SunTrust 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

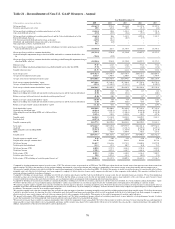

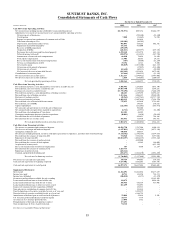

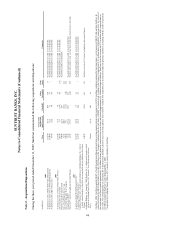

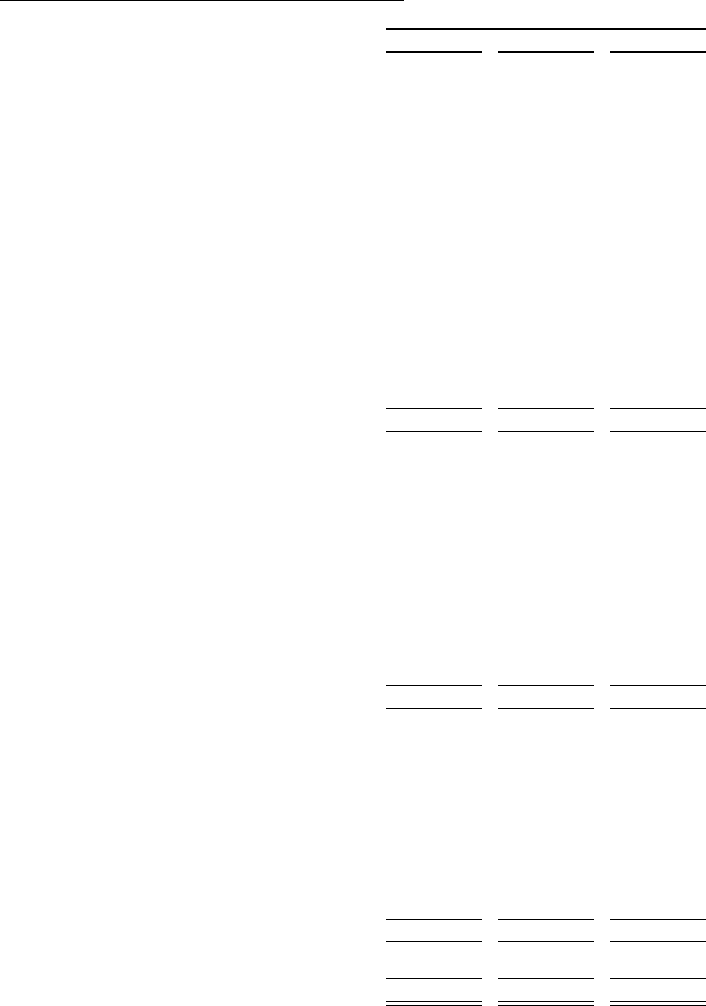

SUNTRUST BANKS, INC.

Consolidated Statements of Cash Flows

For the Year Ended December 31

(Dollars in thousands) 2009 2008 2007

Cash Flows from Operating Activities:

Net income/(loss) including income attributable to noncontrolling interest ($1,551,571) $807,152 $1,646,739

Adjustments to reconcile net income/(loss) to net cash provided by operating activities:

Net gain on sale of businesses -(198,140) (32,340)

Visa litigation 7,000 (33,469) 76,930

Expense recognized on contribution of common stock of Coke -183,418 -

Gain from ownership in Visa (112,102) (86,305) -

Depreciation, amortization and accretion 966,093 824,263 802,342

Impairment of goodwill/intangibles 751,156 415,000 -

Recovery of MSRs impairment (199,159) --

Origination of MSRs (681,813) (485,597) (639,158)

Provisions for credit losses and foreclosed property 4,270,340 2,551,574 683,114

Deferred income tax benefit (894,974) (221,235) (147,758)

Amortization of restricted stock compensation 66,420 76,656 34,820

Stock option compensation 11,406 20,185 24,275

Excess tax benefits from stock-based compensation (387) (4,580) (11,259)

Net loss on extinguishment of debt 39,356 11,723 9,800

Net securities gains (98,019) (1,073,300) (243,117)

Net gain on sale/leaseback of premises -(37,039) (118,840)

Net gain on sale of assets (65,648) (60,311) (30,569)

Net (increase)/decrease in loans held for sale (965,249) 4,191,838 2,479,428

Contributions to retirement plans (25,666) (386,535) (11,185)

Net (increase)/decrease in other assets 1,522,117 (2,694,422) (1,993,001)

Net (decrease)/increase in other liabilities 2,864 (184,601) 1,200,614

Net cash provided by operating activities 3,042,164 3,616,275 3,730,835

Cash Flows from Investing Activities:

Proceeds from maturities, calls and paydowns of securities available for sale 3,406,941 1,292,065 1,073,340

Proceeds from sales of securities available for sale 19,487,740 5,737,627 1,199,231

Purchases of securities available for sale (33,793,498) (8,170,824) (7,640,289)

Proceeds from maturities, calls and paydowns of trading securities 148,283 4,329,198 11,896,617

Proceeds from sales of trading securities 2,113,466 3,046,185 19,240,250

Purchases of trading securities (85,965) (3,687,561) (22,717,152)

Net decrease/(increase) in loans 8,609,239 (5,807,828) (7,158,570)

Proceeds from sales of loans held for investment 755,855 881,410 5,721,662

Proceeds from sale of MSRs -148,387 270,215

Capital expenditures (212,186) (221,602) (186,431)

Net cash and cash equivalents received for sale of businesses -301,604 -

Net cash paid and cash equivalents acquired in acquisitions (6,711) (23,931) (32,200)

Proceeds from sale/redemption of Visa shares 112,102 86,305 -

Contingent consideration payouts related to acquisitions (18,043) (2,830) (50,689)

Proceeds from the sale/leaseback of premises -288,851 764,368

Proceeds from the sale of other assets 566,451 318,910 145,871

Net cash provided by/(used) in investing activities 1,083,674 (1,484,034) 2,526,223

Cash Flows from Financing Activities:

Net increase in consumer and commercial deposits 10,582,750 1,767,908 2,100,134

Net decrease in foreign and brokered deposits (2,497,023) (7,917,898) (8,273,116)

Assumption of deposits, net 448,858 160,517 -

Net decrease in funds purchased, securities sold under agreements to repurchase, and other short-term borrowings (4,114,382) (2,796,359) (1,679,833)

Proceeds from the issuance of long-term debt 574,560 7,834,388 5,197,020

Repayment of long-term debt (10,034,157) (4,024,675) (1,553,412)

Proceeds from the issuance of preferred stock -4,850,000 -

Proceeds from the exercise of stock options -25,569 186,000

Acquisition of treasury stock -- (853,385)

Excess tax benefits from stock-based compensation 387 4,580 11,259

Proceeds from the issuance of common stock 1,829,735 --

Repurchase of preferred stock (228,124) --

Common and preferred dividends paid (328,673) (1,041,470) (1,056,869)

Net cash used in financing activities (3,766,069) (1,137,440) (5,922,202)

Net increase in cash and cash equivalents 359,769 994,801 334,856

Cash and cash equivalents at beginning of period 6,637,402 5,642,601 5,307,745

Cash and cash equivalents at end of period $6,997,171 $6,637,402 $5,642,601

Supplemental Disclosures:

Interest paid $2,366,891 $3,868,034 $5,277,639

Income taxes paid 44,723 341,396 724,351

Income taxes refunded (106,020) (4,275) (13,859)

Securities transferred from available for sale to trading -- 15,143,109

Loans transferred from loans to loans held for sale 124,879 - 4,054,246

Loans transferred from loans held for sale to loans 306,966 656,134 837,401

Loans transferred from loans to other real estate owned 811,659 754,091 -

Issuance of common stock for acquisition of GB&T -154,513 -

Noncash gain on contribution of common stock of Coke -183,418 -

Unsettled purchases of securities available for sale as of year-end -8,898,279 -

Unsettled sales of securities available for sale as of year-end -6,386,795 -

Amortization of deferred gain on sale/leaseback of premises 59,044 55,616 5,301

U.S. Treasury preferred dividend accrued but unpaid 10,777 7,778 -

Accretion on U.S. Treasury preferred stock 23,098 3,732 -

Extinguishment of forward stock purchase contract 173,653 --

Gain on repurchase of Series A preferred stock 94,318 --

See Notes to Consolidated Financial Statements.

85