SunTrust 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and credit quality. While Florida has been hard hit by the

current recession, we believe the state’s long-term prospects

are favorable and that it will continue to be an attractive

market for the same reasons it was before the recession.

Our relationship-based operating model allows us to

effectively meet the evolving needs of our clients. We

are building loyalty by understanding client preferences

and aligning our business to respond. We believe that

we have the optimal breadth and depth of products and

services to retain clients and attract new ones.

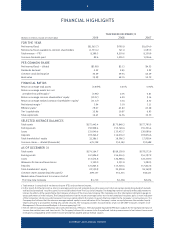

Strong Capital, Excellent Liquidity

We successfully completed capital actions that created

even stronger capitalization and complied with the new

rules established by the Federal Reserve under the

Supervisory Capital Assessment Program. While

disappointed that we were required to raise common

capital at arguably the deepest part of the recession with

depressed stock prices, the transactions were exceedingly

successful. Given our current capital and liquidity, we

are well positioned to repay TARP funds when regulatory

approval is received.

Regrettably, as we looked at all the ways necessary to

preserve capital in light of the recession, the uncertainty

created by it, and the related pressure on SunTrust’s

earnings and capital, we made the decision to reduce

our quarterly dividend to $0.01 per common share. This

decision was extremely diffi cult and made only after

signifi cant evaluation and deliberation. We did what

was necessary, and we believe prudent, to preserve and

generate the appropriate amount of capital. I can assure

you that we are looking forward to the time when we can

begin increasing the dividend.

With respect to liquidity, we have a diversifi ed funding

base with stable core deposits providing the majority of

SunTrust’s funding. We benefi ted from a sizeable increase

in deposits in 2009. Further, the composition of the

growth has been favorable with a large increase in lower

cost demand deposits. There are strong indications that

our efforts to grow deposit-based clients at a greater rate

than our competitors contributed to this outcome and that

it was not simply a function of broader economic forces.

Credit Quality

Despite the obvious—and in 2009, severe—credit

deterioration that comes with an economic downturn,

we believe that our mix of products, geographies

with solid long-term growth profi les, and historically

conservative underwriting are key elements in our relative

credit strength. The conservative nature of our portfolio

is evidenced, for example, by the fact that we have no

subprime or option ARM loans, a small credit card

portfolio, and low levels of unsecured loans to consumers

and small businesses.

Our loan portfolio is well diversifi ed by borrower type,

purpose, and collateral. The largest concentration is in

consumer loans and lines of credit secured by residential

real estate. This product concentration, coupled with our

Florida market share, has produced the majority of the

asset quality issues so far in this downturn. We remain

committed to this business though, obviously, adjustments

have been made. Not only has it historically been a profi t

driver for us, but it also provides opportunities to expand

and to deepen our relationships with clients.

We also have a conservative commercial loan portfolio

that has continued to perform relatively well throughout

this cycle. We have successfully reduced exposure to

higher risk loan categories, such as construction loans,

while continuing to experience stable performance in the

rest of the commercial portfolio.

Further, we maintain signifi cant loan loss reserves.

We continuously monitor the credit quality of our loan

portfolio and maintain an allowance for loan and lease

losses suffi cient to absorb current probable and estimable

losses inherent in our loan portfolio. We are committed to

the timely recognition of problem loans and to maintaining

an appropriate and adequate reserve against future losses.

GROWTH INITIATIVES

Building on the strong foundation outlined above, we

are actively implementing a variety of growth initiatives

to improve performance. Changes that we have already

implemented—from reducing expenses to more closely

aligning our service offerings with clients’ needs—have

not only given us an advantage in managing through

the current economy, but also provide a springboard for

moving forward. Specifi c programs of note are aimed

at further enhancing the client experience, improving

effi ciency, and optimizing the balance sheet and business

mix. All of this was built upon fundamental principles

such as a conservative risk posture.

Client Focus

We believe that enhanced client service, including making

it easier and more effi cient to do business with us, is critical

to driving revenue growth and improved shareholder

value. Over the past several years, we have undertaken

a deep look at our internal activities and processes

to identify new ways to improve our efficiency and

effectiveness in serving clients. Specifi c initiatives move

beyond quick fi xes to improve client satisfaction and get

2

SUNTRUST 2009 ANNUAL REPORT