SunTrust 2009 Annual Report Download - page 84

Download and view the complete annual report

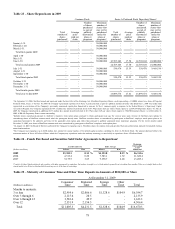

Please find page 84 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FOURTH QUARTER 2009 RESULTS

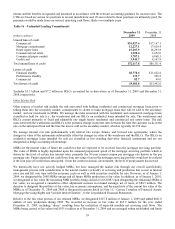

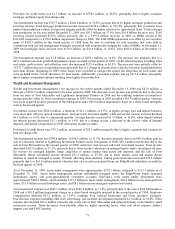

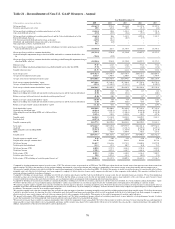

We reported a net loss available to common shareholders of $316.4 million for the fourth quarter of 2009, a decrease of

$58.5 million, or 15.6%, compared to the same period of the prior year. The net loss per average common share was $0.64

for the fourth quarter of 2009 compared to a net loss of $1.07 per common share for the fourth quarter of 2008. The fourth

quarter of 2009 results were adversely impacted by credit-related charges and cyclical expenses that reflected recessionary

pressures as evidenced by soft revenue and weak loan demand from consumer and commercial borrowers. However,

compared to recent quarterly trends, the provision for credit losses declined, deposit mix continued to improve while core

deposit volumes grew, net interest margin increased, and certain of our businesses experienced revenue growth.

For the fourth quarter of 2009, FTE net interest income was $1,206.8 million, essentially flat compared to the fourth quarter

of 2008 due to a decline in average earning assets which resulted from a reduction in client demand for credit, offset by

improvement in the net interest margin. Margin expansion was due to lower rates paid for funds as client deposits increased,

the mix of deposits improved, and higher cost sources of funding were reduced. Net interest margin grew from 3.14% in the

fourth quarter of 2008 to 3.27% for the same period of 2009.

For the fourth quarter of 2009, the provision for credit losses was $973.7 million and included $57.2 million in provision for

unfunded commitments. In the fourth quarter of 2009, we elected to change our financial statement presentation to include

the provision for unfunded commitments in the provision for credit losses. Previously, the unfunded commitment provision

was included in noninterest expense. The provision for loan losses was $46.0 million below the provision for loan losses

recorded in the fourth quarter of 2008. On an overall basis, the provision for credit losses increased only slightly as the

impact of increased charge-offs was largely offset by lower increases to the ALLL.

Total noninterest income was $742.3 million for the fourth quarter of 2009, an increase of $24.6 million, or 3.4%, from the

fourth quarter of 2008. This increase was primarily driven by lower market-related losses on illiquid securities and other

instruments carried at fair value, including our public debt. These lower losses in the fourth quarter of 2009 were largely

offset by higher estimated losses related to the potential repurchase of mortgage loans resulting in lower mortgage production

income. The fourth quarter of 2009 results include $220.2 million in estimated losses related to the potential repurchase of

mortgage loans that were previously sold to third parties compared to $60.4 million recognized in the fourth quarter of 2008.

Although mortgage production related income declined $40.2 million, the decline was partially offset by lower market

valuation losses and a 17% increase in loan production during the fourth quarter of 2009. Mortgage servicing income

increased $382.8 million compared to the fourth quarter of 2008, as a result of the $370.0 million temporary impairment

recognized in the fourth quarter of 2008 related to MSRs that were carried at the LOCOM compared to a recovery of $10.5

million recognized during the current quarter. During the fourth quarter of 2009, we recorded $72.8 million of net gains from

the sale of available for sale securities compared to $411.1 million of net gains from the sale of available for sale securities in

the fourth quarter of 2008 that were realized in conjunction with risk management strategies associated with hedging the

value of MSRs. Trading account profits/(losses) and commissions increased $30.7 million compared to the fourth quarter of

2008 as market-related valuation losses on illiquid securities and other instruments carried at fair value improved. Valuation

losses on our public debt and related hedges carried at fair value were $38.1 million, a reduction of $6.2 million compared to

the fourth quarter of 2008. Trust and investment management income increased $8.2 million, or 6.5%, on increased

performance based fees; however, retail investment income decreased $15.9 million, or 22.7%, due to lower transaction

volume.

Total noninterest expense was $1,453.6 million during the fourth quarter of 2009, a decrease of $132.6 million, or 8.4%,

compared to the fourth quarter of 2008. The decrease was a result of credit-related expenses declining significantly and

controllable expenses continuing to be tightly managed. Operating losses declined $210.2 million, or 89.0%, as fraud-related

credit losses were recorded in the provision for credit losses beginning in the first quarter of 2009. Mortgage reinsurance

losses declined $89.7 million, or 89.7%, as we reached the limits of our exposure to reinsurance losses (see Note 18,

“Reinsurance Arrangements and Guarantees,” to the Consolidated Financial Statements). Other credit-related expenses

including collection and credit costs and other real estate expense increased $58.6 million due to property valuation losses

and increased loss mitigation efforts. FDIC and regulatory expense increased $40.0 million, or 195.4%, in conjunction with

the replenishment of the FDIC’s insurance fund through increased premiums. Personnel expenses increased $56.1 million, or

8.8%, due to higher pension costs and increased incentives related to improved financial performance in certain lines of

business. The fourth quarter of 2009 also included $23.5 million in net losses related to early termination fees for FHLB

advances repaid during the quarter, net of gains on the early extinguishment of other long-term debt. These advance

terminations were part of the initiative we took to take advantage of the strong liquidity position we currently benefit from to

repay wholesale funding and improve margin.

The income tax benefit for the fourth quarter of 2009 was $263.0 million compared to the income tax benefit of $309.0

million for the fourth quarter of 2008. The decrease in the income tax benefit was primarily attributable to the lower level of

pre-tax losses in fourth quarter of 2009 compared to the same period in 2008.

68