SunTrust 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

to current economic conditions and Company projections for wage growth, merit increases, and real inflation, compensation

growth assumptions of 2.0% to 3.5% will be used for the next three years (2010 – 2012) with the ultimate assumption

returning to 4% in 2013.

Actuarial gains and losses are created when actual experience deviates from assumptions. The actuarial losses on obligations

generated within the Pension Plans in 2009 resulted from lower lump sum rates and changes to actuarial demographic

assumptions offset by higher discount rates and lower salary increases.

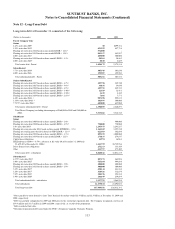

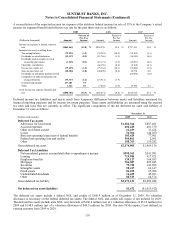

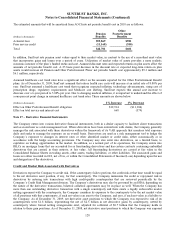

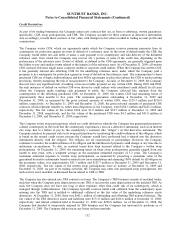

The change in benefit obligations for the years ended December 31 was as follows:

Pension Benefits

Other Postretirement

Benefits

(Dollars in thousands) 2009 2008 2009 2008

Benefit obligation, beginning of year $1,922,252 $1,841,153 $204,742 $200,723

Service cost 63,858 77,872 292 618

Interest cost 119,548 117,090 11,211 11,811

Plan participants’ contributions - - 22,015 21,632

Actuarial (gain)/loss 18,681 (7,646) (27,859) 1,360

Benefits paid (116,399) (106,217) (33,792) (34,902)

Less federal Medicare drug subsidy - - 2,518 3,500

Benefit obligation, end of year $2,007,940 $1,922,252 $179,127 $204,742

The accumulated benefit obligation for the Pension Benefits at December 31, 2009 and 2008 was $1.9 billion and $1.8

billion, respectively.

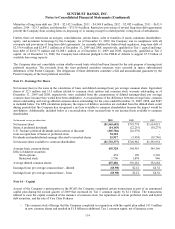

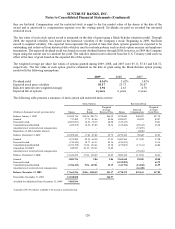

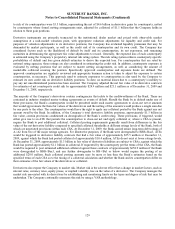

Pension Benefits

Other Post-

retirement Benefits

(Weighted average assumptions used to determine

benefit obligations, end of year) 2009 2008 2009 2008

Discount rate 6.32 % 6.14 % 5.70 % 5.95 %

Rate of compensation increase 4.00 24.00/4.50 1N/A N/A

1At year-end 2008, all salaries were expected to increase by 2.00% for 2009 (0% for nonqualified plans), 3.00% for 2010, and total salaries were assumed to

increase at 4.50% while base salaries were assumed to increase at 4.00% for 2011 and beyond.

2At year-end 2009, all salaries were expected to increase by 2.00% for 2010, 3.00% for 2011, 3.50% for 2012, and 4.00% for 2013 and beyond.

The change in plan assets for the years ended December 31 was as follows:

Pension Benefits

Other

Postretirement Benefits

(Dollars in thousands) 2009 2008 2009 2008

Fair value of plan assets, beginning of year $1,919,349 $2,287,322 $147,167 $162,881

Actual return on plan assets 506,297 (617,770) 24,923 (32,965)

Employer contributions 24,943 356,014 723 30,521

Plan participants’ contributions --22,015 21,632

Benefits paid (116,399) (106,217) (33,792) (34,902)

Fair value of plan assets, end of year $2,334,190 $1,919,349 $161,036 $147,167

Employer contributions and benefits paid in the above table include only those amounts contributed to pay participants’ plan

benefits or added to plan assets in 2009 and 2008, respectively. SERPs are not funded through plan assets.

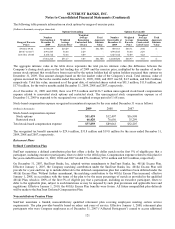

The basis for determining the overall expected long-term rate of return on plan assets considers past experience, current

market conditions and expectations on future trends. A building block approach is used that considers long-term inflation,

real returns, equity risk premiums, target asset allocations, market corrections (for example, narrowing of fixed income

spreads between corporate bonds and U.S. Treasuries) and expenses. Capital market simulations from internal and external

sources, survey data, economic forecasts and actuarial judgment are all used in this process.

123