SunTrust 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

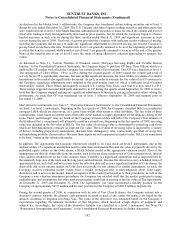

As disclosed in the tabular level 3 rollforwards, the Company also transferred certain trading securities out of level 3

during the year ended December 31, 2009. The U.S. Treasury and federal agency trading securities and other assets that

were transferred out of level 3 were Small Business Administration securities or loans for which the volume and level of

observable trading activity had significantly decreased in prior quarters, but for which the Company began to observe

limited increases in such activity during the three months ended March 31, 2009 and significant increases in such

activity during the rest of 2009. This level of activity provided the Company with sufficient market evidence of pricing,

such that the Company did not have to make any significant adjustments to observed pricing, nor was the Company’s

pricing based on unobservable data. Transfers into level 3 are generally assumed to be as of the beginning of the quarter

in which the transfer occurred, while transfers out of level 3 are generally assumed to occur as of the end of the quarter.

None of the transfers into or out of level 3 were the result of using alternative valuation approaches to estimate fair

values.

As discussed in Note 11, “Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest

Entities,” to the Consolidated Financial Statements, the Company began to purchase CP from Three Pillars, which is a

multi-seller CP conduit with which the Company has certain levels of involvement. This CP was classified as level 3.

The downgrade of Three Pillars’ CP to A-2/P-1 during the second quarter of 2009 caused the volume and level of

activity for its CP to significantly decrease. Because of this significant decrease, the observability for identical or similar

transactions in the market also significantly decreased. As such, in order to estimate the fair value of its CP issuances to

the Company, significant adjustments were required to the most similar asset for which a sufficient level of market

observability existed. Three Pillars subsequently received a F-1 rating from Fitch, such that it is now rated F-1/P-1.

These ratings triggered increased third party demand for its CP during the quarter ended September 30, 2009 to such a

level that the Company stopped making any significant adjustments to third party pricing information when valuing the

investments. As such, this CP was transferred out of level 3 effective September 30, 2009 and matured prior to

December 31, 2009.

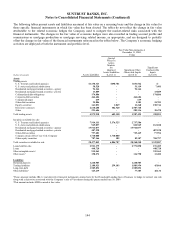

Most derivative instruments (see Note 17, “Derivative Financial Instruments” to the Consolidated Financial Statements)

are level 1 or level 2 instruments. Beginning in the first quarter of 2008, the Company classified IRLCs on residential

mortgage LHFS which are derivatives, on a gross basis within other assets or other liabilities. The fair value of these

commitments, while based on interest rates observable in the market, is highly dependent on the ultimate closing of the

loans. These “pull-through” rates are based on the Company’s historical data and reflect the Company’s best estimate of

the likelihood that a commitment will ultimately result in a closed loan. Beginning in the first quarter of 2008, servicing

value was included in the fair value of IRLCs. The fair value of servicing value is determined by projecting cash flows

which are then discounted to estimate an expected fair value. The fair value of servicing value is impacted by a variety

of factors, including prepayment assumptions, discount rates, delinquency rates, contractually specified servicing fees

and underlying portfolio characteristics. Because these inputs are not transparent in market trades, IRLCs are considered

to be level 3 assets in the valuation hierarchy.

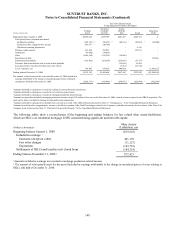

In addition, The Agreements the Company entered into related to its Coke stock are level 3 instruments, due to the

unobservability of a significant assumption used to value these instruments. Because the value is primarily driven by the

embedded equity collars on the Coke shares, a Black-Scholes model is the appropriate valuation model. Most of the

assumptions are directly observable from the market, such as the per share market price of Coke common stock, interest

rates, and the dividend rate on the Coke common stock. Volatility is a significant assumption and is impacted both by

the unusually large size of the trade and the long tenor until settlement. Because the derivatives carry scheduled terms of

approximately six and a half and seven years from the effective date and are on a significant number of Coke shares, the

observable and active options market on Coke does not provide for any identical or similar instruments. As such, the

Company receives estimated market values from a market participant who is knowledgeable about Coke equity

derivatives and is active in the market. Based on inquiries of the market participant as to their procedures, as well as the

Company’s own valuation assessment procedures, the Company has satisfied itself that the market participant is using

methodologies and assumptions that other market participants would use in arriving at the fair value of The Agreements.

At December 31, 2009 and December 31, 2008, The Agreements’ fair value represented a liability position for the

Company of approximately $45.9 million and an asset position for the Company of $249.5 million, respectively.

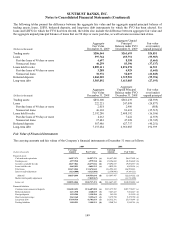

During the second quarter of 2009, in connection with its sale of Visa Class B shares, the Company entered into a

derivative contract whereby the ultimate cash payments received or paid, if any, under the contract are based on the

ultimate resolution of litigation involving Visa. The value of the derivative was estimated based on the Company’s

expectations regarding the ultimate resolution of that litigation, which involved a high degree of judgment and

subjectivity. Accordingly, the value of the derivative liability was classified as a level 3 instrument. See Note 18,

“Reinsurance Arrangements and Guarantees”, to the Consolidated Financial Statements for further discussion.

142