SunTrust 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

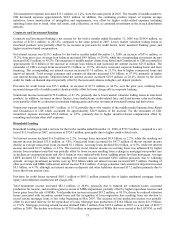

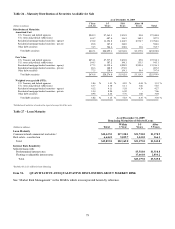

Total noninterest income was $1.4 billion, a decrease of $29.3 million, or 2.1%, from the same period in 2008. The decrease

was primarily due to a $54.3 million, or 6.8%, decrease in service charges on deposits driven by lower consumer and

commercial NSF fees. The decrease in service charges was partially offset by a $37.2 million, or 11.8%, increase in ATM

and card fees primarily due to an increase in accounts and transactions.

Total noninterest expense was $3.3 billion, up $562.6 million, or 20.6%, over the same period in 2008. FDIC insurance

expense increased $135.7 million primarily due to increased premium rates. Credit-related expense increased $123.9 million

including operating losses, collections services, and other real estate. Also, the first quarter of 2009 included a non-cash

charge of $299.2 million related to the impairment of goodwill associated with the Commercial Real Estate and Affordable

Housing businesses. The economic downturn has negatively impacted commercial real estate asset values and expected

earnings; however, we remain committed to the clients, products, and services of these businesses and believe that the longer

term growth prospects of these businesses are strong.

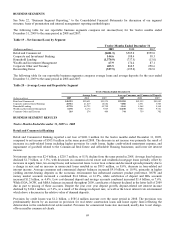

Corporate and Investment Banking

Corporate and Investment Banking’s net income for the twelve months ended December 31, 2009 was $144.6 million, a

decrease of $43.8 million, or 23.3%, compared to the same period in 2008. The decline was driven by a $242.9 million

increase in provision for credit losses which was mostly offset by strong growth in capital markets revenue and net interest

income.

Net interest income was $389.3 million, an increase of $49.7 million, or 14.7%, from the prior year primarily due to an

increase in loan portfolio spreads. Average loan balances decreased $698.2 million, or 3.2%, while the loan-related net

interest income increased $69.1 million, or 31.6%, due to increased portfolio spreads. Loan balances have decreased 9.8%

compared to the third quarter of 2009 as higher revolver utilization by large corporate clients experienced early in the year

has declined as borrower’s needs diminish and as access to capital markets funding has improved. Net interest income on

investments decreased $21.0 million primarily due to decreased volume. Total average customer deposits increased $457.4

million, or 7.0%, mainly due to a $552.0 million increase in demand deposits offset by a $94.8 million decrease in time

deposits. Customer deposit-related net interest income increased $1.5 million or 1.8%, due to increased average balances

partially offset by spread compression related to a decrease in the relative value of demand deposits.

Provision for credit losses was $298.2 million, as net charge-offs increased $242.9 million from the prior year driven by a

small number of large corporate borrowers operating in economically sensitive industries.

Total noninterest income was $700.1 million, an increase of $138.3 million, or 24.6%, over the prior year. Capital markets

related noninterest income increased $161.6 million, or 51.3%, primarily due to performance in equity derivatives, debt and

equity originations, fixed income sales and trading, and syndications. The strong performance in capital markets was partially

offset by higher write-downs on private equity investments, equipment write downs on terminated leases and market

volatility on credit hedges related to the corporate loan book.

Total noninterest expense was $559.7 million, an increase of $18.8 million, or 3.5%. The increase was primarily due to

higher operating losses, revenue based incentive compensation, and pension expense. Offsetting these higher expenses were

lower salaries and other staff expenses, as well as lower outside processing and miscellaneous expenses.

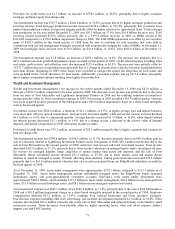

Household Lending

Household Lending reported a net loss of $1.4 billion for the year ended December 31, 2009 compared with a net loss of

$737.5 million in 2008. The $633.4 million increase in net loss was driven by higher credit costs and goodwill impairment

resulting from deterioration in residential real estate market conditions. Partially offsetting these costs were higher

production and servicing income.

Net interest income was $780.2 million for the year ended December 31, 2009, up $53.3 million, or 7.3%, primarily due to

higher net interest income on LHFS, credit cards, and student loans offset by lower consumer mortgage net interest income

and increased levels of nonaccrual loans. Additionally, the loan-related net interest income decline was influenced by the

decline in higher yielding second lien loans and lower yields on prime first lien mortgages. Average loans declined $2.0

billion, or 4.5%, while the resulting net interest income declined $39.3 million, or 7.2%. Consumer mortgages and

construction to perm loans declined $3.6 billion, or 11.8%, contributing $76.2 million to the decline in loan-related net

interest income. Additionally, nonaccrual loans increased $1.0 billion, resulting in a net interest income reduction of $38.4

million. Partially offsetting these declines was a $0.8 billion, or 24.2%, increase in student loans and bank card loans, which

increased net interest income $80.3 million. LHFS increased $0.2 billion and contributed $70.9 million to the increase in net

interest income due to improved funding costs resulting from lower short-term rates. Customer deposit-related net interest

income also increased $12.8 million principally due to higher volume.

70