SunTrust 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

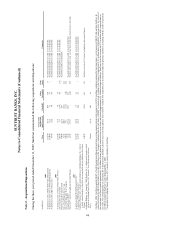

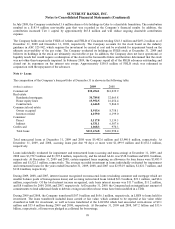

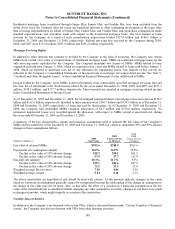

The changes in the carrying amount of goodwill by reportable segment for the years ended December 31, 2009 and 2008 are

as follows:

(Dollars in thousands) Retail Commercial

Retail &

Commercial Wholesale

Corporate and

Investment

Banking

Household

Lending Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury Total

Balance, January 1, 2008 $4,893,970 $1,272,483 $- $- $147,454 $- $275,840 $331,746 $- $6,921,493

Intersegment transfers (4,893,970) (1,272,483) 5,780,742 522,667 (147,454) - - - 10,498 -

NCF purchase adjustments - - (11,782) (119) - - (416) 1,502 - (10,815)

Sale of First Mercantile Trust Company - - - - - - - (11,734) - (11,734)

Acquisition of GB&T - - 143,030 - - - - - - 143,030

Sale of TransPlatinum Service Corp. - - - - - - - - (10,498) (10,498)

Purchase of remaining interest in ZCI - - - - - - - 20,712 - 20,712

Sale of majority interest in ZCI - - - - - - - (15,433) - (15,433)

Acquisition of Cymric Family Office Service - - - - - - - 1,378 - 1,378

SunAmerica contingent consideration - - - - - - 2,830 - - 2,830

Purchase price adjustments - - - - - - - 2,540 - 2,540

Balance, December 31, 2008 $- $- $5,911,990 $522,548 $- $- $278,254 $330,711 $- $7,043,503

Intersegment transfers 1- - 125,580 (522,548) 223,307 451,915 (278,254) - - -

Goodwill impairment - - (299,241) - - (451,915) - - - (751,156)

Seix contingent consideration - - - - - - - 12,722 - 12,722

Acquisition of Epic Advisors, Inc. - - - - - - - 5,012 - 5,012

TBK contingent consideration - - - - - - - 2,700 - 2,700

Inlign contingent consideration - - - - - - - 2,621 - 2,621

Purchase price adjustments - - 474 - - - - 1,206 - 1,680

Other - - - - - - - 1,996 - 1,996

Balance, December 31, 2009 $- $- $5,738,803 $- $223,307 $- $- $356,968 $- $6,319,078

1Goodwill was reallocated among the reportable segments as a result of the corporate restructuring described in Note 22, “Business Segment Reporting,” to the Consolidated Financial Statements.

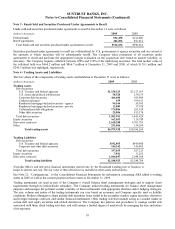

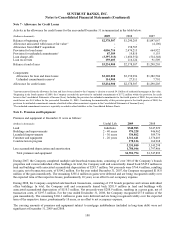

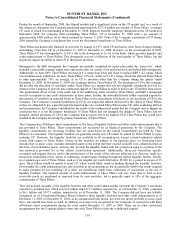

The changes in carrying amounts of other intangible assets for the years ended December 31 are as follows:

(Dollars in thousands)

Core Deposit

Intangibles

MSRs

LOCOM

MSRs Fair

Value Other Total

Balance, January 1, 2008 $172,655 $1,049,425 $- $140,915 $1,362,995

Amortization (56,854) (223,092) - (19,406) (299,352)

MSRs originated - 485,597 - - 485,597

MSRs impairment reserve - (371,881) - - (371,881)

MSRs impairment recovery - 1,881 - - 1,881

Sale of interest in Lighthouse Partners - - - (5,992) (5,992)

Sale of MSRs - (131,456) - - (131,456)

Customer intangible impairment charge - - - (45,000) (45,000)

Purchased credit card relationships 1- - - 9,898 9,898

Acquisition of GB&T229,510 - - - 29,510

Sale of First Mercantile Trust - - - (3,033) (3,033)

Other - - - 2,260 2,260

Balance, December 31, 2008 $145,311 $810,474 $- $79,642 $1,035,427

Designated at fair value (transfers from amortized cost) - (187,804) 187,804 - -

Amortization (41,071) (218,008) - (14,736) (273,815)

MSRs originated - - 681,813 - 681,813

MSRs impairment recovery - 199,159 - - 199,159

Changes in fair value

Due to changes in inputs or assumptions 3- - 160,639 - 160,639

Other changes in fair value 4- - (94,695) - (94,695)

Other - - - 2,771 2,771

Balance, December 31, 2009 $104,240 $603,821 $935,561 $67,677 $1,711,299

1During the third quarter of 2008, SunTrust purchased a credit card portfolio of loans including the cardholder relationships from another financial institution

representing an outstanding balance of $82.4 million at the time of acquisition. A majority of the premium paid was attributed to the cardholder

relationships and is being amortized over seven years.

2During the second quarter of 2008, SunTrust acquired 100% of the outstanding shares of GB&T. As a result of the acquisition, SunTrust assumed $1.4

billion of deposit liabilities and recorded core deposit intangibles that are being amortized over an eight year period.

3Primarily reflects changes in discount rates and prepayment speed assumptions, due to changes in interest rates.

4Represents changes due to the collection of expected cash flows, net of accretion, due to passage of time.

102