SunTrust 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

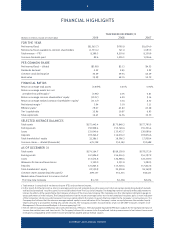

YEAR ENDED DECEMBER 31

(Dollars in millions, except per share data) 2009 2008 2007

FOR THE YEAR

Net income/(loss) ($1,563.7) $795.8 $1,634.0

Net income/(loss) available to common shareholders (1,733.4) 741.0 1,593.0

Total revenue — FTE 1 8,299.3 9,210.6 8,250.9

Common dividends paid 82.6 1,004.1 1,026.6

PER COMMON SHARE

Net income/(loss) — diluted ($3.98) $2.12 $4.52

Dividends declared 0.22 2.85 2.92

Common stock closing price 20.29 29.54 62.49

Book value 35.29 48.74 50.72

FINANCIAL RATIOS

Return on average total assets (0.89)% 0.45% 0.92%

Return on average assets less net

unrealized securities gains 2 (0.96) 0.05 0.81

Return on average common shareholders’ equity (10.07) 4.20 9.14

Return on average realized common shareholders’ equity 2 (11.12) 0.16 8.52

Net interest margin 3 3.04 3.10 3.11

Effi ciency ratio 3 79.07 63.83 63.28

Tier 1 capital ratio 12.96 10.87 6.93

Total capital ratio 16.43 14.04 10.30

SELECTED AVERAGE BALANCES

Total assets $175,442.4 $175,848.3 $177,795.5

Earning assets 150,908.4 152,748.6 155,204.4

Loans 121,040.6 125,432.7 120,080.6

Deposits 119,246.2 116,076.3 119,876.6

Total shareholders’ equity 22,286.1 18,596.3 17,928.4

Common shares — diluted (thousands) 435,328 350,183 352,688

AS OF DECEMBER 31

Total assets $174,164.7 $189,138.0 $179,573.9

Earning assets 147,896.2 156,016.5 154,397.2

Loans 113,674.8 126,998.4 122,319.0

Allowance for loan and lease losses 3,120.0 2,351.0 1,282.5

Deposits 121,863.6 113,328.4 117,842.6

Total shareholders’ equity 22,530.9 22,500.8 18,169.9

Common shares outstanding (thousands) 499,157 354,515 348,411

Market value of investment in common stock of

The Coca-Cola Company $1,710 $1,358 $2,674

1 Total revenue is comprised of net interest income (FTE) and noninterest income.

2 In this report, SunTrust presents a return on average assets less net unrealized securities gains and return on average realized equity which exclude

realized and unrealized securities gains/losses and dividends from The Coca-Cola Company. The foregoing numbers primarily refl ect adjustments to

remove the effects of the ownership by the Company of shares of The Coca-Cola Company. The Company uses this information internally to gauge its

actual performance in the industry. The Company believes that the return on average assets less the net unrealized securities gains is more indicative

of the Company’s return on assets because it more accurately refl ects the return on assets that are related to the Company’s core businesses. The

Company also believes that the return on average realized equity is more indicative of the Company’s return on equity because the excluded equity

relates primarily to a long-term holding of a specifi c security. The Company provides reconcilements of all non-US GAAP measures in Table 21 of

Management’s Discussion and Analysis in the accompanying 10-K.

3 The net interest margin and effi ciency ratios are presented on a FTE basis. The fully-taxable equivalent (FTE) basis adjusts for the tax-favored status of

income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and

it enhances comparability of net interest income arising from taxable and tax-exempt sources.

FINANCIAL HIGHLIGHTS

SUNTRUST 2009 ANNUAL REPORT

8