SunTrust 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

they are forfeited. Compensation cost for restricted stock is equal to the fair market value of the shares at the date of the

award and is amortized to compensation expense over the vesting period. Dividends are paid on awarded but unvested

restricted stock.

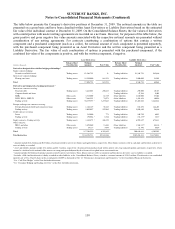

The fair value of each stock option award is estimated on the date of grant using a Black-Scholes valuation model. Through

2008, the expected volatility was based on the historical volatility of the Company’s stock. Beginning in 2009, SunTrust

moved to implied volatility. The expected term represents the period of time that stock options granted are expected to be

outstanding and is derived from historical data which is used to evaluate patterns such as stock option exercise and employee

termination. The expected dividend yield was based on recent dividend history through 2008; however, in 2009 the Company

began using the current rate to calculate the yield. The risk-free interest rate is derived from the U.S. Treasury yield curve in

effect at the time of grant based on the expected life of the option.

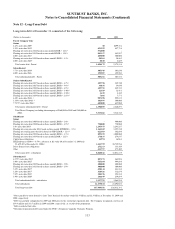

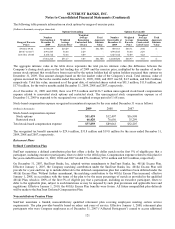

The weighted average per share fair values of options granted during 2009, 2008, and 2007 were $5.13, $7.63 and $16.72,

respectively. The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing

model with the following assumptions:

2009 2008 2007

Dividend yield 4.16% 5.62% 3.01%

Expected stock price volatility 83.17 25.73 20.07

Risk-free interest rate (weighted average) 1.94 2.63 4.70

Expected life of options 6 years 6 years 6 years

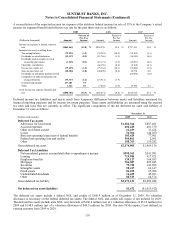

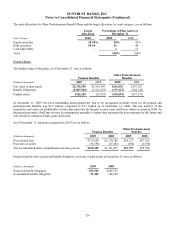

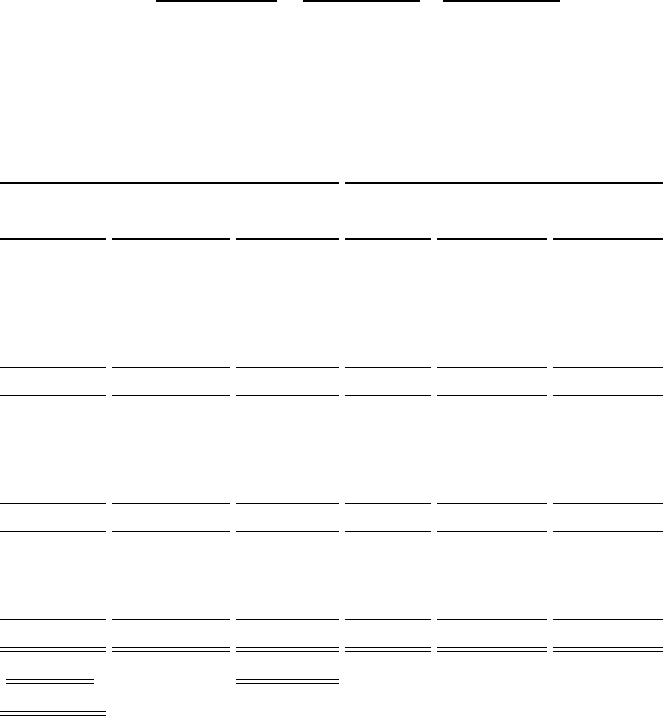

The following table presents a summary of stock option and restricted stock activity:

Stock Options Restricted Stock

(Dollars in thousands except per share data) Shares

Price

Range

Weighted

Average

Exercise Price Shares

Deferred

Compensation

Weighted

Average

Grant Price

Balance, January 1, 2007 18,680,710 $14.56 - $83.74 $64.39 1,870,604 $60,487 $57.12

Granted 717,494 77.75 - 85.06 85.04 1,054,837 88,892 84.27

Exercised/vested (2,887,293) 14.56 - 78.39 60.50 (339,437) - 50.21

Cancelled/expired/forfeited (452,765) 14.56 - 85.06 72.36 (315,660) (20,612) 65.30

Amortization of restricted stock compensation - - - - (35,299) -

Repurchase of AMA member interests - - - - (2,846) -

Balance, December 31, 2007 16,058,146 17.06 - 85.06 65.79 2,270,344 90,622 69.63

Granted 1,473,284 29.54 - 64.58 57.43 2,021,564 117,039 57.90

Exercised/vested (514,149) 18.77 - 65.33 49.16 (213,431) - 55.16

Cancelled/expired/forfeited (1,476,358) 31.80 - 154.61 69.30 (275,065) (17,611) 64.04

Acquisition of GB&T 100,949 46.39 - 154.61 76.82 - - -

Amortization of restricted stock compensation - - - - (76,656) -

Balance, December 31, 2008 15,641,872 17.06 - 150.45 65.29 3,803,412 113,394 64.61

Granted 3,803,796 9.06 9.06 2,565,648 28,205 10.40

Exercised/vested - - - (1,255,092) - 64.79

Cancelled/expired/forfeited (1,784,452) 9.06 - 149.81 65.39 (343,796) (16,018) 46.59

Amortization of restricted stock compensation - - - - (66,420) -

Balance, December 31, 2009 17,661,216 $9.06 - $150.45 $53.17 4,770,172 $59,161 $37.02

Exercisable, December 31, 2009 12,108,820 $64.97

Available for Additional Grant, December 31, 2009 19,085,834

1Includes 4,597,441 shares available to be issued as restricted stock.

120