SunTrust 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Allowance for Credit Losses

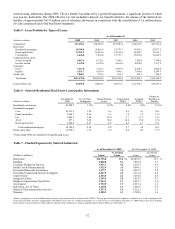

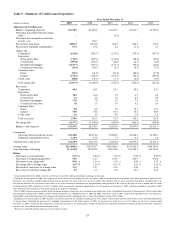

The allowance for credit losses consists of the ALLL as well as the reserve for unfunded commitments.

We continuously monitor the credit quality of our loan portfolio and maintain an ALLL sufficient to absorb current probable

and estimable losses inherent in our loan portfolio. We are committed to the timely recognition of problem loans and

maintaining an appropriate and adequate ALLL. In addition to the review of credit quality through ongoing credit review

processes, we employ a variety of modeling and estimation techniques to measure credit risk and construct an appropriate

ALLL. Numerous asset quality measures, both quantitative and qualitative, are considered in estimating the ALLL. Our ALLL

Committee has the responsibility of affirming the allowance methodology and assessing significant risk elements in order to

determine the appropriate level of allowance for the inherent losses in the loan portfolio at the point in time being reviewed. The

multiple factors evaluated include internal risk ratings, net charge-off trends, collateral values and geographic location, borrower

FICO scores, delinquency rates, nonperforming and restructured loans, origination channel, product mix, underwriting practices,

and economic trends. These credit quality factors are incorporated into various loss estimation models and analytical tools

utilized in our ALLL process and/or are qualitatively considered in evaluating the overall reasonableness of the ALLL. The

factors that have the greatest quantitative impact on the estimated ALLL tend to be internal risk rating trends, recent net

charge-off trends, delinquency rates, and loss severity levels (i.e., collateral values). Other factors such as nonperforming or

restructured loans tend to have a more isolated impact on subsets of loans in the loan pools. Also impacting the ALLL is the

estimated incurred loss period, which tends to be approximately one year for consumer-related loans and between one and

one-quarter to three years for wholesale-related loans. During periods of economic stress, the incurred loss period tends to

contract. The ALLL process excludes loans measured at fair value as subsequent mark to market adjustments related to loans

measured at fair value include a credit risk component. Starting in third quarter 2009, the ALLL includes results from a recently

enhanced residential mortgage loss forecast model. The model utilizes more granular loan specific information, as well as home

price index changes at the Metropolitan Statistical Area level to estimate incurred losses and loss severities. The enhanced

modeling capabilities, as well as declines in the home price index, resulted in increases to average loss severity estimates related

to residential mortgage loans, which partially contributed to the increase in the ALLL.

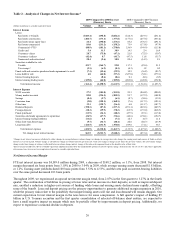

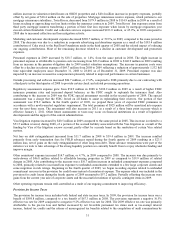

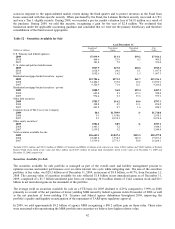

At December 31, 2009, the ALLL was $3,120.0 million, which represented 2.76% of period-end loans not carried at fair

value. This compares with an ALLL of $2,351.0 million, or 1.86% of period-end loans not carried at fair value, as of

December 31, 2008. The year-over-year increase of $769.0 million in the ALLL is comprised of quarterly increases of

$384.0 million (December 31, 2008 to March 31, 2009); $161.0 million (March 31, 2009 to June 30, 2009); $128.0 million

(June 30, 2009 to September 30, 2009); and $96.0 million (September 30, 2009 to December 31, 2009) which reflects a

declining trend in ALLL increases as a result of stabilizing leading asset quality indicators. The year-over-year increase in

ALLL reflects, among other items, the current economic downturn, decreasing home prices, and higher losses in the

residential and commercial real estate-related portions of the loan portfolio. Future changes in the ALLL will depend

significantly on credit quality indicators, which are highly influenced by the broader economy. The majority of the increase

in the allowance for loan losses pertained to the residential real estate-related portion of the loan portfolio and specific

reserves for residential developers. In the first quarter of 2009, we began classifying losses associated with borrower

misrepresentation and insurance claim denials in the ALLL. Previously, these fraud-related losses were recorded in operating

losses within noninterest expense. These losses are now being recorded in the ALLL since we believe that borrower credit-

related issues due to the deteriorating economic environment have become the predominant contributor to the losses.

Realized losses on these loans are reflected as charge-offs.

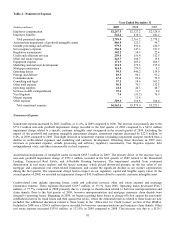

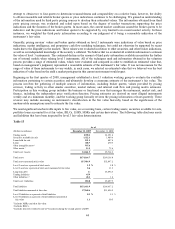

Our ALLL framework has two basic elements: specific allowances for loans individually evaluated for impairment and a

component for pools of homogeneous loans not individually evaluated. The first element of the ALLL analysis involves the

estimation of allowance specific to individually evaluated impaired loans including accruing and nonaccruing restructured

commercial and consumer loans. In this process, specific allowance is established for larger commercial impaired loans

based on an analysis of the most probable sources of repayment, including discounted cash flows, liquidation of collateral, or

the market value of the loan itself. Restructured consumer loans are also evaluated in this element of the estimate. As of

December 31, 2009, the specific allowance related to commercial impaired loans individually evaluated and restructured

consumer loans totaled $538.0 million, compared to $201.8 million as of December 31, 2008; $292.2 million of this increase

is driven by the loan modification efforts on consumer and residential loans. Specific reserves associated with larger

commercial loans individually evaluated increased $44.0 million to $193.0 million at December 31, 2009. This increase is

primarily driven by deterioration in loans to residential builders.

The second element of the ALLL, the general allowance for homogeneous loan pools not individually evaluated, is determined

by applying allowance factors to pools of loans within the portfolio that have similar risk characteristics. The general allowance

factors are determined using a baseline factor that is developed from an analysis of historical net charge-off experience and

expected losses. Expected losses are based on estimated probabilities of default and loss given default derived from our internal

risk rating process. These baseline factors are developed and applied to the various loan pools. Adjustments may be made to

baseline reserves for some of the loan pools based on an assessment of internal and external influences on credit quality not fully

reflected in the historical loss or risk-rating data. These influences may include elements such as changes in credit underwriting,

concentration risk, macroeconomic conditions, and/or recent observable asset quality trends.

36