SunTrust 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

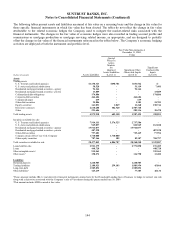

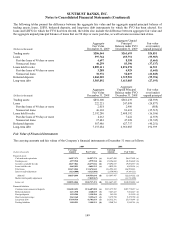

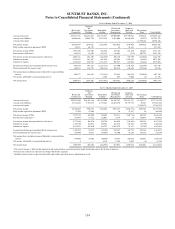

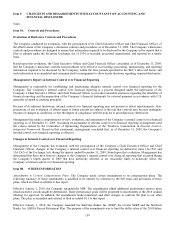

The following tables present the difference between the aggregate fair value and the aggregate unpaid principal balance of

trading assets, loans, LHFS, brokered deposits, and long-term debt instruments for which the FVO has been elected. For

loans and LHFS for which the FVO has been elected, the tables also include the difference between aggregate fair value and

the aggregate unpaid principal balance of loans that are 90 days or more past due, as well as loans in nonaccrual status.

(Dollars in thousands)

Aggregate

Fair Value

December 31, 2009

Aggregate Unpaid

Principal

Balance under FVO

December 31, 2009

Fair value

over/(under)

unpaid principal

Trading assets $286,544 $261,693 $24,851

Loans 397,764 453,751 (55,987)

Past due loans of 90 days or more 4,697 8,358 (3,661)

Nonaccrual loans 46,259 83,396 (37,137)

Loans held for sale 2,889,111 2,874,578 14,533

Past due loans of 90 days or more 3,288 4,929 (1,641)

Nonaccrual loans 30,976 52,019 (21,043)

Brokered deposits 1,260,505 1,319,901 (59,396)

Long-term debt 3,585,892 3,613,085 (27,193)

(Dollars in thousands)

Aggregate

Fair Value

December 31, 2008

Aggregate

Unpaid Principal

Balance under FVO

December 31, 2008

Fair value

over/(under)

unpaid principal

Trading assets $852,300 $861,239 ($8,939)

Loans 222,221 247,098 (24,877)

Past due loans of 90 days or more 2,018 2,906 (888)

Nonaccrual loans 46,103 81,618 (35,515)

Loans held for sale 2,392,286 2,408,392 (16,106)

Past due loans of 90 days or more 4,663 7,222 (2,559)

Nonaccrual loans 27,483 47,228 (19,745)

Brokered deposits 587,486 627,737 (40,251)

Long-term debt 7,155,684 6,963,085 192,599

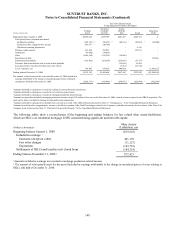

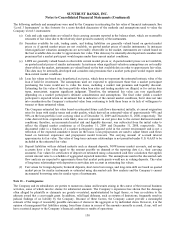

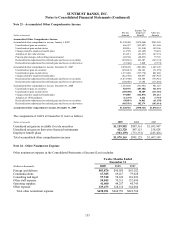

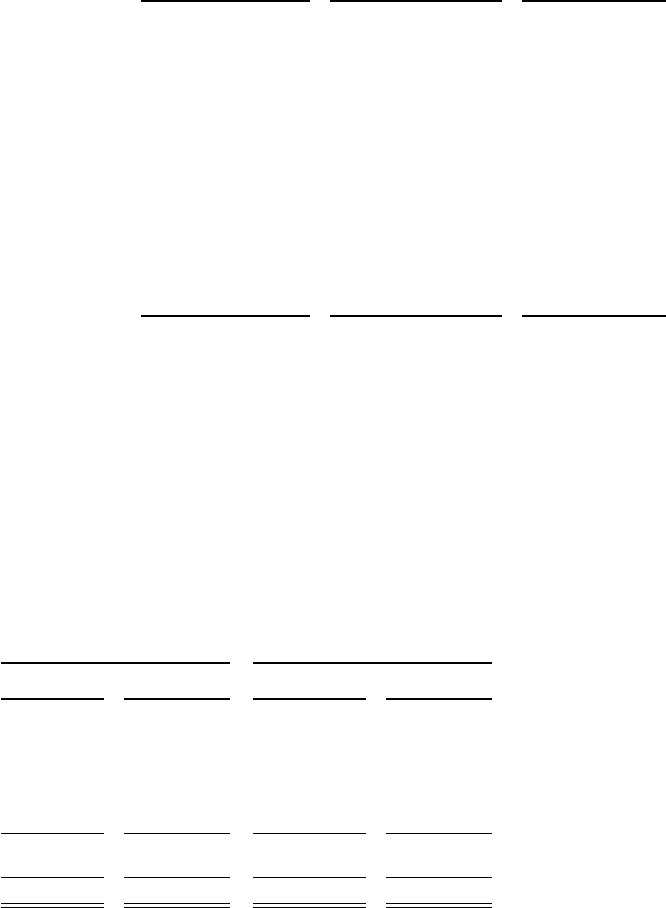

Fair Value of Financial Instruments

The carrying amounts and fair values of the Company’s financial instruments at December 31 were as follows:

2009 2008

(Dollars in thousands)

Carrying

Amount Fair Value

Carrying

Amount Fair Value

Financial assets

Cash and cash equivalents $6,997,171 $6,997,171 (a) $6,637,402 $6,637,402 (a)

Trading assets 4,979,938 4,979,938 (b) 10,396,269 10,396,269 (b)

Securities available for sale 28,477,042 28,477,042 (b) 19,696,537 19,696,537 (b)

Loans held for sale 4,669,823 4,681,915 (c) 4,032,128 4,032,128 (c)

Total loans 113,674,844 113,674,844 126,998,443 126,998,443

Interest/credit adjustment (3,120,000) (4,121,806) (2,350,996) (4,369,121)

Subtotal 110,554,844 109,553,038 (d) 124,647,447 122,629,322 (d)

Market risk/liquidity adjustment - (7,815,567) - (11,731,290)

Loans, net $110,554,844 $101,737,471 (d) $124,647,447 $110,898,032 (d)

Financial liabilities

Consumer and commercial deposits $116,303,452 $116,607,808 (e) $105,275,707 $105,770,657 (e)

Brokered deposits 4,231,530 4,160,835 (f) 7,667,167 7,586,427 (f)

Foreign deposits 1,328,584 1,328,584 (f) 385,510 385,510 (f)

Short-term borrowings 5,365,368 5,355,625 (f) 9,479,750 9,479,750 (f)

Long-term debt 17,489,516 16,701,653 (f) 26,812,381 25,878,644 (f)

Trading liabilities 2,188,923 2,188,923 (b) 3,240,784 3,240,784 (b)

149