SunTrust 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

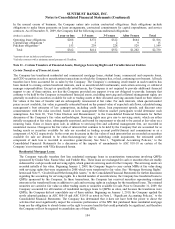

As seller, the Company has made certain representations and warranties with respect to the originally transferred loans,

including those transferred to Ginnie Mae, Fannie Mae, and Freddie Mac, which are discussed in Note 18, “Reinsurance

Arrangements and Guarantees,” to the Consolidated Financial Statements. Additionally, repurchases of loans from QSPEs

sponsored by the Company totaled approximately $17 million in 2008, including approximately $13 million of second lien

loans that were substituted with new loans. No additional repurchases occurred during the year ended December 31, 2009;

however, the Company accrued $36.0 million in the year ended December 31, 2009 for contingent losses related to certain

of its representations and warranties made in connection with prior transfers of second lien loans.

Commercial Mortgage Loans

Certain transfers of commercial mortgage loans were executed with third party VIEs, which the Company deemed to be

QSPEs and did not consolidate. During 2008, the Company sold all of its retained servicing rights, which were not

financial assets subject to the accounting for transfers and servicing of financial assets, in exchange for cash proceeds of

approximately $6.6 million. As seller, the Company had made certain representations and warranties with respect to the

originally transferred loans and the Company has not incurred any losses with respect to such representations and

warranties. The adoption of the provisions of ASC 860-10 and ASC 810-10, on January 1, 2010, did not change the

Company’s conclusions that its prior transfers were sales and that it is not the primary beneficiary of those VIEs.

Commercial and Corporate Loans

In 2007, the Company completed a structured sale of corporate loans to multi-seller CP conduits, which are VIEs

administered by unrelated third parties, from which it retained a 3% residual interest in the pool of loans transferred,

which does not constitute a VI in the third party conduits as it relates to the unparticipated portion of the loans. In the

first quarter of 2009, the Company wrote this residual interest and related accrued interest to zero, resulting in a loss of

approximately $16.6 million. This write off was the result of the deterioration in the performance of the loan pool to

such an extent that the Company expects that it will no longer receive cash flows on the interest until the senior

participation interest has been repaid in full. The fair value of the residual at December 31, 2008 was $16.2 million. The

Company provides commitments in the form of liquidity facilities to these conduits; the sum of these commitments,

which represents the Company’s maximum exposure to loss under the facilities, totaled $322.0 million and $500.7

million at December 31, 2009 and December 31, 2008, respectively. Due to deterioration in the loans that collateralize

these facilities, the Company recorded a contingent loss reserve of $16.1 million on the facilities during the year ended

December 31, 2009. Subsequent to December 31, 2009, the administrator of the conduits drew on these commitments in

full. This event did not modify the estimated contingent loss reserve the Company recorded as of December 31, 2009,

nor did it modify the Company’s sale accounting treatment or conclusion that it is not the primary beneficiary of these

VIEs. In addition, no events have occurred during 2009 that would call into question either the Company’s sale

accounting or the Company’s conclusions that it is not the primary beneficiary of these VIEs.

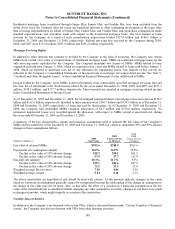

The Company has had involvement with VIEs that own commercial leveraged loans and bonds, certain of which were

transferred by the Company to the VIEs. In addition to retaining certain securities issued by the VIEs, the Company also

acts as manager or servicer for these VIEs. At December 31, 2009 and December 31, 2008, the Company’s direct

exposure to loss related to these VIEs was approximately $0 and $6.8 million, respectively, which represent the

Company’s interests in preference shares of these entities. In the first quarter of 2009, the Company recognized losses of

$6.8 million which represented the complete write off of the preference shares in certain of the VIEs due to the

continued deterioration in the performance of the collateral in those vehicles. The Company does not expect to receive

any significant cash distributions on those preference shares in the foreseeable future. At December 31, 2009 and

December 31, 2008, total assets of these entities not included on the Company’s Consolidated Balance Sheets were

approximately $2.6 billion and $2.7 billion, respectively. No reconsideration events occurred during 2009 that changed

the Company’s conclusion that it is not the primary beneficiary of these entities. Upon adoption of the amendments to

ASC 810-10, the Company determined that it was the primary beneficiary of one of these VIEs due to its collateral

management activities and VIs held by certain of the Company’s consolidated subsidiaries. As such, as of January 1,

2010, the Company consolidated approximately $300 million of the $2.6 billion of assets that were previously

unconsolidated. See Note 1, “Significant Accounting Policies,” to the Consolidated Financial Statements for further

discussion of the impact of implementing the amendments to ASC 810-10.

Student Loans

In 2006, the Company completed one securitization of student loans through a transfer of loans to a QSPE and retained the

corresponding residual interest in the QSPE trust. The fair value of the residual interest at December 31, 2009 and

December 31, 2008 was $18.5 million and $13.4 million, respectively. No events have occurred during 2009 that changed

the status of the QSPE or the nature of the transaction, which called into question either the Company’s sale accounting or

105