SunTrust 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

subordinated securities. To estimate the market value of these securities, consideration was given to dealer indications of

market value as well as the results of discounted cash flow models using market assumptions for prepayment rates, credit

losses and discount rates due to illiquidity in the market for non-agency residential MBS.

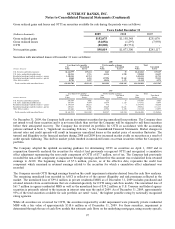

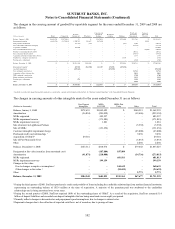

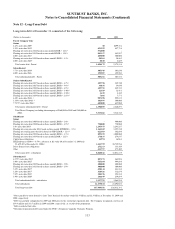

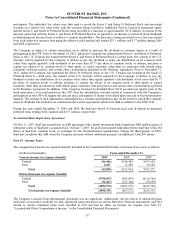

December 31, 2009

(Dollars in millions)

Residential

Mortgage Student Loans CDO Securities Total

Fair Value $216.7 $18.5 $25.5 $260.7

Prepayment Rate 11.4% - 17% 5.9% 0%

Decline in fair value from 10% adverse change 5.4 0.2 - 5.6

Decline in fair value from 20% adverse change 9.9 0.6 - 10.5

Expected Credit Losses 0.26% - 21% nm 33.7% -38.4%

Decline in fair value from 10% adverse change 2.6 nm - 2.6

Decline in fair value from 20% adverse change 4.3 nm - 4.3

Annual Discount Rate 5% - 450% 22.5% 25.8% - 27.7%

Decline in fair value from 10% adverse change 6.6 0.6 2.7 9.9

Decline in fair value from 20% adverse change 12.2 1.3 5.1 18.6

Weighted Average Life (in years) 4.14 - 16.7 4.92 24.22

Expected Static Pool Losses 0.26% - 28.6% nm 33.7% - 38.4%

“nm”- not meaningful.

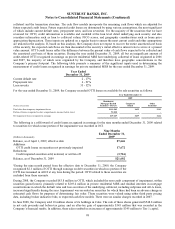

At December 31, 2008, the total fair value of retained interests, excluding MSRs, was approximately $367.0 million. The

weighted average remaining lives of the Company’s retained interests ranged from approximately 2.5 years to 18 years for

interests in residential mortgage loans, commercial and corporate loans, and student loans as of December 31, 2008, with the

weighted average remaining life of interests in CDO securities approximating 24 years. To estimate the fair values of these

securities, consideration was given to dealer indications of market value, where applicable, as well as the results of

discounted cash flow models using key assumptions and inputs for prepayment rates, credit losses, and discount rates. For the

majority of the retained interests, the Company has considered the impacts on the fair values of two unfavorable variations

from the estimated amounts, related to the fair values of the Company’s retained and residual interests, excluding MSRs.

Declines in fair values for the total retained interests due to 10% and 20% adverse changes in the key assumptions and inputs

totaled approximately $22.2 million and $45.7 million, respectively, as of December 31, 2008. For certain subordinated

retained interests in residential mortgage securitizations, the Company used dealer indicated prices, as the Company believed

these price indications more accurately reflected the severe disruption in the market for these securities. As such, the

Company has not evaluated any adverse changes in key assumptions of these values. As of December 31, 2008, the fair value

of these subordinated interests was $4.4 million based on a weighted average price of 12.3% of par. Expected static pool

losses were approximately 5% or less for residential mortgage loans and commercial and corporate loans, as of December 31,

2008. For interests related to securitizations of CDO securities, expected static pool losses ranged from approximately 23%

to 31% as of December 31, 2008.

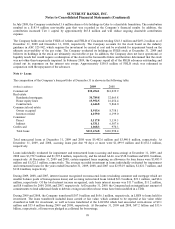

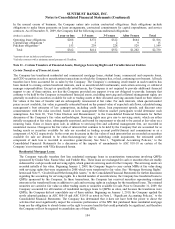

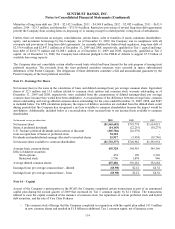

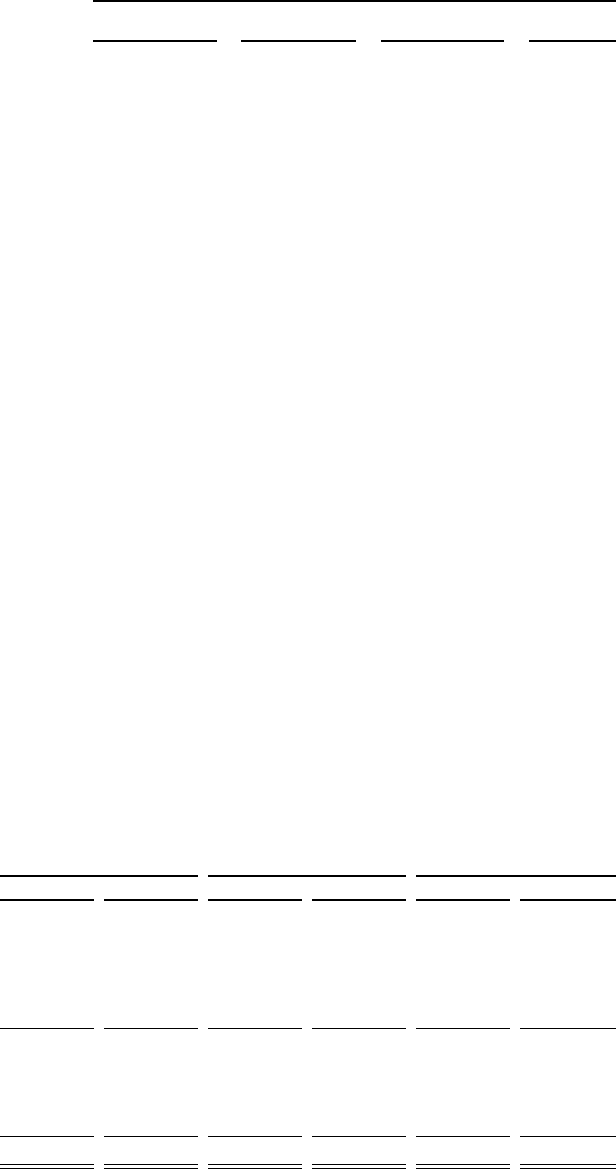

Portfolio balances and delinquency balances based on 90 days or more past due (including accruing and nonaccrual loans) as

of December 31, 2009 and December 31, 2008, and net charge-offs related to managed portfolio loans (both those that are

owned by the Company and those that have been transferred) for years ended December 31, 2009 and 2008 are as follows:

Principal Balance Past Due Net Charge-offs

(Dollars in millions) 2009 2008 2009 2008 2009 2008

Type of loan:

Commercial $32,494.1 $41,039.9 $507.8 $340.9 $572.4 $194.6

Residential mortgage and home equity 46,742.3 48,520.2 4,064.6 2,727.6 1,902.6 950.5

Commercial real estate and construction 21,721.2 24,821.1 1,901.7 1,492.6 527.2 215.2

Consumer 11,648.9 11,646.9 428.4 411.1 152.1 172.4

Credit card 1,068.3 970.3 --83.4 31.6

Total loan portfolio $113,674.8 $126,998.4 $6,902.5 $4,972.2 $3,237.7 $1,564.3

Managed securitized loans

Commercial 3,460.2 3,766.8 64.5 30.2 27.9 -

Residential mortgage 1,482.3 1,836.2 122.9 129.5 44.2 24.7

Other 506.1 565.2 25.1 61.6 0.4 0.3

Total managed loans $119,123.4 $133,166.6 $7,115.0 $5,193.5 $3,310.2 $1,589.3

107