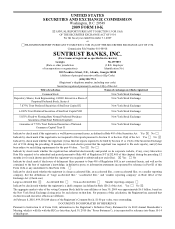

SunTrust 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS

Writing this in early 2010, I must admit to a certain

degree of relief that 2009 is behind us. Details of the

severe, recession-related pressures faced last year by

our industry, our clients, and our Company have been

well reported and need not be recounted in detail here.

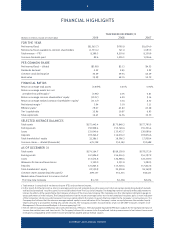

The impact on SunTrust’s fi nancial performance—notably

higher credit costs, softer fee income, and generally

weak loan demand—ultimately caused a loss of $3.98

per share for the year. There is no way to minimize my

disappointment in this result—recession or no recession.

The fact that our entire industry experienced the negative

earnings impact of the turbulent operating environment

does not make it any more palatable to report to you.

As diffi cult as 2009 was, the year ended on a more

encouraging note than it began. Fears of a global fi nancial

meltdown largely receded following coordinated efforts

to restore stability to financial markets. In the US,

indications that the recession is behind us are increasingly

credible, and there are even signs of improvement in the

housing market. This is all welcome news, and it augurs

well for SunTrust’s post-recession prospects.

Positive signals notwithstanding, we are tempered in our

optimism. The economy is far from strong, and there is

uncertainty in the outlook. Asset quality, revenues, and

ultimately earnings improvement will need time to gain

traction. That timing is largely dependent upon the

strength and sustainability of the economic recovery

coupled with the increasing effectiveness of our efforts

to grow the business. While our business was negatively

affected by the recessionary environment and borrowers’

intense focus on reducing leverage, SunTrust supported

its clients and communities through the extension of

approximately $90 billion in new loan originations,

commitments and renewals of commercial and consumer

loans during the year.

The operating environment for banks is also cloudy in

terms of the legislative and regulatory framework within

which we will be operating. The fi nancial services industry

is poised at the brink of a new relationship with our

rulemakers. It is not clear at this point what changes

there will be and how they will affect the way we do

business. We fundamentally agree with the idea that

certain regulatory reforms are needed and could

contribute to a more smoothly functioning financial

system, which is in everyone’s best interest. But, to

borrow a phrase, the devil is in the details. Our hope

is that specifi c legislative measures will be thoughtful,

responsible, inclusive, and augment the industry’s

ability to continue to support our communities,

finance individual dreams, and help contribute to

national economic growth. We are working with others

in our industry, and with government officials in

Washington, DC, to encourage the development of

responsible reform legislation.

Looking beyond Washington, our teammates are serving

our clients, running our businesses more effi ciently, and

executing the strategies aimed at making sure we are

well positioned competitively to take full advantage of

post-recession growth opportunities. To that end, we are

improving service quality and front-line execution. We

continue to be focused on controlling expenses and

managing risk. We are thinking in new ways and sharing

ideas across the organization. In time, we are confi dent

that the positive impact of these efforts will be refl ected

in our results.

The details of our 2009 fi nancial results are presented

in the 10-K that comprises the bulk of this annual report.

I will spend the balance of this letter outlining the

strong, stable foundation upon which we believe we can

drive improved performance. We are pursuing initiatives

designed to deliver that improved performance now and

as the economy recovers.

A STRONG FOUNDATION

As we see it, the elements that comprise SunTrust’s

strong foundation are our large and well-diversifi ed

franchise, solid capital, excellent liquidity, and relative

credit strength.

Large and Well-Diversifi ed Franchise

In terms of growth potential, SunTrust’s southeastern

and mid-Atlantic footprint is arguably the best in banking

with projected population growth well above the

national average. We have built strong market share in

some of the highest growth markets in the country. We

tend to focus our presence around the larger metropolitan

areas, and we believe that we are well diversifi ed within

our footprint, which includes a strong presence in Florida

that historically has contributed positively to our growth

SUNTRUST 2009 ANNUAL REPORT

1