SunTrust 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

several taxing authorities during 2009. The tax benefit was reduced by a goodwill impairment, a significant portion of which

was non-tax deductible. The 2008 effective tax rate included a discrete tax benefit related to the release of the deferred tax

liability of approximately $65.8 million (net of valuation allowance) in connection with the contribution of 3.6 million shares

of Coke common stock to the SunTrust Foundation.

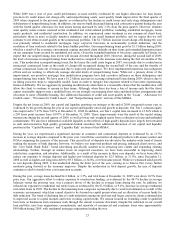

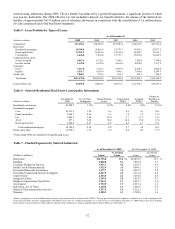

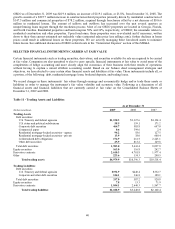

Table 5 - Loan Portfolio by Types of Loans

As of December 31

(Dollars in millions) 2009 2008 2007 2006 2005

Commercial $32,494.1 $41,039.9 $35,929.4 $34,613.9 $33,764.2

Real estate:

Residential mortgages 30,789.8 32,065.8 32,779.7 33,830.1 29,877.3

Home equity lines 15,952.5 16,454.4 14,911.6 14,102.7 13,635.7

Construction 6,646.8 9,864.0 13,776.7 13,893.0 11,046.9

Commercial real estate:

Owner occupied 8,915.4 8,758.1 7,948.5 7,709.0 7,398.6

Investor owned 6,159.0 6,199.0 4,661.0 4,858.8 5,117.4

Consumer:

Direct 5,117.8 5,139.3 3,963.9 4,160.1 5,060.8

Indirect 6,531.1 6,507.6 7,494.1 7,936.0 8,389.5

Credit card 1,068.3 970.3 854.1 350.7 264.5

Total loans $113,674.8 $126,998.4 $122,319.0 $121,454.3 $114,554.9

Loans held for sale $4,669.8 $4,032.1 $8,851.7 $11,790.1 $13,695.6

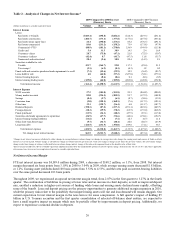

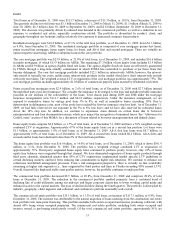

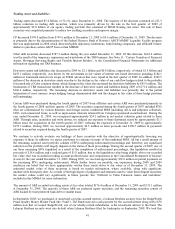

Table 6 - Selected Residential Real Estate Loan Quality Information

(Dollars in millions)

December 31,

2009

30 - 89 Days

Delinquent

Nonperforming

Loans

Nonaccruing

TDRs1

Accruing

TDRs

Portion of

Portfolio in

Florida

Residential construction $3,822.9 1.55% 34.8% 0.2% 0.0% 27.0 %

Residential mortgages:

Core 23,913.5 1.98 8.5 2.6 4.5 30.3

Prime second lien 2,904.1 2.46 3.1 1.2 3.3 11.9

Lot 1,086.9 3.00 25.0 3.7 11.7 53.1

Alt-A 897.1 5.22 30.2 14.2 15.0 19.0

Home equity loans 1,988.2 2.47 2.8 0.6 1.7 31.1

Total residential mortgages 30,789.8 2.18 8.8 2.7 4.8 29.1

Home equity lines 15,952.5 1.36 1.8 0.2 0.9 37.5

1Nonaccruing TDRs are included in Nonperforming Loans

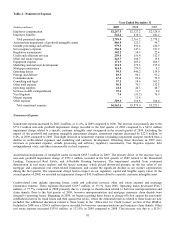

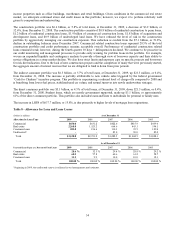

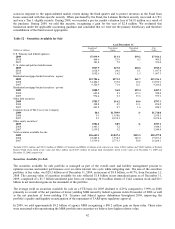

Table 7 - Funded Exposures by Selected Industries1

As of December 31, 2009 As of December 31, 2008

(Dollars in millions) Loans

% of Total

Loans Loans

% of Total

Loans

Real Estate $12,756.0 11.2 % $16,853.5 13.3 %

Retailing 6,060.8 5.3 7,207.8 5.7

Consumer Products & Services 5,933.7 5.2 6,187.5 4.9

Health Care & Pharmaceuticals 3,922.9 3.5 4,098.3 3.2

Diversified Financials & Insurance 3,477.7 3.1 4,033.5 3.2

Diversified Commercial Services & Supplies 2,867.9 2.5 3,313.2 2.6

Capital Goods 2,463.8 2.2 3,264.2 2.6

Energy & Utilities 2,195.1 1.9 3,414.7 2.7

Religious Organizations/Non-Profits 1,964.3 1.7 2,067.7 1.6

Government 1,954.9 1.7 2,015.4 1.6

Individuals, Inv. & Trusts 1,664.8 1.5 1,086.2 0.9

Media & Telecommunication Services 1,537.4 1.4 2,121.1 1.7

Materials 1,285.5 1.1 1,722.6 1.4

1Industry groupings have been modified from the prior year presentation that was based on the NAICS. The new presentation presents exposure to industries as a result of repayment risk

of the loan and allows for better comparability with industry peers who use a similar presentation. As a result of the new presentation, December 31, 2008 balances have been modified

from the prior year presentation to reflect industry repayment risk. Groupings are loans in aggregate greater than $1 billion as of December 31.

32