SunTrust 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

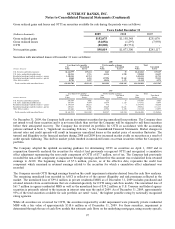

Intangible assets subject to amortization must be tested for impairment whenever events or changes in circumstances indicate

that their carrying amounts may not be recoverable. The Company experienced a triggering event with respect to certain

Wealth and Investment Management customer relationship intangibles during the second quarter of 2008 and performed

impairment testing which resulted in an impairment charge of $45.0 million. The fair value of the customer relationship

intangibles was determined using the residual income method and was compared to the carrying value to determine the

amount of impairment. The impairment charge was recorded in noninterest expense and pertains to the client relationships

that were recorded in 2004 in connection with an acquisition. While the overall acquired business was performing

satisfactorily, the attrition level of the legacy clients had increased resulting in the impairment of this intangible asset.

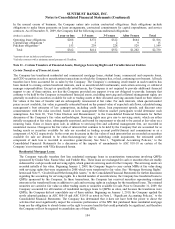

See Note 11, “Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities,” to the

Consolidated Financial Statements for discussion of the impairment reserve recorded with respect to MSRs during 2008.

The Company elected to create a second class of MSRs effective January 1, 2009. This new class of MSRs is reported at fair

value and is being actively hedged as discussed in Note 17, “Derivative Financial Instruments,” to the Consolidated Financial

Statements. The transfer of MSRs from LOCOM to fair value did not have a material effect on the Consolidated Financial

Statements since the MSRs were effectively reported at fair value as of December 31, 2008 as a result of impairment losses

recognized at the end of 2008. MSRs associated with loans originated or sold prior to 2008 continued to be accounted for at

December 31, 2009 at LOCOM and managed through the Company’s overall asset/liability management process. Effective

January 1, 2010, the Company elected to designate all remaining MSRs carried at LOCOM at fair value. Upon designating

the remaining MSRs at fair value in January 2010, the Company recognized a cumulative effect adjustment increase to

retained earnings, net of taxes, of $88.5 million.

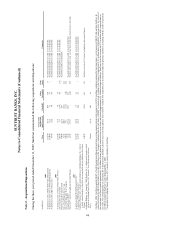

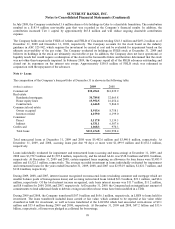

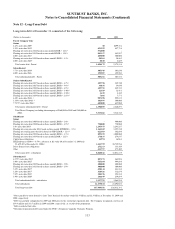

The estimated amortization expense for intangible assets, excluding amortization of MSRs, is as follows:

(Dollars in thousands)

Core Deposit

Intangibles Other Total

2010 $33,059 $13,925 $46,984

2011 26,533 10,780 37,313

2012 20,016 10,124 30,140

2013 13,617 8,729 22,346

2014 7,408 7,810 15,218

Thereafter 3,607 16,309 19,916

Total $104,240 $67,677 $171,917

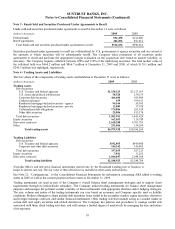

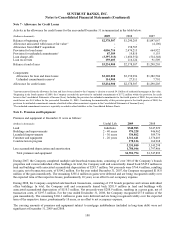

Note 10 - Other Short-Term Borrowings and Contractual Commitments

Other short-term borrowings as of December 31 include:

2009 2008

(Dollars in thousands) Balance Rates Balance Rates

Master notes $1,362,922 .75 % $1,034,555 .25 %

Dealer collateral 584,781 various 1,055,606 various

U.S. Treasury demand notes 62,100 - 39,200 -

Term Auction Facility --2,500,000 .49

Short-term promissory notes -- 70,000 1.50

Other 52,474 various 466,999 various

Total other short-term borrowings $2,062,277 $5,166,360

The average balances of other short-term borrowings for the years ended December 31, 2009, 2008, and 2007 were $2.7

billion, $3.1 billion, and $2.5 billion, respectively, while the maximum amounts outstanding at any month-end during the

years ended December 31, 2009, 2008, and 2007 were $5.8 billion, $5.2 billion, and $3.8 billion, respectively. As of

December 31, 2009, the Company had collateral pledged to the Federal Reserve discount window to support $11.6 billion of

available borrowing capacity.

103