SunTrust 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

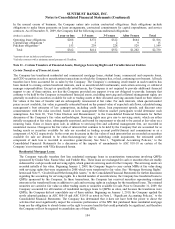

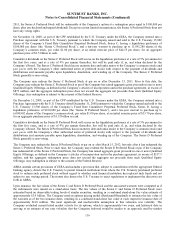

For other partnerships, the Company acts only in a limited partnership capacity. The Company has determined that it is

not the primary beneficiary of these partnerships because it will not absorb a majority of the expected losses of the

partnership. Typically, the general partner or an affiliate of the general partner provide guarantees to the limited partner

which protect the Company from losses attributable to operating deficits, construction deficits, and tax credit allocation

deficits. The Company accounts for its limited partner interests in accordance with the income tax guidance for

investments in affordable housing projects. Partnership assets of approximately $1.1 billion and $1.0 billion in these

partnerships were not included in the Consolidated Balance Sheets at December 31, 2009 and December 31, 2008,

respectively. These limited partner interests had carrying values of $218.1 million and $188.9 million at December 31,

2009 and December 31, 2008, respectively, and are recorded in other assets on the Company’s Consolidated Balance

Sheets. The Company’s maximum exposure to loss for these limited partner investments totaled $468.2 million and

$473.2 million at December 31, 2009 and December 31, 2008, respectively. The Company’s maximum exposure to loss

would be borne by the loss of the limited partnership equity investments along with $219.4 million and $202.7 million

of loans issued by the Company to the limited partnerships at December 31, 2009 and December 31, 2008, respectively.

The difference between the maximum exposure to loss and the investment and loan balances is primarily attributable to

the unfunded equity commitments. Unfunded equity commitments are amounts that the Company has committed to the

partnerships upon the partnerships meeting certain conditions. When these conditions are met, the Company will invest

these additional amounts in the partnerships.

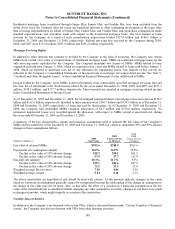

When SunTrust owns both the limited partner and general partner or acts as the indemnifying party, the Company

consolidates the partnerships and does not consider these partnerships VIEs because, as owner of the partnerships, the

Company has the ability to directly and indirectly make decisions that have a significant impact on the business. As of

December 31, 2009 and December 31, 2008, total assets, which consist primarily of fixed assets and cash, attributable to

the consolidated, non-VIE partnerships were $424.9 million and $493.5 million, respectively, and total liabilities,

excluding intercompany liabilities, primarily representing third-party borrowings, were $209.0 million and $327.6

million, respectively.

Registered and Unregistered Funds Advised by RidgeWorth

RidgeWorth, a registered investment advisor and wholly-owned subsidiary of the Company, serves as the investment

advisor for various private placement and publicly registered investment funds (collectively the “Funds”). The Company

evaluates these Funds to determine if the Funds are voting interest entities or VIEs, as well as monitors the nature of its

interests in each Fund to determine if the Company is required to consolidate any of the Funds.

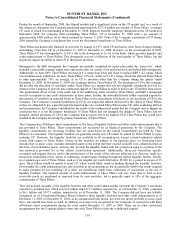

The Company has concluded that some of the Funds are VIEs because the equity investors lack decision making rights.

However, the Company has concluded that it is not the primary beneficiary of these funds as the Company does not

absorb a majority of the expected losses or expected returns of the funds. As the Company does not directly invest in

these funds, its exposure to loss is limited to the investment advisor and other administrative fees it earns. Payment on

these fees is received from the individual investor accounts. The total unconsolidated assets of these funds as of

December 31, 2009 and December 31, 2008 were $3.3 billion and $3.6 billion, respectively. Beginning on January 1,

2010, the Company adopted the amendments to ASC 810-10 as noted in Note 1, “Significant Accounting Policies.” In

January 2010, the FASB voted to finalize an ASU that would defer the amendments to ASC 810-10 for certain

investment funds that meet specific criteria. The Company has determined that these Funds meet the criteria for deferral

and accordingly will continue to be accounted for under the previous accounting model.

While the Company does not have any contractual obligation to provide monetary support to any of the Funds, the

Company did elect to provide support for specific securities on one occasion in 2008 and two occasions in 2007 to three

of the funds. In 2008 and 2007, the Company purchased approximately $2.4 billion of securities from these three funds

at amortized cost plus accrued interest. The Company took these actions in response to the unprecedented market events

to protect investors in these funds from possible losses associated with these securities. Two of the funds were

previously considered voting interest entities and in connection with these purchases, the Company re-evaluated its

involvement with these funds. As a result of the unprecedented circumstances that caused the Company to intervene, the

lack of any contractual obligation to provide any current or future support to the funds, and the size of the financial

support ultimately provided, the Company concluded that these two funds were still voting interest entities. The

Company concluded that the third fund was a VIE and that, as a result of the purchase of securities, it was the primary

beneficiary of this fund as it was likely to absorb a majority of the expected losses of the fund. Accordingly, this fund

was consolidated in September 2007 and was subsequently closed in November 2007, which resulted in the termination

of the VIE. At December 31, 2009 and December 31, 2008, the Company still owned securities purchased from these

three funds of $159.3 million and $246.0 million, respectively.

112