SunTrust 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

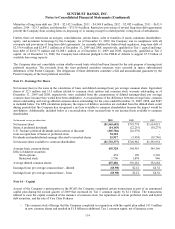

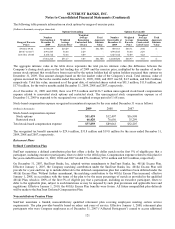

The expected long-term rate of return on plan assets was 8.00% and 8.25% in 2009 and 2008, respectively. The expected

long-term rate of return is 8.00% for 2010. The asset allocation for the Pension Plans and the target allocation, by asset

category, are as follows:

Target

Allocation1

Percentage of Plan Assets

at December 312

Asset Category 2010 2009 2008

Equity securities 55-75% 61% 62 %

Debt securities 25-45 37 35

Cash equivalents 0-5 2 3

Total 100% 100 %

1SunTrust Pension Plan only.

2SunTrust and NCF Pension Plans.

The fair value of plan assets is measured based on the fair value hierarchy which is discussed in detail in Note 20, “Fair

Value Election and Measurement” to the Consolidated Financial Statements. The valuations are based on third party data

received as of the balance sheet date. Level 1 assets such as equity securities, mutual funds, and REITS are instruments that

are traded in active markets and are valued based on identical instruments. Fixed income securities and common and

collective trust funds are classified as level 2 assets because there is not an identical asset in the market upon which to base

the valuation; however, there are no significant unobservable assumptions used to value level 2 instruments. Level 3 assets

primarily consist of private placement and non-investment grade bonds. Limited visible market activity exists for these

instruments or similar instruments and therefore significant unobservable assumptions are used to value the securities.

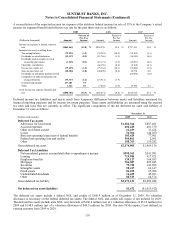

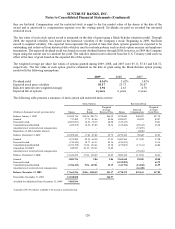

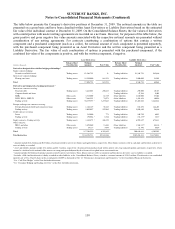

The following table sets forth by level, within the fair value hierarchy, plan assets related to Pension Benefits at fair value as

of December 31, 2009:

Fair Value Measurements at

December 31, 2009 Using 1

(Dollars in thousands)

Assets Measured at

Fair Value December 31,

2009

Quoted Prices In

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3)

Money market funds $55,053 $55,053 $- $-

Mutual funds:

Fixed income funds 96,617 96,617 - -

International diversified funds 356,614 356,614 - -

Large cap funds 263,052 263,052 - -

Small and mid cap funds 214,082 214,082 - -

Equity securities:

Consumer 100,505 100,505 - -

Energy and utilities 40,103 40,103 - -

Financials 43,904 43,904 - -

Healthcare 65,182 65,182 - -

Industrials 51,461 51,461 - -

Information technology 157,471 157,471 - -

Materials 19,909 19,909 - -

Exchange traded funds 98,330 98,330 - -

Fixed income securities:

Corporate - investment grade 554,307 - 471,645 82,662

Corporate - non-investment grade 25,822 - - 25,822

Foreign bonds 177,222 - 139,396 37,826

Other 1,311 - 389 922

Real estate investment trusts 182 182 - -

$2,321,127 $1,562,465 $611,430 $147,232

1Schedule does not include accrued income amounting to less than 0.6% of total plan assets.

124