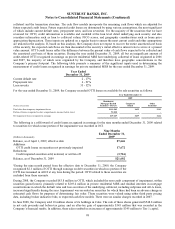

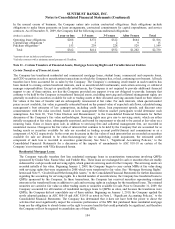

Gross realized gains and losses and OTTI on securities available for sale during the periods were as follows:

Years Ended December 31

(Dollars in thousands) 2009 2008 2007

Gross realized gains $152,075 $1,158,348 $251,076

Gross realized losses (34,056) (1,297) (7,959)

OTTI (20,000) (83,751) -

Net securities gains $98,019 $1,073,300 $243,117

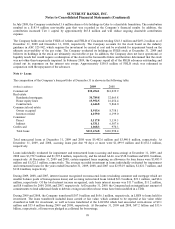

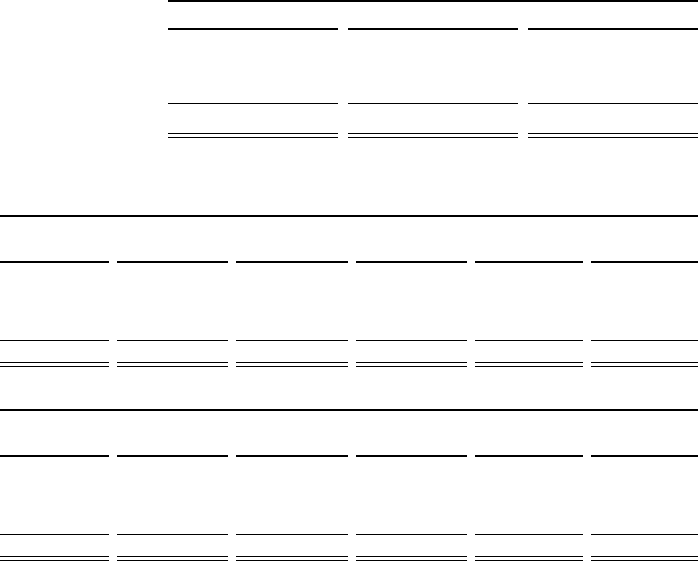

Securities with unrealized losses at December 31 were as follows:

2009

Less than twelve months Twelve months or longer Total

(Dollars in thousands)

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

U.S. Treasury and federal agencies $6,424,579 $39,224 $263 $5 $6,424,842 $39,229

U.S. states and political subdivisions 125,524 5,711 64,516 4,918 190,040 10,629

Residential mortgage-backed securities - agency 5,418,226 61,724 - - 5,418,226 61,724

Residential mortgage-backed securities - private 14,668 4,283 327,996 95,142 342,664 99,425

Other debt securities 30,704 1,207 30,416 3,371 61,120 4,578

Total securities with unrealized losses $12,013,701 $112,149 $423,191 $103,436 $12,436,892 $215,585

2008

Less than twelve months Twelve months or longer Total

(Dollars in thousands)

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

U.S. Treasury and federal agencies $43,584 $302 $23 $- $43,607 $302

U.S. states and political subdivisions 169,693 4,980 14,879 1,118 184,572 6,098

Residential mortgage-backed securities - agency 3,354,319 10,223 472 7 3,354,791 10,230

Residential mortgage-backed securities - private 450,653 98,696 40,269 16,631 490,922 115,327

Other debt securities 143,666 6,901 28,944 6,158 172,610 13,059

Total securities with unrealized losses $4,161,915 $121,102 $84,587 $23,914 $4,246,502 $145,016

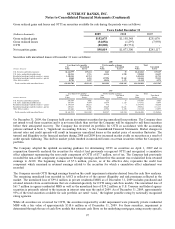

On December 31, 2009, the Company held certain investment securities having unrealized loss positions. The Company does

not intend to sell these securities and it is not more likely than not that the Company will be required to sell these securities

before their anticipated recovery. The Company has reviewed its portfolio for OTTI in accordance with the accounting

policies outlined in Note 1, “Significant Accounting Policies,” to the Consolidated Financial Statements. Market changes in

interest rates and credit spreads will result in temporary unrealized losses as the market price of securities fluctuates. The

turmoil and illiquidity in the financial markets during 2008 and 2009 have increased market yields on securities as a result of

credit spreads widening. This shift in market yields resulted in unrealized losses on certain securities within the Company’s

portfolio.

The Company adopted the updated accounting guidance for determining OTTI on securities on April 1, 2009 and in

conjunction therewith analyzed the securities for which it had previously recognized OTTI and recognized a cumulative

effect adjustment representing the non-credit component of OTTI of $7.7 million, net of tax. The Company had previously

recorded the non-credit component as impairment through earnings and therefore this amount was reclassified from retained

earnings to AOCI. The beginning balance of $7.6 million, pre-tax, as of the effective date, represents the credit loss

component which remained in retained earnings related to the securities for which a cumulative effect adjustment was

recorded.

The Company records OTTI through earnings based on the credit impairment estimates derived from the cash flow analyses.

The remaining unrealized loss recorded in AOCI is reflective of the current illiquidity and risk premiums reflected in the

market. The unrealized loss of $99.4 million in private residential MBS as of December 31, 2009 includes purchased and

retained interests from securitizations that are evaluated quarterly for OTTI using cash flow models. The unrealized loss of

$61.7 million in agency residential MBS as well as the unrealized loss of $39.2 million in U.S. Treasury and federal agency

securities is primarily related to the increase in interest rates near the end of 2009. As of December 31, 2009, approximately

95% of the total securities available for sale portfolio are rated “AAA,” the highest possible rating by nationally recognized

rating agencies.

While all securities are reviewed for OTTI, the securities impacted by credit impairment were primarily private residential

MBS with a fair value of approximately $310.6 million as of December 31, 2009. For these securities, impairment is

determined through the use of cash flow models that estimate cash flows on the underlying mortgages, using security specific

97