SunTrust 2009 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

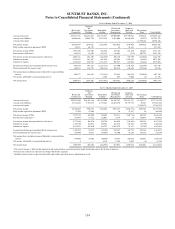

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

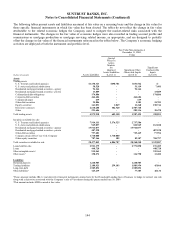

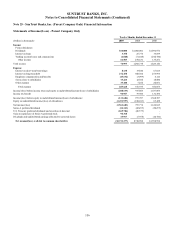

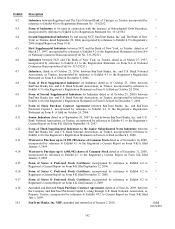

Twelve Months Ended December 31, 2008

Retail and

Commercial

Corporate

and

Investment

Banking

Household

Lending

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $58,337,176 $32,254,013 $56,333,437 $9,009,009 $19,745,012 $169,618 $175,848,265

Average total liabilities 86,620,846 15,042,794 2,832,518 9,981,004 42,842,054 (67,237) 157,251,979

Average total equity - - - - - 18,596,286 18,596,286

Net interest income $2,559,079 $274,821 $726,850 $325,076 $146,968 $586,862 $4,619,656

Fully taxable-equivalent adjustment (FTE) 34,511 64,719 - 29 18,227 1 117,487

Net interest income (FTE)12,593,590 339,540 726,850 325,105 165,195 586,863 4,737,143

Provision for credit losses2589,879 55,250 893,139 26,895 (735) 909,787 2,474,215

Net interest income after provision for credit losses 2,003,711 284,290 (166,289) 298,210 165,930 (322,924) 2,262,928

Noninterest income 1,392,267 561,807 481,290 949,103 1,103,243 (14,247) 4,473,463

Noninterest expense 2,730,344 540,910 1,531,178 969,813 121,004 (14,226) 5,879,023

Income/(loss) before provision/(benefit) for income taxes 665,634 305,187 (1,216,177) 277,500 1,148,169 (322,945) 857,368

Provision/(benefit) for income taxes3160,657 116,759 (480,216) 102,259 278,643 (127,886) 50,216

Net income/(loss) including income attributable to noncontrolling

interest 504,977 188,428 (735,961) 175,241 869,526 (195,059) 807,152

Net income attributable to noncontrolling interest 2 - 1,530 849 9,000 (3) 11,378

Net income/(loss) $504,975 $188,428 ($737,491) $174,392 $860,526 ($195,056) $795,774

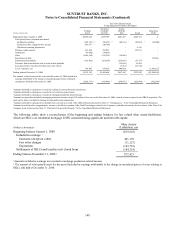

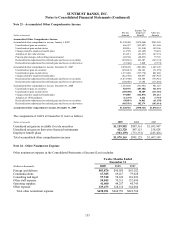

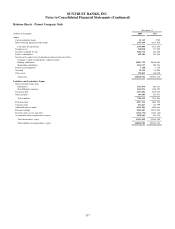

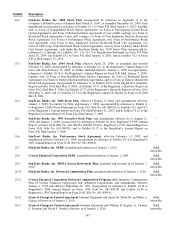

Twelve Months Ended December 31, 2007

Retail and

Commercial

Corporate

and

Investment

Banking

Household

Lending

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $59,033,586 $25,051,326 $59,413,905 $8,898,787 $23,815,137 $1,582,777 $177,795,518

Average total liabilities 87,254,458 9,555,275 2,773,461 10,429,670 49,757,933 96,347 159,867,144

Average total equity - - - - - 17,928,374 17,928,374

Net interest income $2,902,467 $196,391 $742,801 $355,157 ($166,573) $689,301 $4,719,544

Fully taxable-equivalent adjustment (FTE) 37,252 47,509 - 54 17,837 28 102,680

Net interest income (FTE)12,939,719 243,900 742,801 355,211 (148,736) 689,329 4,822,224

Provision for credit losses2164,471 37,722 212,067 8,519 65 242,078 664,922

Net interest income after provision for credit losses 2,775,248 206,178 530,734 346,692 (148,801) 447,251 4,157,302

Noninterest income 1,310,730 382,031 398,961 812,874 547,883 (23,795) 3,428,684

Noninterest expense 2,697,027 495,630 981,797 1,016,979 53,327 (23,707) 5,221,053

Income/(loss) before provision/(benefit) for income taxes 1,388,951 92,579 (52,102) 142,587 345,755 447,163 2,364,933

Provision/(benefit) for income taxes3429,948 34,277 (41,458) 54,100 86,199 155,128 718,194

Net income/(loss) including income attributable to noncontrolling

interest 959,003 58,302 (10,644) 88,487 259,556 292,035 1,646,739

Net income attributable to noncontrolling interest 4 - 2,330 1,394 9,002 (6) 12,724

Net income/(loss) $958,999 $58,302 ($12,974) $87,093 $250,554 $292,041 $1,634,015

1Net interest income is fully taxable-equivalent and is presented on a matched maturity funds transfer price basis for the line of business.

2Provision for credit losses represents net charge-offs for the segments.

3Includes regular income tax provision/(benefit) and taxable-equivalent income adjustment reversal.

154